Deed Fraud: Could Someone “Steal” Your House? (Annoyingly… kinda.)

I hate being the person who shows up to your happy little home and garden internet corner and goes, “So, criminals exist!” But I’d rather you be mildly annoyed with me for five minutes than blindsided later.

Here’s the spicy part: in a lot of counties, someone can file a deed that looks legit, and it can get recorded without anyone doing the signature version of a background check. In a 2023 survey, 83% of county officials said property fraud alerts are the most effective homeowner protection tool… and yet most people have never signed up. Which is very on brand for adulthood, honestly.

So let’s talk deed fraud: how it works, who gets targeted, and what you can do (mostly for free) to make yourself a giant pain in a scammer’s butt.

First: “Steal your home” isn’t quite the right phrase (but it’s still a mess)

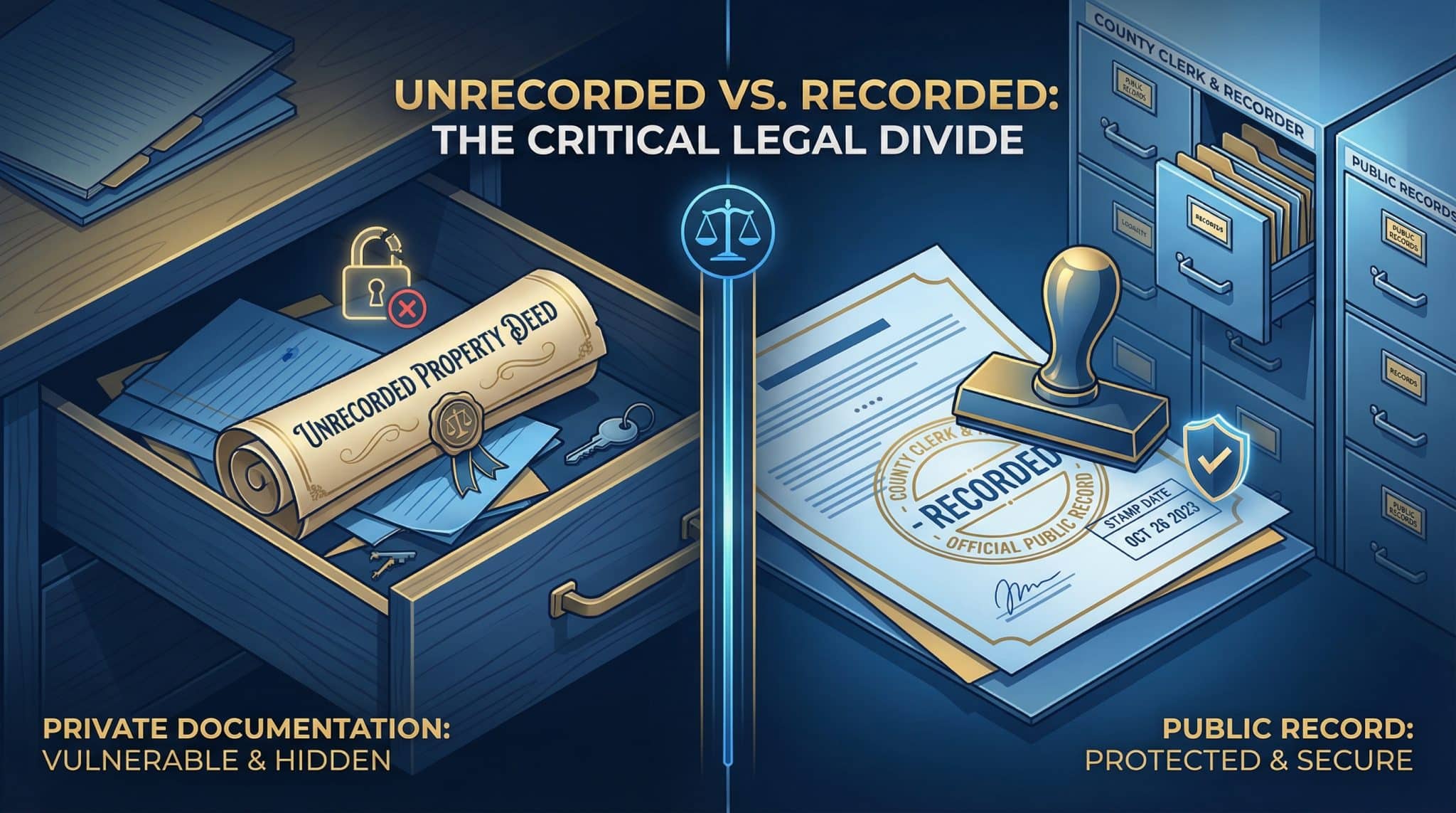

If someone records a fraudulent deed, it usually doesn’t mean you instantly stop owning your home in a magical, evil paperwork spell.

