Have you ever looked at successful property owners and wondered how they built their wealth?

Starting a property business might seem complex at first. However, with the right approach, anyone can embark on this rewarding path.

Property businesses offer multiple income streams. They can provide rental income, appreciation, and tax benefits. Many people find financial freedom through real estate investments today.

In this blog, I’ll show you everything you need to know. You’ll learn the basics, planning steps, and growth strategies. We’ll cover each stage clearly and make it accessible to beginners.

Let’s start building your property business today. Success begins with understanding the fundamentals first. Ready to start your real estate venture?

Why Start a Property Business?

Property businesses create lasting wealth through multiple channels. Real estate offers both immediate cash flow and long-term appreciation benefits.

Unlike other investments, property provides tangible assets you can control. The rewards extend beyond just monthly rental income.

Property ownership builds equity while tenants pay your mortgage. Smart investing creates financial freedom through compound growth over time.

Key Advantages for Investors:

- Earn rental income while building equity.

- Deduct repairs and operating expenses.

- Physical assets hedge against market swings.

- Increase value through property improvements.

Each property contributes to long-term wealth, setting the foundation for future generations. Every rental helps you build your path to financial independence.

Is Starting a Property Business Right for You?

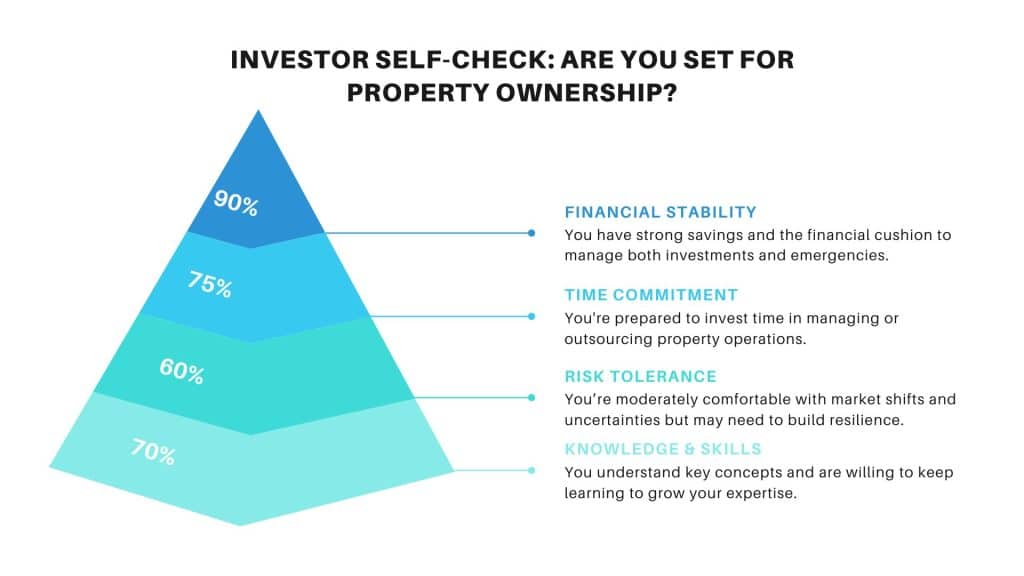

Property investing demands careful self-assessment across four critical areas that determine your success. Each factor plays a vital role in building a profitable real estate portfolio.

Score yourself honestly in each area, and if you’re below 70% overall, consider building these foundations before making an investment. Strong preparation today prevents costly mistakes tomorrow.

Before you begin your property business, it’s essential to assess your finances, time, and risk tolerance to decide if a property business fits your goals.

Understanding your readiness helps prevent costly mistakes down the road. Financial stability forms the foundation of property investing.

You need capital for down payments and unexpected repairs. Emergency funds protect against periods of vacancy and market downturns.

Core Principles for Property Business

Property investing success depends on comprehending the core principles that experienced investors use on a daily basis. Without these foundations, even promising properties can become financial drains.

These interconnected skills form a complete system for evaluating properties. Weakness in any area creates vulnerabilities that markets eventually expose.

Start with one rental property to practice these concepts. Test your analysis skills without risking significant capital.

Track every expense for six months. Real numbers teach lessons that theory never can.

Join local investor groups for market insights. Experienced investors share valuable neighborhood knowledge and contacts with vendors.

Build relationships with reliable contractors early. Good maintenance teams save money and reduce stress during emergencies.

Create standard operating procedures for tenant issues. Consistent policies prevent emotional decisions that hurt profitability.

Review your portfolio performance quarterly. Regular check-ins catch small problems before they grow expensive.

Consider starting with house hacking or short-term rentals. These strategies offer faster feedback loops for new investors.

Step-By-Step Roadmap to Start a Property Business

Building a property business follows a proven path to success. Each step creates the foundation for the next phase, turning beginners into profitable investors.

Follow this systematic approach to minimize risks and maximize profits. Success comes from completing each phase thoroughly before advancing, ensuring sustainable growth.

Step 1: Write a Business Plan

Your business plan serves as the foundation for all future decisions. It clearly outlines your investment strategy, target markets, and financial goals.

Market research reveals opportunities and challenges in your chosen area. Understanding local trends enables you to make informed investment decisions.

Financial projections indicate whether your business model is profitable. Calculate expected income, expenses, and return on investment carefully.

Important Note: Establish specific ROI targets and exit strategies for each property to measure success objectively.

