Imagine owning three rental properties. One tenant stops paying rent, legal fees mount, and suddenly your personal savings are at risk. This is where an SPV could be your safety net.

An SPV might be the answer you’re looking for. These specialized companies exist solely to own property, creating a protective barrier between your assets and your investments.

Whether you’re buying your first rental property or building a portfolio, understanding SPVs could save you thousands in taxes and protect your wealth.

This guide walks you through the complete SPV framework, covering legal structures, tax advantages, setup procedures, and ongoing maintenance requirements.

You’ll learn when SPVs make sense, how to create one, and ways to avoid common pitfalls. Ready to find out whether this robust investment structure aligns with your property strategy?

What Is an SPV in Property?

A Special Purpose Vehicle (SPV) is a separate legal entity created specifically for property investments. Think of it as a company that exists solely to own and manage real estate assets.

An SPV operates as a standalone company designed to hold real estate assets. This structure establishes a clear distinction between your assets and property investments.

The main goal is risk isolation. Each property gets its own company. If one investment fails, your other assets stay protected. Banks and investors prefer this clean structure.

Now that you know what an SPV is, let’s break down the core elements that make this structure so effective for property ownership

Core Elements of the SPV Structure

The core elements that define an SPV’s structure are presented here. These serve as the foundation for its legal, financial, and operational design.

- Company Structure: A limited company format that exists solely to own property assets.

- Single-Asset Focus: Each SPV typically owns only one property, facilitating cleaner management.

- Dedicated Banking: Maintaining separate bank accounts ensures that property finances remain entirely independent.

- Legal Independence: The SPV operates as its own independent legal entity, possessing full rights.

- Transparent Records: Clear ownership documentation makes transactions and audits straightforward.

Why Use SPV in Property Deals?

Property investors choose SPVs for several practical reasons. The structure offers financial protection, operational benefits, and professional advantages.

Savvy investors recognize that these benefits outweigh the complexity of setup for serious property ventures.

1. Liability Separation

Your wealth stays insulated from potential property-related disputes. This protection also extends to mortgage defaults.

The company bears responsibility, not you personally. Legal claims against the property will not affect your other assets or personal savings.

2. Operational Clarity

Each property gets its financial records. Income and expenses stay separate. Tax calculations become straightforward.

Performance tracking improves significantly. Selling becomes cleaner, too. This separation makes portfolio management much easier for multi-property investors.

3. Lender Appeal

Banks view SPVs favorably due to their clear asset ownership and professional structure. The format makes risk assessment easier for lenders.

Security arrangements stay clean and straightforward. Banks appreciate defined exit strategies. This professional approach often leads to better lending terms.

4. Investment Flexibility

SPVs make partnership deals smoother. Multiple investors can own shares easily. Ownership percentages adjust without property transfers.

Exit strategies remain flexible for all parties. Future funding rounds work better with clear share structures.

How SPV Works in Property Setup?

Setting up an SPV isn’t as complicated as it sounds. Think of it like creating a protective box for your property investment.

First, you’ll need to understand the legal basics. Property SPVs operate exclusively as limited companies; they can’t run other businesses on the side. It’s all about that one property (or sometimes a few related ones).

