Ever wondered why your wealthy neighbor seems so relaxed about money?

Chances are, they own rental properties. While most people stress about retirement savings, property investors often sleep soundly knowing their tenants are paying down their mortgages.

The short answer might surprise you. Property has quietly made more millionaires than almost any other investment class.

However, here’s the thing – it’s not the get-rich-quick scheme some people think it is.

Whether you’re a complete beginner or someone who’s been sitting on the fence, this guide breaks down everything you need to know.

We’ll scour the real numbers, uncover the genuine benefits, and, yes, we’ll also discuss the risks.

By the end, you’ll have a clear picture of whether property investment deserves a place in your financial future.

Why is Real Estate a Good Investment?

Yes, property can be a good investment for many people. Real estate has historically delivered solid returns of 8-12% annually over the long term, making it one of the more reliable wealth-building options available.

What makes property attractive is its dual benefit: you can earn rental income while your asset potentially appreciates. Unlike stocks or bonds, you’re investing in something tangible that you can see and control.

The leverage aspect is compelling. You can purchase a $500,000 property with just a $100,000 down payment, significantly amplifying your potential returns.

Property investment is most effective as a long-term strategy. The most successful investors think in years and decades, understanding that real estate markets have natural cycles.

Patience typically rewards those who can weather the ups and downs.

Current market conditions present both opportunities and challenges. Interest rates, local supply and demand, and economic factors all play a role in determining success.

The real question isn’t whether property is good in general – it’s whether it fits your specific financial goals, timeline, and personal situation.

How Property Investment Works?

Property investment might seem complex, but it’s built on straightforward principles. Understanding these basics helps you make informed decisions about whether real estate fits your investment strategy.

Buy-to-let Model Explained

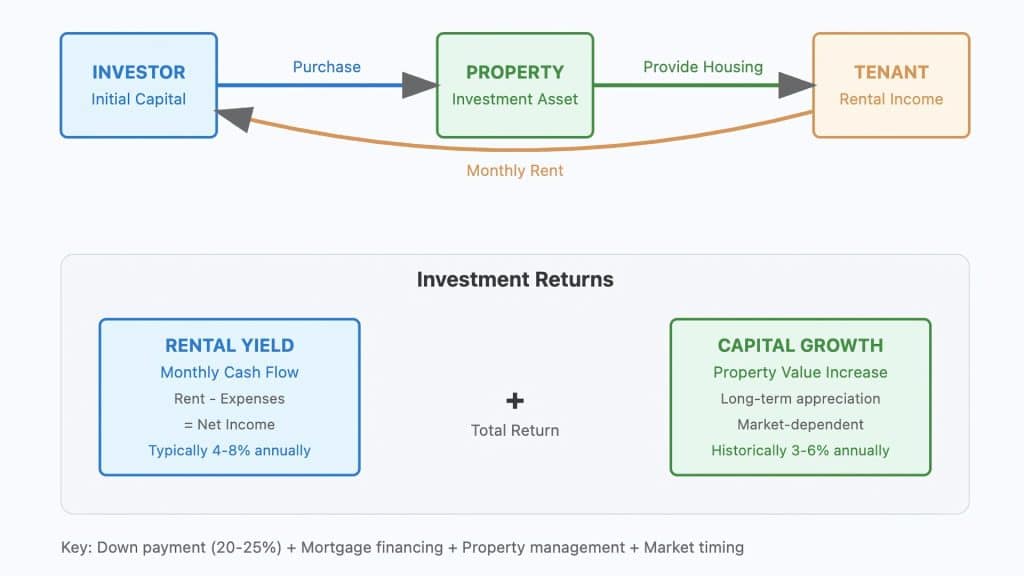

The buy-to-let model is straightforward. You purchase a property to rent it out to tenants. Your initial investment covers the down payment, closing costs, and any immediate repairs or improvements.

Once you have tenants, they pay monthly rent that covers your mortgage, property taxes, insurance, and maintenance costs.

Any leftover amount becomes your profit. Meanwhile, the property itself may appreciate over time.

Rental Yields and Returns

Rental yield is how much income your property generates compared to its value. It’s calculated by dividing your annual rental income by the property’s purchase price or current market value.

There are two types of rental yields to understand. Gross yield examines total rental income before deducting expenses, net yield factors in all costs, like maintenance, insurance, property management, and vacancy periods.

Key Factors Affecting Rental Yields:

- Location and local rental demand

- Property type and condition

- Market rental rates in the area

- Your financing costs and loan terms

- Property management efficiency

Most investors target gross yields of 6-10% annually, though this varies significantly by location.

High-growth areas might offer lower yields but better capital appreciation potential. Regional markets often provide higher yields but slower capital growth.

The sweet spot is finding properties that balance decent rental income with good long-term appreciation prospects. This requires understanding your local market dynamics and rental demand patterns.