Step 2: Select a Business Structure & Register Your Business

Choosing the proper legal structure effectively protects your assets. LLCs shield you from business liabilities while offering tax flexibility.

Registration makes your business legitimate in the eyes of the law. File the necessary paperwork with state authorities and obtain the required licenses promptly.

Maintaining separate business accounts helps keep finances organized for tax purposes. This separation simplifies bookkeeping and protects personal credit ratings.

Key Consideration: Familiarize yourself with local rental laws, licenses, and safety regulations to ensure compliance and avoid potential legal issues.

Step 3: Build a Financial Foundation

Strong finances enable you to seize good investment opportunities quickly. Lenders prefer borrowers with substantial reserves and excellent credit.

Multiple funding sources provide flexibility for different property types. Traditional mortgages, hard money loans, and private investors offer options.

Emergency reserves protect against vacancies and unexpected repairs. Save at least six months of operating expenses before making an investment.

Pro Tip: Know your mortgage options, like buy-to-let or bridging loans; weigh pros and cons, and explore beginner-friendly funding strategies for low starting capital.

Step 4: Choose Your Niche and Target Market

Different property types require varying levels of involvement and expertise. Residential rentals provide a steady income with moderate management requirements.

Commercial properties often offer longer leases but require specialized knowledge. Specialty niches, such as vacation rentals, can yield higher returns.

Focus on one niche initially to build expertise faster. Master your chosen market before expanding into other areas.

Things to Consider: Student rentals offer high yields but require more management than family homes.

Step 5: Find and Acquire Properties

Successful investors use multiple channels to find profitable deals. Network with agents, wholesalers, and other investors for opportunities.

Thorough analysis prevents costly mistakes and ensures profitability. Calculate all costs, including repairs, carrying costs, and closing fees.

Strong negotiation based on facts improves your profit margins. Use inspection findings and market data to justify lower offers.

Pro Tip: Join local real estate investment groups to access off-market deals before they list publicly.

Step 6: Prepare Properties for Tenants or Sale

First impressions determine the quality of tenants you attract. Clean, well-maintained properties command higher rents and better residents.

Strategic improvements maximize your return on investment in renovations. Focus on updates that tenants value most, like kitchens.

Code compliance and safety features protect against legal issues. Install smoke detectors, carbon monoxide alarms, and ensure proper exits are available.

Key Considerations: Never skip professional inspections; hidden problems can significantly impact your profit margins.

Step 7: Market Your Property Business

Professional marketing attracts quality tenants willing to pay more. High-quality photos and detailed descriptions showcase your property’s best features.

Multiple listing platforms expand your reach to different demographics. Post on rental websites, social media, and local classifieds.

Thorough screening prevents problem tenants and protects your investment. Always verify income, check references, and run background checks.

Follow This: List properties on multiple platforms simultaneously to fill vacancies within 7-10 days, at most.

Scaling Tips for Your Property Business

Growth requires strategic planning beyond initial success. Intelligent scaling protects your existing investments while allowing for expansion.

- Reinvest Profits: Use rental income for down payments. Buy properties in emerging neighborhoods. Compound growth through strategic acquisitions.

- Build Teams: Hire reliable property managers for efficiency. Work with trusted contractors regularly. Develop relationships with real estate professionals.

- Diversify Holdings: Mix property types for stability and resilience. Spread investments across different areas. Balance risk with varied tenant demographics.

- Technology Integration: Use property management software for the organization. Automate rent collection and maintenance requests. Track expenses digitally for taxes.

- Education Continuation: Attend real estate seminars and workshops to improve your knowledge and skills. Join investor groups for networking. Stay updated on market trends.

Care & Risk Prevention Tips for Property Business

Protecting your investment requires ongoing attention and careful planning throughout the ownership period. Prevention strategies cost significantly less than handling emergency repairs and tenant problems.

- Schedule quarterly walk-throughs to thoroughly inspect property conditions and document any issues with photos for your records.

- Service heating and cooling systems before each season starts to prevent breakdowns and extend equipment life by years.

- Verify that the employment history and income meet your rental requirements, as tenants should earn at least three times the monthly rent.

- Maintain liability limits that exceed your total net worth because one lawsuit could destroy everything you’ve built without proper coverage.

- Keep trusted contractor phone numbers easily accessible at all times and maintain relationships with backup vendors for emergencies.

- Reserve three months of rental income for unexpected repairs, as major issues like roof replacements or HVAC failures can occur suddenly.

Conclusion

Starting a property business opens doors to financial independence and wealth building.

You now have the roadmap to begin your real estate investment journey. Each step builds toward creating lasting passive income streams.

Remember that successful investors started with just one property. Take action on what you’ve learned here today. Your first investment teaches valuable lessons for future growth.

Property businesses reward patience, planning, and thoughtful decision-making over time. Start small, learn continuously, and scale gradually. The best time to begin is now.

What questions do you have about starting your property business? Please share your thoughts or concerns in the comments section below.

Frequently Asked Questions

What Real Estate Business Is Most Profitable?

Rental properties provide steady income, fix-and-flip offers quick profits, apartment buildings allow scaling, and Section 8 housing guarantees government-backed rent payments.

What Is the 2% Rule?

Monthly rent should equal 2% of the purchase price. A $100,000 property needs $2,000 monthly rent. Consider expenses and location before investing.

How Do I Start Owning Property?

Start by saving for a down payment, checking your credit score, getting pre-approved for a mortgage, and researching local markets to find affordable properties within your budget.