Found your dream home but haven’t sold your current one yet? Bridge loans seem like the obvious solution until you see the price tag.

Interest rates of 8-12%, expensive fees, and the stress of carrying two mortgages can quickly turn your dream into a financial nightmare.

Smart homebuyers know there are better options available. From HELOCs (Home Equity Line of Credit)with lower rates to innovative buy-before-you-sell programs, you have multiple alternatives that can save thousands while reducing your risk.

Many buyers rush into bridge loans without first exploring safer, more affordable options.

In this comprehensive guide, you’ll learn what bridge loans really cost, proven alternatives that work better for most buyers, how to choose the right financing option for your situation, and qualification requirements for each alternative.

What is a Bridge Loan?

A bridge loan is a temporary financing option that allows you to buy a new home before selling your current one. Think of it as a financial bridge that connects your old property to your new purchase.

These short-term loans typically last 6 to 12 months and use your existing home’s equity as security. They’re perfect when you find your dream house, but you haven’t sold your current property yet.

The loan “bridges” the gap between buying and selling, giving you the cash needed to close on your new home without waiting.

How Do Bridge Loans Work?

Simple answer: You borrow against your current home’s value to buy a new property, then pay back the loan when your old house sells.

Here’s a quick example: Sarah owns a $400,000 home with a remaining mortgage balance of $200,000. She wants to buy a $500,000 house, but she hasn’t yet sold her current home. A bridge loan lets her borrow against her $200,000 equity to make the new purchase. Once her original home sells, she uses those proceeds to pay off the bridge loan.

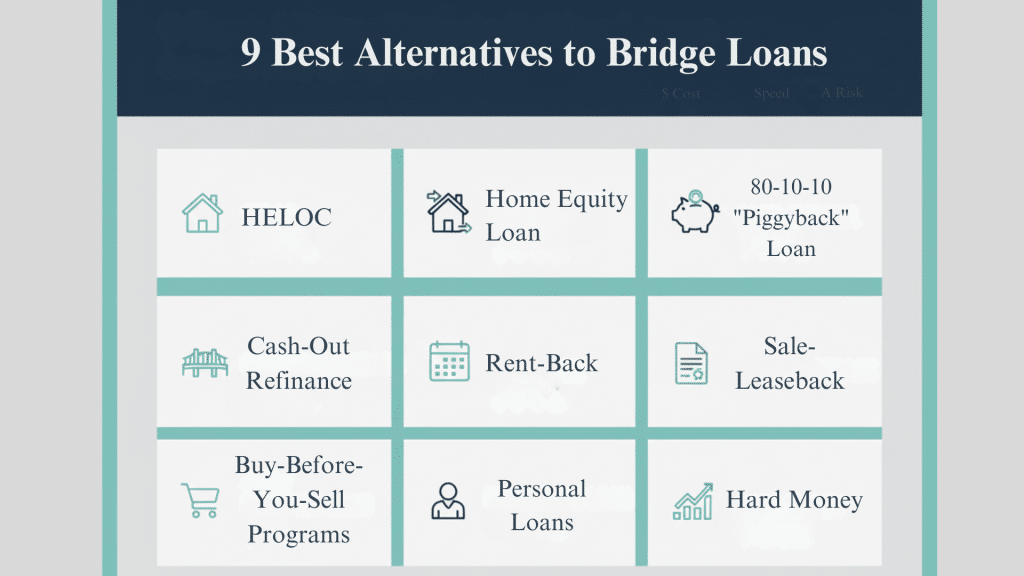

9 Best Alternatives to Bridge Loans

Bridge loans aren’t your only option. Here are 9 smarter alternatives that might save you money and stress:

1. Home Equity Line of Credit (HELOC)

A HELOC gives you flexible revolving credit against your home’s equity, like a giant credit card.

You only pay interest on what you use, and rates are typically lower than those of bridge loans. Perfect for buyers who need varying amounts of cash over time.

2. Home Equity Loan (Second Mortgage)

This fixed-rate lump sum loan utilizes your home as collateral, offering predictable monthly payments.

You receive all the money upfront at a fixed interest rate that won’t fluctuate. Great when you know exactly how much you need and want payment certainty.

3. Cash-Out Refinance

Replace your current mortgage with a larger one and pocket the difference in cash. You get lower rates than most alternatives since it’s a first mortgage. Best when current rates are competitive and you want long-term fixed payments.

4. 80-10-10 “Piggyback” Loan

Take two loans simultaneously: an 80% first mortgage, a 10% second mortgage, and a 10% down payment. This avoids PMI while freeing up cash for your move. Works great for buyers with good credit but limited cash reserves.

5. Rent-Back or Post-Occupancy Agreement

Sell your current home first, then rent it back from the buyer for 30-60 days.

You receive sale proceeds immediately, allowing you time to find your next home. Perfect when you need the sale money to qualify for your new purchase.

6. Sale-Leaseback

Sell your home to an investor or company, then lease it back while you house hunt.

You receive immediate cash without having to move twice, although you will still pay rent during the transition. Ideal for sellers who need time but want guaranteed sale proceeds.

