What if the stress of funding your house move could disappear with one simple loan application?

Moving to a new home costs more than most people expect. Between hiring movers, paying deposits, and covering travel expenses, the bills quickly add up.

Many families find themselves short on cash when it’s time to relocate.

I’ll show you exactly how to get the funding you need for your move. Personal loans, specialized moving loans, and other financial options can bridge the gap when your savings fall short.

Through this blog, I’ll guide you through various types of loans for moving house, help you assess which option best suits your situation, and provide step-by-step instructions for getting approved.

You’ll also learn about free assistance programs that might help reduce your costs.

What is a Moving Loan?

A moving loan is a personal loan specifically designed to help you cover the costs of relocation.

You can use these funds to hire professional movers, cover security deposits, pay for travel expenses, or handle utility setup fees at your new home.

Most moving loans work as unsecured personal loans. This means you don’t need to put up your car or home as collateral. The lender approves you based solely on your credit history and income.

Here’s how the process typically works:

- You apply for a specific loan amount

- Once approved, you get the full amount in one lump sum

- You pay it back in fixed monthly payments

Repayment terms usually range from 12 to 60 months. Shorter terms result in higher monthly payments but lower interest paid over the entire term.

Your credit score and income directly affect whether you get approved and what interest rate you’ll pay. Better credit means better rates.

Most lenders deposit the money into your bank account within a few business days of approval.

Pros and Cons of Moving Loans

Before you decide if a moving loan is right for you, let’s look at both sides. Understanding the benefits and drawbacks helps you make a smart choice.

Here’s a clear breakdown of what you gain and what you should watch out for:

| Pros | Cons |

|---|---|

| Quick access to funds – Get money within 1-3 business days after approval | Interest costs – You’ll pay more than the loan amount over time |

| No collateral needed – Your home or car stays safe with unsecured loans | Credit score impact – Hard inquiries and new debt affect your credit rating |

| Fixed monthly payments – Know exactly what you’ll pay each month | Qualification requirements – Need good credit and steady income for best rates |

| Flexible use of funds – Cover any moving expense from deposits to movers | Monthly payment burden – Another bill to manage in your new budget |

| Predictable repayment – Fixed terms mean no surprise rate changes | Fees and penalties – Origination fees and potential prepayment penalties |

| Builds credit history – On-time payments improve your credit score | Debt obligation – You’re committed to payments even if circumstances change |

| Better than credit cards – Lower interest rates than most credit cards | Risk of overborrowing – Easy to borrow more than you actually need |

The key is borrowing only what you need and ensuring the monthly payments fit comfortably in your post-move budget.

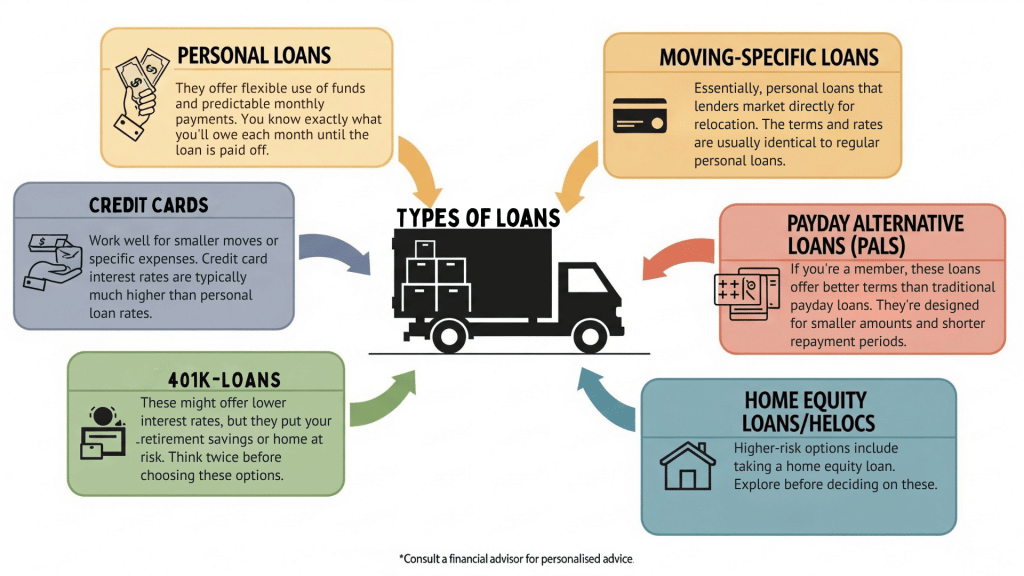

Types of Loan Options Available for Moving

When you need funding for your move, you have several options. Each type of loan works differently and fits different situations. Let me break down your choices so you can pick the right one.