Capital Appreciation Mechanics

Capital appreciation is the increase in your property’s value over time. This happens through various market forces, including inflation, supply and demand imbalances, economic growth, and area development.

Unlike rental income, capital appreciation isn’t guaranteed. Property values can fluctuate based on economic conditions, interest rates, local employment levels, and government policies.

However, historically, real estate has shown consistent long-term appreciation trends.

Factors driving capital appreciation:

- Population growth and urbanization

- Infrastructure development and improvements

- Economic growth in the local area

- Scarcity of available land or housing

- Government policies and zoning changes

The key is understanding that capital appreciation typically compounds over time. A property that appreciates 4% annually will double in value in about 18 years.

Combined with rental income, this creates the wealth-building power of real estate investment.

Savvy investors focus on areas with strong fundamentals – growing populations, diverse economies, and ongoing development.

These locations tend to show more consistent appreciation patterns over the long term.

Key Reasons to Invest in Real Estate

Real estate offers several compelling advantages that make it an attractive investment option for investors. These benefits work together to create multiple income streams and long-term wealth-building opportunities.

1. Rental Income Potential

Rental income provides steady monthly cash flow that can supplement or replace your regular salary.

Unlike other investments, rental demand remains consistent because people always need housing, creating reliable income streams.

The amount you earn depends on location, property type, and local market conditions.

A well-chosen property can generate annual returns of 6-10% through rental income alone, providing passive income while building long-term wealth.

2. Capital Appreciation Over Time

Property values have historically trended upward over time due to population growth, economic development, and a limited land supply.

This appreciation creates significant wealth through compounding – a $400,000 property growing 5% annually becomes worth $650,000 in ten years.

Different areas appreciate at varying rates, with urban centers and emerging neighborhoods often showing stronger growth.

Patient investors who hold properties for the long term typically benefit most from capital appreciation combined with rental income.

3. Leverage and Mortgage Benefits

Leverage allows you to control large assets with small down payments. A $100,000 investment can control a $500,000 property, significantly amplifying returns when property values rise.

Your tenants essentially pay down the mortgage through rent.

Mortgage interest is often tax-deductible, reducing investment costs.

This leverage effect magnifies gains during appreciation periods, though it also increases risks if property values decline. Long-term investors typically benefit most from leveraged property investments.

4. Inflation Hedge and Stability

Property acts as a natural inflation hedge because rents and property values typically rise in line with the cost of living. This protects your purchasing power when inflation erodes the value of cash and fixed-income investments.

Real estate offers portfolio stability, with slower and more predictable value movements compared to the volatility of stock markets.

This stability, combined with inflation protection, makes property particularly valuable during uncertain economic periods and market downturns.

Pros and Cons of Buying Real Estate

Property investment isn’t all sunshine and profits. Like any investment strategy, real estate comes with both significant advantages and notable drawbacks that every potential investor should understand before diving in.

The key is weighing these factors against your financial situation, risk tolerance, and investment goals. What works brilliantly for one investor might be entirely wrong for another.

| ✓ Advantages | ✗ Risks and Drawbacks |

|---|---|

| Steady Cash Flow: Monthly rental income provides a consistent passive income stream. | High Entry Costs: Large down payments, closing costs, and immediate repair expenses. |

| Leverage Power: Control large assets with small down payments, amplifying returns. | Market Volatility: Property values can drop significantly during economic downturns. |

| Inflation Protection: Rents and property values typically rise with the cost of living. | Low Liquidity: Takes months to sell properties, unlike stocks or bonds. |

| Tax Benefits: Deductions for mortgage interest, depreciation, and maintenance costs. | Active Management: Dealing with tenants, maintenance, repairs, and vacancy periods. |

| Tangible Asset: Physical property you can see, touch, and potentially use yourself. | Geographic Risk: Local market conditions heavily impact investment performance. |

Comprehending these trade-offs helps you make informed decisions about whether property investment aligns with your financial goals and lifestyle. The advantages can be compelling, but the risks are real and shouldn’t be ignored.

Many successful investors mitigate the drawbacks through careful planning, adequate reserves, and professional property management. Others find that real estate doesn’t fit their risk profile or available time commitment.

The bottom line is that property investment works best for people who understand both sides of this equation and have realistic expectations about the effort and capital required for success.

Wrapping Up

So, is property a good investment? For many people, absolutely. The combination of rental income, capital growth, and tax benefits creates a powerful wealth-building formula that has stood the test of time.

But success isn’t guaranteed. It takes research, patience, and realistic expectations. The investors who thrive are those who understand both the opportunities and the challenges.

The real question isn’t whether property investment works – it’s whether it works for you. Consider your financial situation, risk tolerance, and long-term goals.

What’s your next move?

Pick one area in your city, spend this weekend driving around, and start noticing “For Rent” signs.

Check online rental prices. Talk to three property owners. Small actions today can shape your financial future.