7. Buy-Before-You-Sell Programs

Companies like Knock and Homeward let you buy your new home first, then help sell your old one.

They handle the financing complexity while you avoid bridge loan risks. Best for buyers in competitive markets who need to act fast.

8. Personal Loans or 401(k) Loans

Consider using personal loans or borrowing from your retirement account for smaller funding needs.

These work for down payments, closing costs, or temporary cash flow gaps. Good for smaller amounts when you don’t want to tap into your home equity.

9. Hard Money or DSCR Investor Loans

These investor-focused loans provide rapid funding based on property value, rather than personal income.

They close quickly but cost more than traditional financing. Perfect for real estate investors or unique property situations.

Types of Bridge Loans

Before you choose, it’s helpful to know the main types of bridge loans and when each one is suitable.

| Loan Type | Description | Risk Level | Best For |

|---|---|---|---|

| Closed Bridge Loan | The sale completion date is already set | Lower | Buyers with confirmed sale contracts |

| Open Bridge Loan | No confirmed sale date yet | Higher | Properties still on the market |

| First-Charge Loan | Primary loan secured against property | Medium | Properties with little or no existing mortgage |

| Second-Charge Loan | An additional loan behind the existing mortgage | Higher | Homes with substantial current mortgages |

Key Differences:

Closed vs Open Bridge Loans: Closed loans are safer because you already have a buyer lined up. Open loans are riskier since your sale isn’t guaranteed, which means higher interest rates.

First vs Second Charge: First-charge loans replace your existing mortgage entirely. Second-charge loans sit behind your current mortgage, making them riskier for lenders (and more expensive for you).

Requirements for Getting a Bridge Loan

Getting approved for a bridge loan isn’t automatic. Here are the 5 key requirements most lenders look for:

- Adequate Equity (CLTV Cap): You need at least 20-35% equity in your current home, as lenders typically cap the combined loan-to-value ratio at 65-80%.

- Strong Credit & Clean Recent History: Most lenders want a credit score of 660-700+ with no recent missed payments or bankruptcies.

- Verifiable Income & Manageable DTI: You must prove you can afford two mortgage payments temporarily through tax returns and bank statements.

- Documented Exit Strategy & Timeline: Lenders require a signed listing agreement or purchase contract that outlines how you’ll repay the loan within 6-12 months.

- Acceptable Collateral, Valuation & Funds to Close: Your home requires a current appraisal, a clear title, and proper insurance. Additionally, you will need cash for closing costs.

Pros and Cons of Bridge Loans

Before choosing a bridge loan, weigh these key advantages and disadvantages:

| Pros | Cons |

|---|---|

| Quick Funding – Close in 2-4 weeks vs months for traditional loans | Higher Interest Rates – Often 2-5% above conventional mortgages |

| Flexibility – Buy without selling first, avoid contingent offers | Expensive Fees – Origination, appraisal, and legal costs add up |

| Competitive Advantage – Make stronger, non-contingent offers | Risk if Sale Falls Through – Stuck with two mortgage payments |

| No Sale Pressure – Take time to sell at the right price | Short Repayment Terms – Usually 6-12 months max |

| Secure Dream Property – Don’t lose your ideal home to other buyers | Stricter Qualifications – Need substantial equity and income |

| Timing Control – Move when you want, not when buyers dictate | Potential Double Payments – Carry two properties temporarily |

Bridge loans work great when you have strong finances and a solid exit strategy. They’re expensive but can be worth it to secure the right property in competitive markets.

How to Choose the Right Option?

Picking the best financing option depends on your specific situation. Start by checking your home equity; you need at least 20% for most alternatives.

Next, review your credit score, as higher scores can open more doors and secure better rates.

Consider your sale timeline; if your home isn’t listed yet, avoid closed bridge loans. Finally, be honest about your risk tolerance. Can you handle two mortgage payments if things go wrong?

Quick Decision Checklist:

- Plenty of equity + great credit? → Consider HELOC or cash-out refinance

- Do you need to make a quick purchase in a competitive market? → Look at buy-before-you-sell programs

- Want guaranteed sale proceeds first? → Try rent-back or sale-leaseback options

- Small funding gap only? → Personal loans or 401(k) loans might work

- High-risk tolerance + urgent timeline? → Bridge loans could be worth the cost

The key is matching your financial strength, timeline, and comfort level with the right financing tool.

Final Thoughts

Bridge loans aren’t your only choice when buying before selling. While they offer quick funding and flexibility, the high costs and risks often outweigh the benefits for most homebuyers.

HELOCs, cash-out refinancing, and buy-before-you-sell programs frequently provide better value with lower interest rates and reduced stress.

The key is matching your financial situation, timeline, and risk tolerance to the right option. R

emember to consider your home equity, credit score, and exit strategy before making any decision. Don’t let expensive bridge loan fees eat into your home-buying budget when smarter alternatives exist.

Ready to explore your options? Compare rates from multiple lenders, speak with a mortgage advisor about your specific situation, and get pre-approved for the financing solution that best suits your needs. Your dream home shouldn’t cost you a financial nightmare.