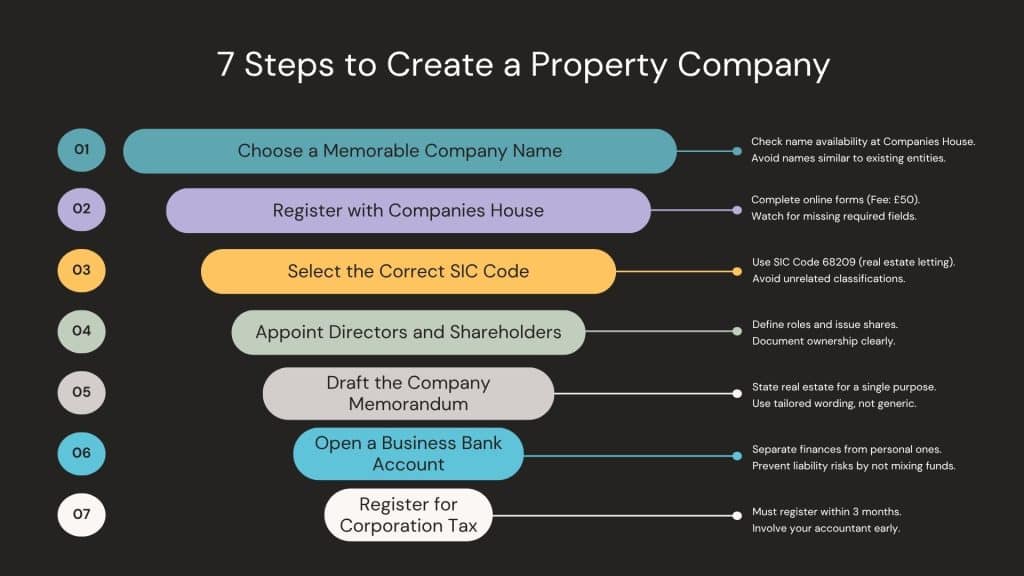

The incorporation process feels similar to starting any company. You’ll select a name, file the necessary paperwork with Companies House, and choose the correct classification code.

Most investors handle this themselves in about a week. Here’s where it gets property-specific: your SPV needs special documentation that reflects its real estate purpose.

The company’s memorandum shows it’s built for property. You’ll also want everything ready for buy-to-let mortgages from day one.

Once running, your SPV operates like a regular company. It files accounts, directors make decisions, and rental income flows through the company’s bank accounts.

The difference? Everything revolves around your property investment, keeping things focused and clean.

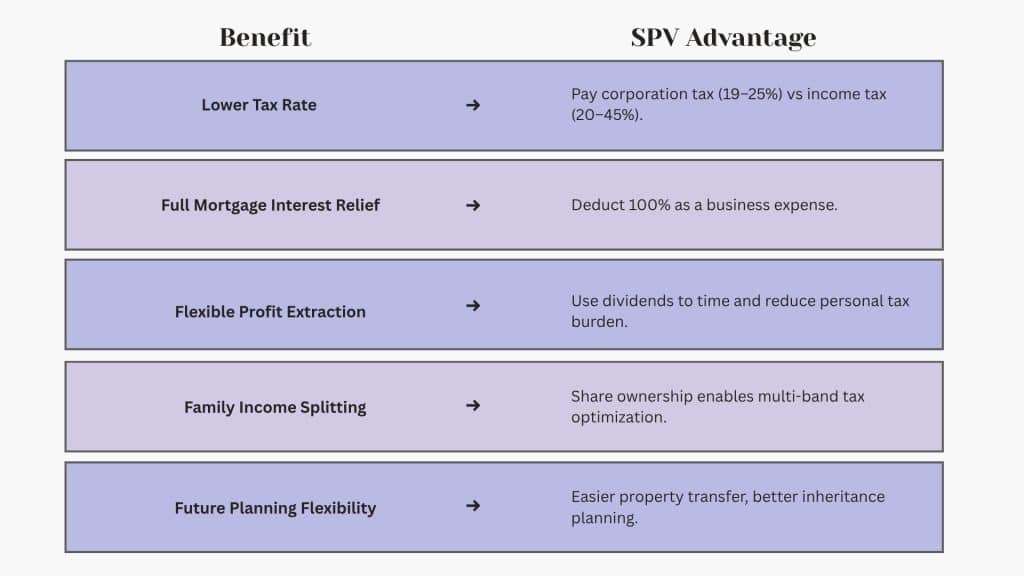

How SPVs Help Cut Property Taxes?

Tax efficiency drives many investors toward SPVs. The structure offers multiple advantages over personal ownership, resulting in annual savings of thousands of dollars.

Personal landlords have faced severe restrictions on interest relief since 2017. SPVs deduct full mortgage interest as a business expense, which has a significant impact on their profitability.

Important note: Higher-rate taxpayers often save 20-25% on mortgage interest through SPVs compared to owning the property personally.

Future planning options multiply with SPVs. Property transfers simplify, inheritance planning improves, and exit strategies offer better tax efficiency.

What Is the Role of SPV in Property Financing?

SPVs fundamentally change how property investors access funding. Lenders view these company structures as separate business entities, opening up different financing options.

Banks prefer SPVs for their clean, single-purpose nature. One property per company means straightforward security and clear financial performance.

- Commercial Lending Access: SPVs qualify for business mortgages with different terms than personal loans.

- Portfolio Flexibility: Refinance individual properties without affecting others.

- Investment Readiness: Professional structure attracts partners and private funding.

- Simplified Security: Banks secure against company shares, not complex personal guarantees.

