Letting agent fees can eat into your rental profits faster than you think.

I’ve seen landlords pay anywhere from £500 for basic tenant finding to over £300 monthly for full management services.

The pricing maze gets confusing when you factor in location, service levels, and those sneaky additional charges that pop up later.

What if you could understand exactly what you’re paying for and why?

I’ve broken down the real costs, hidden fees, and regional differences that affect your bottom line. You’ll see which services actually deliver value and which ones you might skip.

Let me walk you through the complete fee structure so you can make informed decisions about your rental property investment.

What Are Letting Agent Fees and Who Pays Them?

Letting agent fees are charges for professional services in the rental property market. These fees cover the work agents do to connect landlords with tenants and manage rental properties.

Agents act as middlemen, handling advertising, tenant screening, rent collection, and maintenance coordination.

Letting agent fees are split into two main types. Each type affects different people in the rental process.

Landlord-Side Fees

Property owners pay these costs for services like finding tenants, marketing properties, reference checks, and rent collection. Most landlords pay between 8% to 15% of annual rent for complete management services.

Tenant-Side Charges

Before 2019, tenants paid many fees to letting agents on top of rent and deposits. These costs often reached hundreds of pounds.

The Tenant Fees Act changed this system on June 1, 2019. The law banned most tenant fees to make renting more affordable.

Now, tenants only pay rent, capped deposits, utilities, and specific charges like late payment fees or lost key replacements.

The Tenant Fees Act Impact

The 2019 law stopped agents from charging tenants for most services. This major shift changed who pays what in the rental process.

Banned tenant fees include administration charges, credit check costs, reference fees, inventory fees, and cleaning charges at the start of tenancy.

What tenants still pay:

- Rent payments

- Security deposits (capped at five weeks’ rent)

- Holding deposits (capped at one week’s rent)

- Utilities and council tax

- Late payment charges (after 14 days)

- Lost key replacement costs

- Contract changes requested by tenants

This law shift means landlords now cover most letting agent costs. The change aimed to make renting more affordable for tenants.

Fee Types & Typical Costs (UK-Wide Averages)

Letting agent fees vary based on the service level you choose. Most agents offer three main service types with different pricing structures.

1. Tenant-Find Only Services

These “let only” services help landlords find tenants, but stop there. Agents handle property marketing, viewings, and tenant screening, including credit checks and references.

Once a tenant moves in, the landlord takes over all responsibilities, such as rent collection and maintenance.

Cost: 8-12% of annual rent or £500-£1,500 one-off fee

Some agents take 50% to 100% of the first month’s rent as payment. For a £1,200 monthly rental, this could mean paying £600 to £1,200 upfront.

2. Rent Collection Services

This middle option includes finding tenants plus ongoing rent collection. Agents chase late payments and handle basic tenant communication.

Landlords still manage property maintenance and complex tenant issues.

Cost: 5-8% of monthly rent

For a £1,000 monthly rental, expect to pay £50 to £80 each month. This works well for hands-on landlords who can handle maintenance themselves.

3. Full Property Management

This complete service covers everything from tenant finding to maintenance coordination. Agents handle all tenant communication, arrange repairs, conduct inspections, and ensure legal compliance.

Landlords receive monthly reports but have minimal day-to-day involvement.

Cost: 10-20% of monthly rent

London and premium agents often charge 15% to 20%. Regional agents may offer lower rates, around 10% to 15%. For a £1,500 monthly rental, full management could cost £150 to £300 per month. The higher fee reflects the extensive service level and the landlord’s peace of mind.