What it does mean is you can end up with what’s called a cloud on title basically a big legal smudge that can block you from:

- selling

- refinancing

- getting a home equity loan

- using your property as collateral

And clearing that smudge can take months and involve attorneys and court filings and lots of “Wait, I have to prove I own my own house???” energy.

So yes, you’re still the rightful owner but the cleanup is a time sucking, money sucking nuisance. Which is why spotting it early is the whole game.

How deed fraud usually goes down (the short, horrifying version)

County recording offices are built for speed, not for “let’s CSI this signature.” If the document uses common deed formatting and has signatures/notary stamps, it often gets recorded. Even if it’s all fake.

A pretty typical scam looks like this:

- Scammer grabs info from public records (your name, address, sometimes even a signature from old filings).

- Creates a new deed “transferring” your property to them (or their LLC with a name like “Patriot Holdings 123,” because of course).

- Adds a fake notary stamp/signature.

- Records it.

- Then they hustle because scammers do not lounge.

Common next moves:

- Apply for a home equity loan / cash out refi (often within a few weeks)

- List the house for sale to an unsuspecting buyer

- If it’s a rental: contact tenants and redirect rent payments (“Hi, I’m the new owner!”)

The scam works best when you don’t notice quickly. They’re counting on you being busy living your life and not casually checking county records like it’s your new hobby.

Who tends to get targeted (aka: the “easy” properties)

Technically anyone can be targeted, but scammers love the path of least resistance. So if any of these describe you, pay extra attention:

Vacant land / vacant houses / second homes

If nobody’s physically there, it’s easier to get away with nonsense longer. Missing mail? Random “For Sale” sign? A neighbor mentions strangers? Easy to miss if you’re not around.

Seniors with paid off homes

No mortgage company watching the title. Less noise. More equity. It’s gross, but it’s common. If you’ve got parents/relatives in this category, helping them set up alerts and credit freezes is a genuinely loving act (and takes less time than arguing about whether they “really need” a smartphone).

Rental properties

This is the one that makes my blood pressure spike. Sometimes scammers record a deed and then tell tenants to send rent to a new account. Tenants don’t know it’s fake they’re just trying to pay rent and live their lives.

If you’re a landlord: tell tenants, in writing, how ownership changes will be communicated (and that random phone calls/emails don’t count).

Properties “in transition” (buying/selling/refinancing)

Not deed fraud exactly, but real estate transactions are also prime time for wire fraud. If wiring instructions suddenly “change,” treat it like a raccoon in your kitchen: assume chaos until proven otherwise.

Red flags that should make you investigate immediately

Deed fraud often announces itself in the most boring way possible: mail.

Watch for:

- Missing property tax bills you always get (or mortgage statements/utility bills suddenly stopping)

- Mail addressed to someone else at your address that smells like mortgage/refinance offers

- Notices of default for loans you never took out (panic worthy)

- Tenants saying “someone called and said they’re the new owner” (drop everything)

For vacant/remote properties: neighbors reporting activity, utilities turning on, someone “moving in,” or anyone claiming ownership.

If your gut says “this is weird,” listen to it. Your gut is basically your internal spam filter.

My “make this annoying to scam” protection plan (mostly free)

Think of this in layers. You don’t need to live in fear. You just need a few simple tripwires.

1) Sign up for county recorder alerts (your #1 free tool)

This is the closest thing to a smoke detector for your title.

Many counties offer free email/text alerts when something is recorded for your name or property address.

How to find it (takes like 15 minutes if the website behaves):

- Google: “[your county] recorder property alert” or “[your county] deed fraud alert”

- Register your name and/or property address

- Make sure it’s set to email/text you actually check

Some states require these programs (Arizona, Florida, Illinois, Utah), and many other counties offer them voluntarily.

