I’ve seen many business owners struggle with a common question: Can a limited company rent residential property?

The confusion is understandable. While most people rent homes personally, the rules change when a business becomes involved.

Many entrepreneurs miss out on significant tax benefits and operational advantages simply because they are unaware that company leases are a legal and often beneficial option.

What if I told you that renting through a limited company could reduce your tax burden, protect your assets, and give you better control over accommodation costs? The benefits go far beyond what most business owners realize.

I’ll walk you through everything you need to know about company residential rentals, from legal requirements to tax implications, so that you can make an informed decision about this business strategy.

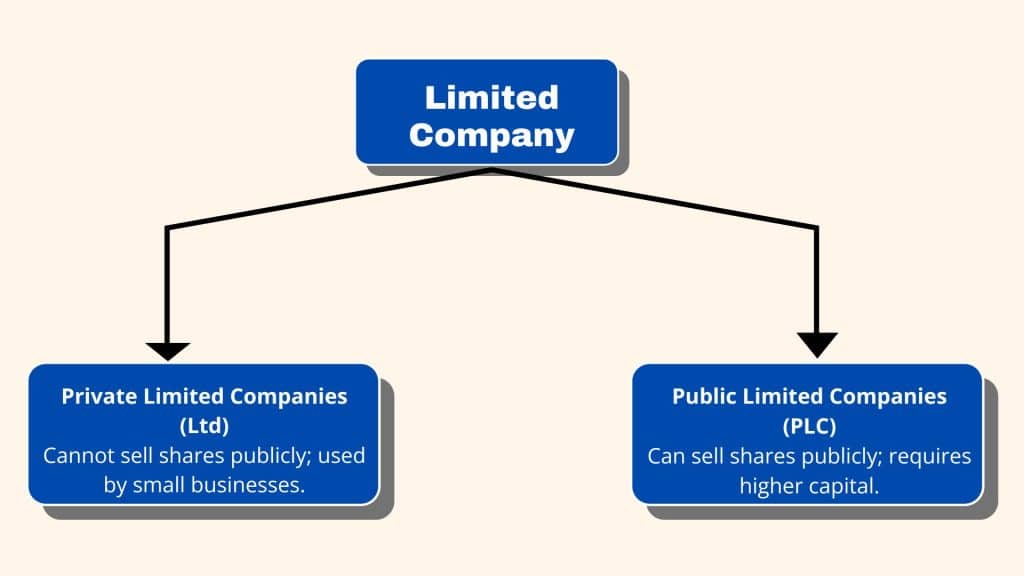

What Is a Limited Company?

A limited company is a business structure where the company exists as a separate legal entity from its owners.

This means the business can own assets, enter into contracts, and take on debt in its name.

The company has limited liability protection. This means owners (called shareholders) are only responsible for business debts up to the amount they invested. Their assets stay protected if the business fails.

Basic structure of a Limited Company:

- Directors who run the company.

- Shareholders who own the company and enjoy limited liability.

- A registered office address.

- Articles of association (company rules)

Companies must file annual returns and accounts with Companies House. They pay corporation tax on profits and can retain earnings for future growth.

What Is a Company Let?

A company lease occurs when a business entity rents residential property directly from a landlord. The company signs the lease agreement and takes responsibility for all rental obligations.

This differs from individual tenancies where people rent in their own names.

More companies are opting for this solution to meet their employee housing needs. It provides better control over accommodation costs and quality. As a business rental arrangement, it also simplifies internal housing policies.

Companies can manage multiple properties centrally through professional arrangements and dedicated property management.

The business becomes the official tenant with full legal obligations. Individual employees may occupy the property but are not parties to the lease agreement.

This creates a clear separation between personal and business responsibilities.

Can a Limited Company Rent a House?

Yes, a limited company can legally rent a house. This is known as a company lease, where the business acts as the tenant.

Companies rent houses to accommodate employees during relocations or provide temporary housing for executives and other key personnel.

The rental agreement is signed in the company’s name, making the business responsible for lease obligations.

Company tenants must meet the exact legal requirements as individual renters, including security deposits and lease compliance.

The primary benefits include deducting rental costs as business expenses and maintaining a clear separation between personal and business finances for each rental property leased.

Landlords often prefer company tenants due to their financial stability and reliability. Companies need to provide business documentation and financial statements to qualify for residential rentals.

Residential Tenancies and Company Lets

1. Standard Residential Tenancies: Individual tenants rent homes directly in their names. These agreements fall under standard residential tenancy laws with full tenant protection rights.

2. Company Lets: Limited companies rent properties for their business needs. The company becomes the legal tenant, not the individual employees who may live there. This creates different legal relationships and obligations.

3. Key Differences: Company tenancies may have different terms compared to personal rentals. Landlords often prefer company tenants due to their perceived financial stability and the potential for a professional relationship.

Compliance with Tenancy Laws

1. Landlord and Tenant Act 1985: Companies must follow the same basic tenancy laws as individual tenants. This includes rights to essential repairs, proper notice periods, and protection from unfair eviction.

2. Deposit Protection: Landlords must protect company deposits in government-approved schemes. The same rules apply whether the tenant is a person or a business entity.

3. Health and Safety Standards: Properties rented to companies must meet identical safety requirements. This includes gas safety certificates, electrical checks, and proper fire safety measures.

4. Notice Requirements: Standard notice periods apply to company tenancies. Both landlords and company tenants must follow proper legal procedures for ending agreements.

5. Right to Rent Checks: Companies do not need Right to Rent checks like individual tenants. However, they must provide proper business documentation and registration details.