Different Charges

Beyond the main service fees, letting agents often charge extra for specific tasks and administrative work. These additional costs can range from setup fees to exit charges when ending contracts.

| Charge Type | Typical Cost | Notes |

|---|---|---|

| Setup / Admin Fees | £100 – £300 | Paperwork & listing setup |

| Inventory / Check‑in & Out | £100 – £250+ | Based on size/location |

| Tenancy Renewal Fee | £50 – £200 / ~5% rent | For tenancy extensions |

| Void‑Period Management | Varies | Managing empty property |

| Exit Fees | Varies | Ending the agent contract |

| Inspection Charges | £50 – £150 | Property checks |

| Legal Paperwork | Varies | Contracts & compliance |

| Inventory Disputes | Varies | Damage/deposit issues |

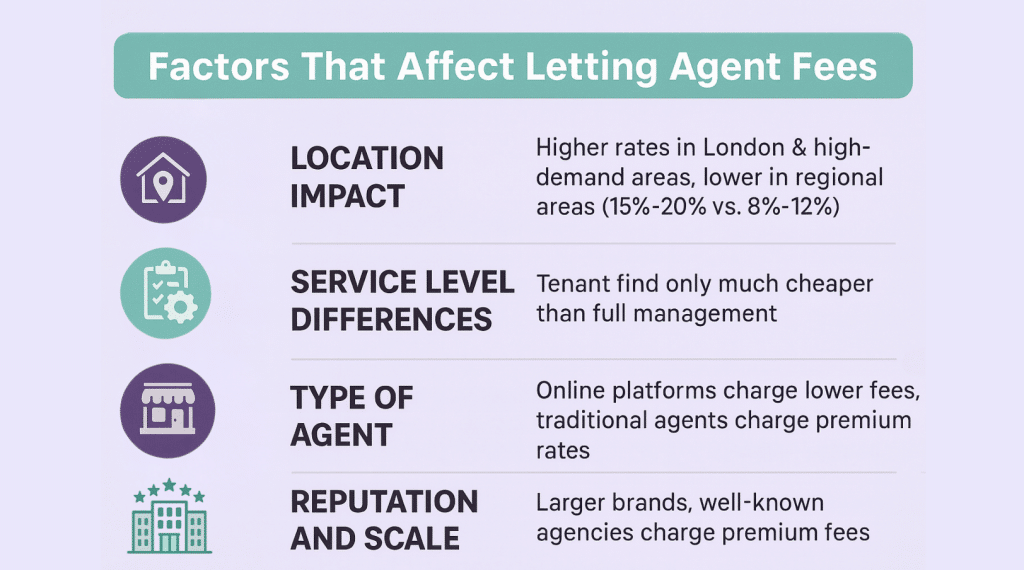

What Influences Letting Agent Pricing?

Comprehending what drives letting agent costs helps landlords make informed decisions.

Several key factors influence how much letting agents charge for their services. These elements can significantly impact your overall rental investment expenses.

By considering these factors, landlords can compare different agents more effectively. This knowledge helps you find the right balance between cost and service quality for your specific needs.

Tax Treatment & Legal Considerations

Understanding the tax and legal aspects of letting agent fees helps both landlords and tenants know their rights and obligations.

1. Tax Benefits for Landlords

Letting agent fees are tax-deductible as a business cost for landlords. This includes all service charges like tenant finding, management fees, and maintenance coordination costs.

Keep all receipts and invoices, as HMRC accepts these as legitimate business expenses.

2. Legal Disclosure Requirements

The Tenant Fees Act requires agents to publish clear fee tables in offices and on websites. All fees must be explained upfront with no hidden costs or surprise charges later.

3. Banned Charges and Reporting

Tenants should watch out for illegal charges like administration fees, credit check costs, and inventory charges. Only rent, deposits, and late payment charges are permitted.

Tenants can report banned charges to local trading standards. Agents face fines up to £5,000 per offense. Citizen’s Advice and Shelter provides free guidance on challenging illegal charges.

This legal framework protects tenants while ensuring landlords can access professional letting services at fair rates.

