What if a simple piece of paper could save your family from years of legal battles and thousands in court fees?

When my neighbor Sarah bought a house with her brother, they thought a handshake was enough. Two years later, they ended up in court fighting over who owned what percentage.

That’s when I learned about declarations of trust, legal documents that prevent these costly battles by clearly stating who owns what from day one.

They’re like insurance policies for shared property, protecting relationships and savings.

If you’re buying property with someone else or managing family assets, understanding declarations of trust could save you thousands in legal fees and preserve important relationships.

What Is a Declaration of Trust?

A declaration of trust is a legal document that creates a formal trust arrangement. It names a trustee and sets out the rules for how the trust operates.

This document prevents disputes by making everything clear from the start. It shows who owns what property and explains each person’s duties. When problems arise, the declaration provides legal proof of the original agreement.

People commonly use declarations of trust for property purchases, business deals, and family arrangements. The document acts like a contract that protects everyone involved.

Without this paperwork, trust arrangements often become confusing. This leads to arguments and expensive court cases. A proper declaration keeps things simple and legally secure.

Who Should Consider a Declaration of Trust?

Various individuals and families can benefit from establishing a declaration of trust. Property owners, business partners, and those planning their estates find these documents particularly useful.

Consider your specific situation to determine if this legal tool meets your needs.

1. Property Co-Owners: People buying property together often need clear ownership agreements. This includes married couples, business partners, or family members pooling resources for real estate investments.

2. Parents Planning for Children: Parents who want to set aside money or property for their children’s future education, marriage, or other milestones should consider trusts. This helps manage assets until children reach appropriate ages.

3. High Net Worth Individuals: People with significant assets benefit from trust structures for tax planning and wealth preservation. Trusts can help reduce estate taxes and protect family wealth across generations.

4. Anyone Wanting Asset Protection: Those concerned about potential lawsuits or creditor claims can use trusts to shield certain assets from legal exposure while maintaining some level of control.

Understanding Property Ownership Types

Learn the key differences between tenants in common and joint tenants to make informed property ownership decisions.

These two structures offer different levels of flexibility and control over shared property. Choose the right option based on your inheritance and selling preferences.

| Aspect | Tenants in Common | Joint Tenants |

|---|---|---|

| Ownership Shares | Can be equal or unequal, based on agreement. | It must be equal for all owners. |

| Transfer on Death | Share passes to heirs or beneficiaries named in a will. | Share automatically transfers to surviving owners (right of survivorship). |

| Selling Rights | Owners can sell their share independently without others’ permission. | Owners cannot sell their share without breaking the joint tenancy or getting an agreement. |

| Legal Requirements | Flexible—owners can acquire shares at different times and in different ways. | Must acquire ownership at the same time with identical rights. |

| Best For | Flexibility and control over inheritance. | Automatic transfer to surviving owners. |

Declaration of Trust vs Trust Agreement vs Certificate of Trust

While all three documents relate to trusts, they serve different purposes: one creates the trust, another governs it in detail, and the last provides proof without revealing sensitive terms.

| Aspect | Declaration of Trust (DOT) | Trust Agreement | Certificate of Trust |

|---|---|---|---|

| Role | Creates the trust and states that a trustee holds property for a beneficiary. | Full legal document covering all terms, duties, and powers. | Summary proving the trust exists without revealing details. |

| Scope | Property, Parties, Purpose. | Complete operational rules administration, succession, and disputes. | Essential details are only the trustee’s identity, powers. |

| Uses | Property co‑ownership, simple trusts. | Complex estate, business, or charitable trusts. | Proof for banks, registries, and third parties. |

| Privacy | Medium. | Low. | High. |

Why You Need a Declaration of Trust?

A declaration of trust provides clear legal protection and structure for all parties involved.

It prevents costly disputes while ensuring proper management of trust assets. This document offers peace of mind through documented agreements and responsibilities.

A declaration of trust is your legal safety net that prevents expensive fights over money and property.

Without one, you’re gambling with relationships and assets when disagreements arise. Get this paperwork sorted upfront to avoid costly legal battles and sleepless nights later.

Key Components of a Declaration of Trust

Every declaration of trust must include specific elements to work properly. These components define roles, properties, and rules for the trust arrangement.

1. Settlor: The person who creates and funds the trust. They transfer their property into the trust and set the rules for how it operates. Settlors can be individuals, couples, or organizations.