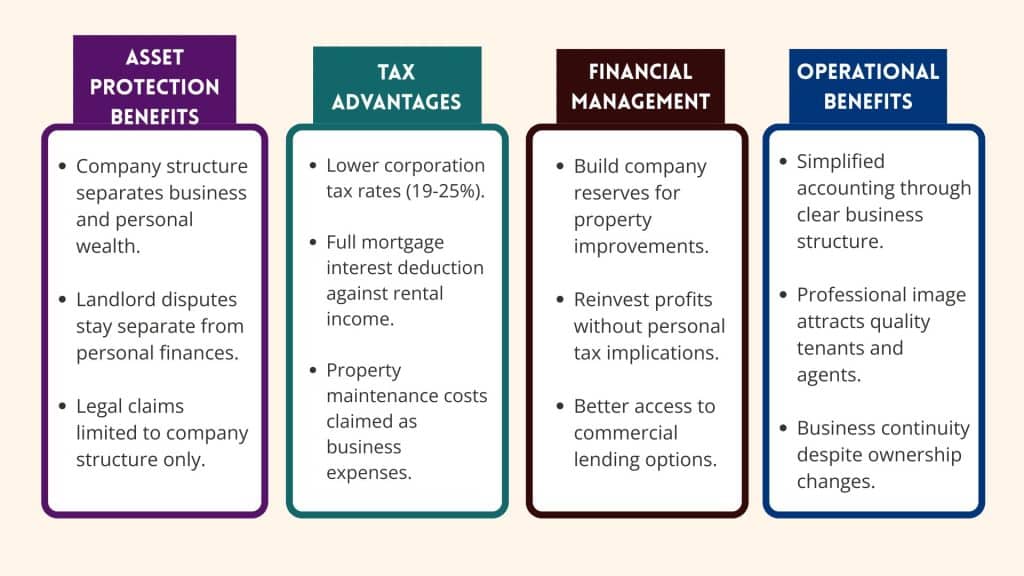

Advantages of Using a Limited Company for Renting

Using a limited company for rental properties offers significant benefits for landlords. This structure offers enhanced protection, tax benefits, and professional credibility.

Company Rental Tax Benefits and Financial Impact

Limited companies face different tax rules when renting residential properties compared to individuals renting properties. These variations can significantly affect your overall financial position and business strategy. This includes how rental income is treated.

| Tax Category | Limited Company | Personal Ownership |

|---|---|---|

| Tax Rates | 21% federal + 0-12% state | 10-37% + state income tax |

| Mortgage Interest | Fully deductible | Limited deductibility |

| Property Expenses | All expenses deductible | Same deductions available |

| Capital Gains | Corporation tax rates | May qualify for lower rates |

| Depreciation | Available to reduce income | Same benefits available |

| Transfer Taxes | Same as individuals | Standard rates apply |

Key Financial Benefits:

- Lower overall tax rates for high-income earners compared to personal ownership.

- A full mortgage interest deduction against rental income can create significant tax savings.

- Enhanced expense deduction flexibility for business-related costs tied to each rental property.

- A professional business structure appeals to lenders and tenants.

Challenges of a Limited Company for Property Rental

Using a limited company for property rental involves several significant challenges. Understanding these issues helps make informed decisions about corporate property arrangements.

1. Mortgage Restrictions

Companies face different lending requirements with higher deposits of 25-40% of the property value. Commercial mortgage rates are typically higher than residential rates. Lenders assess a business’s cash flow and profit history, rather than its income.

The documentation process requires extensive business records, including tax returns and financial statements. New companies may face stricter requirements due to limited business history. Approval times are longer than for personal mortgages.

2. Benefit in Kind (BiK) Tax

Directors and employees residing in company-owned properties are subject to tax implications. The IRS treats personal use of company assets as additional taxable compensation. Companies must determine the fair rental value for tax purposes.

Both companies and individuals have reporting requirements. Companies must include benefits on employee tax forms, while individuals declare them as taxable income on their tax returns.

3. Landlord’s Perspective

Landlords must evaluate a company’s financial strength through its business statements, rather than relying on personal credit scores. Standard leases may need modifications since companies cannot provide personal guarantees.

Communication becomes more complex with corporate representatives and agents. Property insurance may require adjustments for corporate tenants.

Final Thoughts

Now you have a clear answer to that common question about limited companies renting residential property. It’s not only legal but can be a strategic business decision when executed properly.

The evidence speaks for itself: lower corporation tax rates, full mortgage interest deductions, and enhanced asset protection make company leases attractive for many businesses.

Yes, there are challenges, such as higher deposits and complex lending requirements, but the potential benefits often outweigh these considerations.

The real question isn’t whether companies can rent residential property – it’s whether this approach aligns with your business goals.

Consider your specific circumstances, consult with professionals, and make the decision that supports your long-term strategy.

Have you considered how company leases might benefit your business operations? Take the first step by reviewing your current accommodation expenses.

Frequently Asked Questions

Can You Rent a House that Your LLC Owns?

Yes, you can rent a house owned by your LLC. However, you must pay fair market rent and report it as taxable income to avoid tax issues. For an LLC-owned property, keep clear records of the lease and payments.

Why Do People Put Rental Properties in An LLC?

People use LLCs for rental properties to get liability protection, separate personal and business assets, gain tax benefits, and create a professional business structure for easier management. This setup is often called a property LLC.

Can You Rent a Residential Property to a Business?

Yes, you can rent residential property to a business. The company becomes the tenant and signs the lease agreement, taking responsibility for all rental obligations.