The key is matching the loan type to your specific needs and financial situation. Personal loans are suitable for most people, but it’s essential to explore all your options before making a decision.

Recommended Lenders for Moving Loans

Not all lenders are created equal when it comes to moving loans. Some options are better suited for individuals with lower credit scores, while others offer the best rates for borrowers with excellent credit.

Let me share the top lenders in each category:

1. Best for Lower Credit Scores

Best Egg, Upstart, and Avant are solid choices if you need fast approval or have less-than-perfect credit. These lenders are known for their flexible requirements and quick processing times.

They often approve borrowers that bigger banks might turn down.

2. Best for Excellent Credit

SoFi and LightStream are well-suited for individuals with high credit scores. They offer some of the most competitive interest rates in the market.

If your credit is strong, these lenders can save you significant money over the life of your loan.

3. Comparison Tools

Use loan comparison platforms like NerdWallet or LendingTree to get personalized offers. These tools let you see rates from multiple lenders without hurting your credit score.

You can compare terms side by side and choose the best deal for your situation.

Employer Relocation Assistance for Ground Rent

Before you apply for any loan, check if your employer offers relocation packages.

Many companies provide cash bonuses, cover moving service costs, or reimburse your expenses after the move. This free money can reduce or eliminate your need for a loan.

Smart employees can turn employer benefits into thousands of dollars in savings. The key is knowing what to ask for and when to ask.

Types of Relocation Benefits Offered

Company relocation packages come in many forms. Knowing your options helps you know what to request.

Common employer benefits include:

- Lump sum payments – Fixed cash amounts ranging from $2,500 to $25,000 based on your job level

- Direct expense coverage – The Company pays movers, temporary housing, and travel costs directly

- Reimbursement programs – You pay upfront and get money back with receipts

- Home sale assistance – Help selling your current home or buying a new one

- Temporary living allowances – Hotel or rental costs while you search for permanent housing

- Spouse job search support – Career placement services for your partner

- Tax gross-up benefits – Extra money to cover taxes on relocation payments

The amount and type of help depends on your company’s size, industry, and job level. Senior positions typically get more comprehensive packages.

How to Maximize Your Employer Benefits?

Maximizing the benefits of employer benefits requires some strategic planning. Here are key approaches that can save you hundreds or even thousands of dollars:

- Negotiate during job offers – Ask for relocation help before accepting any position, when you have the most bargaining power.

- Research hidden programs – Check your employee handbook and ask HR directly about assistance programs that may not be widely advertised.

- Calculate real savings – A $5,000 employer contribution saves you from borrowing that amount plus interest costs.

- Know the difference – Internal transfers often qualify for different benefits than new hires, so ask about both.

- Factor in taxes – Some relocation benefits are taxable income while others aren’t, so plan accordingly when budgeting your move.