If your county doesn’t? Don’t panic. You just lean harder on the next step.

2) Do quick manual record checks (5 minutes once you know where to click)

Every few months, go to your county recorder/assessor website and search your address.

You’re basically confirming:

- owner name(s) are correct

- any mortgage/lender info looks right

- no weird new deed filings you don’t recognize

The first time will feel like you’re decoding an ancient scroll. After that, it’s quick. I like to save a dated screenshot so I can prove “this was fine on X date” if I ever need to.

3) Freeze your credit (because equity thieves also love identity theft)

If someone records a fake deed, they often try to borrow against your home. A credit freeze helps block new credit accounts/loans in your name.

Freeze with all three (it’s free):

- Equifax

- Experian

- TransUnion

Yes, it’s mildly annoying. But so is dealing with a fraudulent loan, and I promise that’s the deluxe size annoyance.

When paid monitoring makes sense (and one marketing myth to ignore)

If you own vacant land, have multiple properties in different places, or your county doesn’t offer alerts, you might want paid title monitoring (often around $120-$300/year).

One quick reality check, though: the FTC has warned that “title lock” is marketing language. Nobody can literally “lock” your title like it’s a bike at Target.

Monitoring = faster notice. It does not magically prevent fraud.

Title insurance: the part people assume they have (and often… don’t)

This is where things get a little “grown up paperwork,” but stay with me.

- Lender’s title insurance protects the bank (common at closing).

- Owner’s title insurance protects you.

Even if you have an owner’s policy, many standard policies mainly cover issues that existed before you bought the home not necessarily fraud that happens after your closing date.

So do this:

- Find out if you have an owner’s policy (not just lender’s)

- Note your policy date/number

- Ask (in writing) if post policy forgery/unauthorized deed transfers are covered or excluded

If you want protection specifically for forged deeds after purchase, ask about ALTA 49 / 49.1 endorsements:

- ALTA 49 = typically added on new policies (ask at closing)

- ALTA 49.1 = can sometimes be added to an existing owner’s policy (ask your title company)

This is the “if something slips through, who pays the legal bill?” piece. Because the legal cleanup is where people get clobbered.

Tiny daily habits that help (no tinfoil hat required)

- Store your deed/tax/mortgage documents somewhere secure (safe, safe deposit box, encrypted digital backup)

- Shred anything with property/identity info before tossing it

- For remote properties: make sure mail is forwarded somewhere you actually check

And during any closing/refi situation: verify wiring instructions using a phone number you look up yourself (not the one in the email). Read account numbers back digit by digit. Assume any “urgent last minute change” is suspicious until proven otherwise.

If you spot fraud: do this fast (like, “pause Netflix” fast)

I’m not a lawyer, but if you see a weird filing or get that “uh-oh” feeling, speed matters. Here’s the practical checklist.

Within 24 hours

- Call your county recorder and report the fraudulent filing (ask about a fraud affidavit/process)

- File a police report (bring copies of the suspicious deed and a certified copy of your deed if you can)

- If you have a mortgage, notify your lender

- Contact your title insurance company to open a claim (if applicable)

- Freeze your credit (if you haven’t already)

- Report at ic3.gov (FBI Internet Crime Complaint Center)

In the next week or two

- Consider reporting to your district attorney

- Talk to a real estate attorney about a quiet title action (the court process to clear the fake deed)

A quiet title case can take a few months even when it’s straightforward, and attorney costs can run a few thousand dollars (more if it gets contested). Most rightful owners win but winning still takes time, which is exactly why prevention is so worth it.

(Some states are trying to speed this up Utah’s Fraudulent Deeds Act, effective May 2024, is one example but don’t rely on “the system will fix it quickly” as your plan.)

The “do this without spiraling” starter checklist

If you want a simple rollout:

- Today: Sign up for county property/deed fraud alerts (for every property you own)

- This week: Do one manual record check and save a screenshot

- This month: Freeze your credit. Locate your title insurance paperwork and ask about post policy forgery coverage/endorsements

- Ongoing: Quick record checks every few months + pay attention to missing/odd mail

That’s it. You don’t need a bunker. You just need a couple of tripwires so you’re not the last to know something weird got filed.

And if you do nothing else: go sign up for the county alert. It’s the easiest “future you” favor you’ll do all week.