2. Trustee: The person who manages the trust property on behalf of beneficiaries. They handle daily operations, make investment decisions, and distribute benefits. Trustees must act honestly and in the beneficiaries’ best interests.

3. Beneficiary: The person who receives benefits from the trust, such as income or property. Benefits can be immediate or based on certain conditions. Multiple beneficiaries can have different rights.

4. Trust property details: Lists what goes into the trust, including real estate, money, investments, or valuable items. Explains how trustees should manage and protect these assets.

5. Distribution rules: Sets out when and how beneficiaries receive their benefits. This includes income payments, lump sums, or property transfers based on specific conditions or life events.

6. Purpose statements: Clarify why the trust exists and its goals, such as supporting education, caring for family members, or preserving wealth for future generations.

These components work together to create a complete legal framework that protects all parties and ensures the trust operates as intended.

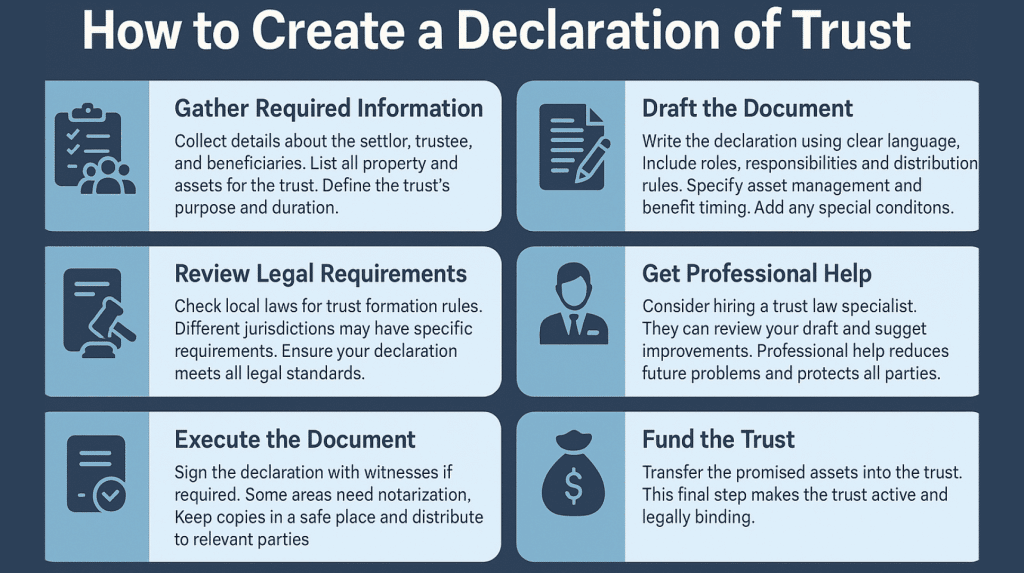

Creating Your Declaration of Trust

Creating a declaration of trust requires careful planning and proper legal documentation. The process involves several important steps to ensure all parties are protected.

Professional guidance helps avoid common mistakes and ensures compliance with local laws.

Creating a declaration of trust isn’t a DIY job – it needs proper legal documentation and professional guidance to protect everyone involved.

Get it wrong, and you risk costly disputes or invalid agreements that won’t hold up when you need them most. Invest in proper legal help upfront to save major headaches later.

Final Thoughts

Creating a declaration of trust is simpler than most people think. You now understand the key components, know who benefits most from these documents, and have a clear roadmap for setting one up.

The difference between tenants in common and joint tenants, the roles of settlors and trustees, and the various trust structures, all these details work together to create a solid legal foundation for your assets.

Your next step depends on your situation. Whether you need basic property protection or complex estate planning, the right declaration of trust can secure your goals.

Start by gathering your financial information and identifying your objectives.

Then connect with a qualified legal professional who can guide you through the process and ensure everything meets your local requirements.

Want to get the legal or money stuff right? Read more here.

Frequently Asked Questions

What Does Self-Declaration of Trust Mean?

A self-declaration of trust means the property owner declares themselves as the trustee while holding the property for beneficiaries. They manage assets they technically own for others.

Do All Trusts Have a Certificate of Trust?

No, not all trusts have certificates. A certificate of trust is optional and created separately to prove the trust exists without revealing private details.

Who Is the Grantor of The Declaration of Trust?

The grantor is the person who creates and funds the trust. They transfer their property into the trust and set the rules for operation.