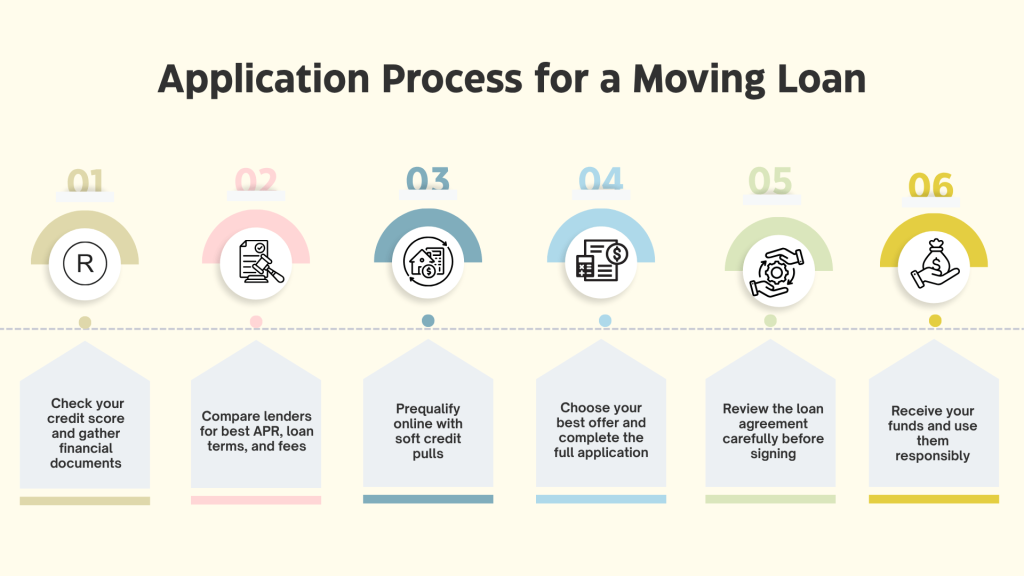

Application Process for a Moving Loan

If free assistance isn’t available or doesn’t cover your full moving costs, it’s time to apply for a loan.

The application process is straightforward, but being prepared makes everything go smoother and helps you get better terms.

Here’s your detailed step-by-step roadmap for getting approved with your application:

Step 1: Check your credit score and gather financial documents: Know your credit score before you start shopping. Collect recent pay stubs, tax returns, bank statements, and proof of employment. Having these ready speeds up the process.

Step 2: Compare lenders for the best APR, loan terms, and fees: Don’t settle for the first offer you see. Look at interest rates, repayment periods, origination fees, and prepayment penalties. Small differences in rates can save you hundreds of dollars.

Step 3: Prequalify online with soft credit pulls: Most lenders offer prequalification that won’t hurt your credit score. This provides you with real rate quotes to compare, without any commitment.

Step 4: Choose your best offer and complete the full application: Once you’ve compared options, pick the lender with the best terms for your situation. The full application will require a hard credit pull and a detailed financial review.

Step 5: Review the loan agreement carefully before signing: Read all terms, especially the interest rate, monthly payment amount, loan length, and any fees. Ensure you understand when payments are due and what happens if you pay early.

Step 6: Receive your funds and use them responsibly: Most lenders deposit approved funds within 1-3 business days. Use the money only for moving expenses as planned, and start making payments on time from the very first day.

Documentation Required for a Moving Loan Application

Proper paperwork ensures that you receive every benefit to which you’re entitled, protecting your financial interests and preventing costly oversights.

Complete documentation also speeds up processing times and reduces the chance of claim denials or delays that could leave you without coverage when you need it most.

- Written relocation policy or agreement

- All receipts for reimbursable expenses

- Mileage logs for travel reimbursement

- Temporary housing documentation

- Travel expense records, including meals and hotels

Submit reimbursement requests promptly. Many companies have strict deadlines for expense reporting.

Conclusion

Moving doesn’t have to drain your bank account or leave you stressed about money. With the right approach, you can fund your relocation without breaking your budget.

Start by exploring free resources, employer benefits, and assistance programs that can cover significant costs. If you need a loan, compare multiple lenders to find the best rates and terms for your credit situation.

Remember to borrow only what you actually need for essential moving expenses.

The key to a successful move is planning ahead and understanding all your options. Take time to assess your finances, gather the right documents, and apply early enough to secure funding before your moving date.

Ready to take the next step? Check your credit score today and start comparing loan offers from the lenders we discussed. Your new home is waiting.

Frequently Asked Questions

What Happens if I Have a Mortgage and I Want to Move?

You can sell your current home to pay off the mortgage, or rent it out while buying a new property. Some lenders offer portable mortgages that can be transferred to your new home.

Do You Pay Movers Before or After Moving?

Most moving companies require payment upon delivery. Some ask for a deposit upfront, with the balance due when your items arrive at your new home.

How Far in Advance Do I Need to Hire Movers?

Book movers 4-8 weeks in advance for local moves and 8-12 weeks for long-distance moves. The peak moving season (summer months) requires booking even earlier to secure your preferred dates.