The financing process shifts from personal to commercial criteria. Lenders focus on rental yields and business plans rather than salary multiples.

SPV vs Direct Property Ownership

Choosing between SPV and personal ownership requires careful comparison. Each approach suits different investor profiles and property strategies.

The decision impacts everything from taxes to financing options. Understanding both structures helps you pick the right path for your situation.

| Comparison Factor | SPV Ownership | Direct Ownership |

|---|---|---|

| Liability Protection | An entity protects personal wealth | Personal assets at risk |

| Tax on Profits | Corporation tax (19-25%) | Income tax (20-45%) |

| Mortgage Interest | Fully deductible | Restricted relief only |

| Setup Costs | £500-2000 initial | Minimal costs |

| Annual Admin | £1000-3000 yearly | Basic tax return |

| Mortgage Options | Limited lenders | Wide market choice |

| Exit Strategy | Sell shares or property | Sell property only |

Your choice depends on portfolio size, tax position, and growth plans. Larger portfolios and higher-rate taxpayers typically benefit more from SPVs.

Key Consideration: Calculate both scenarios before deciding; the tax savings must outweigh the additional costs.

When to Use SPV in Property Ownership?

Recognizing the right moment for setting up an SPV can save thousands. Savvy investors watch for specific triggers that signal it’s time to incorporate.

The sweet spot varies for each investor. Your tax situation and growth ambitions determine optimal timing.

Stay Personal:

Personal ownership is well-suited for first-time buyers seeking simplicity and individuals with tax rates below 20%.

It’s suitable when you own fewer than three properties and aren’t bringing in partners. If your annual profit stays under £30k, the tax burden may not justify the extra costs of an SPV.

Choose SPV:

High earners should consider an SPV for immediate tax savings, especially with rates above 20%.

It’s essential for three or more properties, when bringing in partners, or with annual profits above £30k. If you plan to sell your portfolio later, an SPV offers more flexibility through share sales instead of property transfers.

Each scenario requires careful consideration. First-time landlords earning under £50k annually should keep things simple. However, high earners face immediate tax pain, which SPVs effectively solve.

Multiple properties create complexity that SPVs can manage more effectively. Partnerships need a proper structure to protect all parties involved.

How to Create an SPV for Property?

Creating your property SPV takes 5-7 days with the right approach. The process stays straightforward when you follow proper steps.

Setting up costs range from £500 to £ 2000, including professional fees. Most investors handle company formation themselves, but they hire accountants for tax registration.

US Process Differences: States vary significantly in requirements. Delaware and Wyoming offer investor-friendly structures, while your home state might provide tax advantages.

Tips for Managing SPV Compliance

Ongoing maintenance keeps your SPV compliant and preserves its benefits. Regular attention to key tasks prevents costly problems later.

- Submit annual accounts to Companies House within 9 months of the year-end or face automatic penalties.

- File a yearly confirmation statement to ensure company details remain accurate, which takes approximately 10 minutes.

- Complete corporation tax returns within 12 months of the accounting period, as missed deadlines trigger fines.

- Never mix personal and company funds since this can compromise limited liability protection.

- Store all receipts, invoices, and bank statements for a minimum of 6 years.

- Check if your rental income exceeds the VAT threshold, currently set at £90,000.

Conclusion

SPVs provide property investors with a powerful tool for building wealth while mitigating risk.

The structure provides tax efficiency, liability protection, and professional credibility. Yes, setup costs and ongoing compliance require investment.

However, for serious property investors, these costs pale in comparison to the benefits. Begin by evaluating your current portfolio and tax situation.

Consult professionals who have a deep understanding of property SPVs. Take action when the numbers make sense.

Your future property investments will thank you for building the proper foundation today. Remember, the best time to structure properly is before you need it.

Found this helpful? Share your SPV thoughts below or ask questions about structuring your property investments for tax efficiency.

Learn more about maintaining and improving your property.

Frequently Asked Questions

Who Typically Uses SPVs?

Property investors, developers, and landlords with multiple properties use SPVs. High earners benefit most from tax savings and liability protection.

What Is the Other Name for SPV?

Special Purpose Entity (SPE) or Special Purpose Company (SPC) are common alternatives. Property investors typically refer to themselves as “property companies.”

How Many Investors Are in An SPV?

UK property SPVs have no investor limits. Most have 1-4 shareholders. Complex developments may involve 10 or more investors sharing ownership.