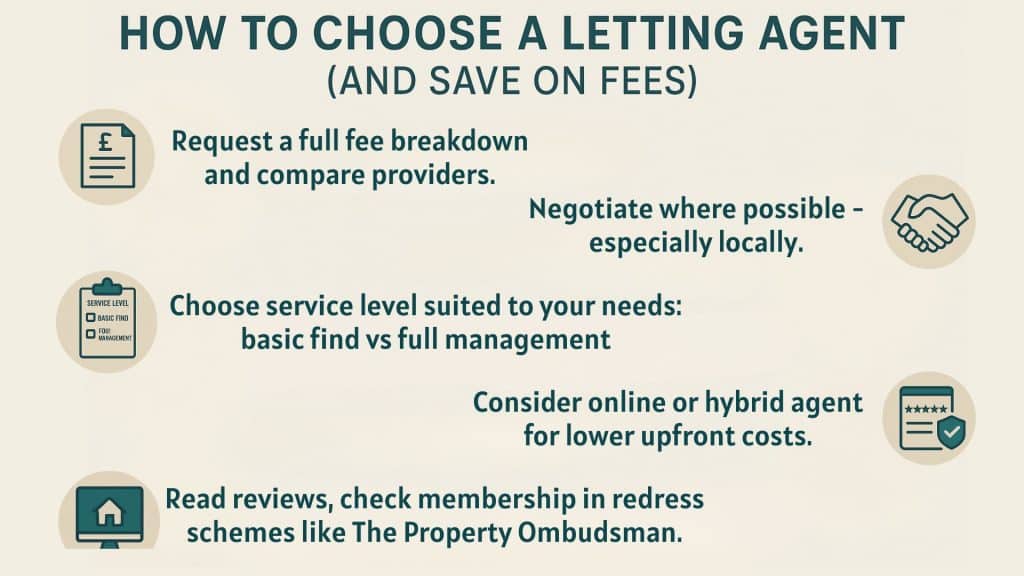

How to Pick the Right Letting Agent?

Smart selection strategies help you find quality agents while keeping costs manageable. These tips ensure you get the best value for your rental investment. Learn how to compare services and negotiate better rates.

Top UK Letting Agent Websites

These leading platforms offer various service levels and pricing options to help landlords and tenants find the right letting solution.

| Letting Agent | Detail |

|---|---|

| 1. OpenRent | Popular online platform with transparent pricing and easy-to-use services. |

| 2. LettingaProperty.com | Offers tech-driven, competitively priced full-service letting solutions. |

| 3. The Online Letting Agents | Top-rated on Trustpilot for excellent customer service. |

| 4. Purple Bricks | A hybrid model combining online convenience with high-street presence. |

| 5. SpareRoom | Popular platform for room rentals and flatshares connecting tenants |

| 6. Your Move | Major high-street agent with strong online platform integration. |

| 7. Rightmove | UK’s largest property portal with extensive rental listings and agent connections. |

| 8. Zoopla | Major UK property portal with rental listings and market data. |

Final Thoughts

Comprehending letting agent fees puts you in control of your rental investment costs.

I’ve shown you how charges range from basic £500 tenant-finding services to full management at 10-20% monthly rent. Location, service level, and agent type all impact what you’ll pay.

The key takeaway? You don’t have to accept the first quote you receive.

Compare different agents, understand exactly what services you’re getting, and factor in those additional charges that can add up quickly.

Remember, letting agent fees are tax-deductible business expenses, so keep those receipts.

Ready to find the right agent for your property?

Begin by obtaining quotes from at least three different agents, then use this guide to assess their true value. Your rental profits will thank you for doing the homework upfront.

Frequently Asked Questions

Is It Worth Using a Letting Agent?

Yes, if you lack time or experience. They handle tenant finding, legal compliance, and property management, but cost 8-20% of rent annually.

Does a Realtor Get Paid if The Deal Falls Through?

No, realtors typically only get paid when a sale completes successfully. However, some agreements may include fees for specific services rendered.

What Does a Letting Agent Do?

They find tenants, handle viewings, collect rent, manage maintenance, conduct inspections, and ensure legal compliance for rental properties on behalf of landlords.