Are you tired of paying high tax rates on your rental income while watching your property profits shrink? You’re not alone. Many UK landlords now face hefty tax bills that eat into their investment returns.

But there’s a solution that could save you thousands. Learning how to buy a house through your business UK can transform your property investment strategy.

This approach lets you claim full mortgage interest relief and pay lower corporation tax rates.

This article will show you exactly how to buy a house through your business UK, from setting up the right company structure to completing your first purchase.

Learn the costs, benefits, and processes that successful property investors use to build wealth more efficiently.

Why Businesses Are Buying Property in the UK

More UK investors now buy property through limited companies than ever before. This trend began in 2016, when the government revised tax rules for individual landlords.

Over 40% of new buy-to-let mortgages now go through companies.

The main reason is tax savings. Companies can claim full mortgage interest as a business expense, while individual landlords lose this benefit under Section 24 rules.

Higher-rate taxpayers save thousands each year, as companies pay 19% corporation tax compared to 40-45% personal rates.

The 3% stamp duty surcharge affects personal buyers, but companies get better overall tax treatment.

Many existing landlords transferred their properties into companies, making this the standard approach for professional investors.

What Does It Mean to Buy via a Limited Company?

When you buy a house through your business in the UK, you use a company structure instead of personal ownership.

This approach creates a legal separation between you and the property investment, while giving you full control over the decisions.

Most investors find this structure provides better protection and tax treatment than personal ownership.

- Company Ownership Structure: The limited company owns the property legally, not you personally. You own shares in the company, which gives you control over all property decisions and rental income.

- Special Purpose Vehicles (SPVs): Most investors create dedicated property companies rather than using existing trading companies. SPVs focus only on property investment, providing cleaner tax treatment and simpler administration.

- Legal Document Signing: All property documents show the company name as the owner. As a company director, you sign contracts and mortgages, maintaining the legal separation while retaining full operational control.

- Asset Protection Benefits: The company structure protects your personal wealth from property-related risks. Creditors can only pursue company assets, leaving your personal savings and home safe from business claims.

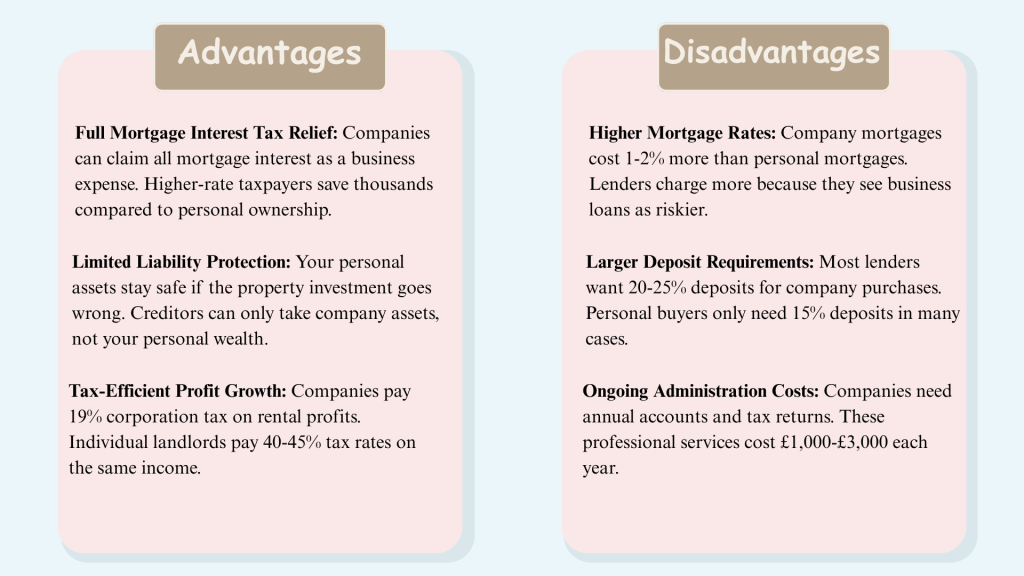

Advantages and Disadvantages: Business Property Purchase UK

Comparing the advantages and disadvantages reveals the key factors that determine whether company or personal ownership suits your property investment strategy better when you buy a house through your UK business.

The tax savings from company ownership typically outweigh the higher costs and complexity for investors with multiple properties; however, single-property buyers may find personal ownership more straightforward, despite the tax disadvantages.

5 Steps to Buy Property Through Your Business in the UK

The entire process typically takes 4-6 weeks from company incorporation to property completion. Start early with professional advice and company setup, as delays in mortgage applications or legal processes can extend timelines. Most investors find the structured approach worthwhile for the extra time it provides, offering long-term tax benefits and asset protection. Before buying a house through your UK business, budget carefully for all associated expenses. The costs are divided into three categories: initial setup costs associated with forming your company, mortgage-related fees incurred during the purchase process, and recurring annual expenses required to maintain your business structure. These financial commitments require careful planning to ensure your investment strategy remains profitable. Expect to invest £3,000-£6,000 more upfront for company purchases compared to personal ownership, plus £1,200-£3,200 annually in ongoing costs. Tax savings for higher-rate taxpayers typically offset higher expenses within the first year of rental income. The choice between personal and business property ownership depends on your tax situation, investment goals, and portfolio size. Higher-rate taxpayers with multiple properties often benefit from company ownership, as it provides significant tax savings and asset protection. Basic-rate taxpayers with smaller portfolios often find personal ownership more straightforward and more cost-effective for their needs. Choose Personal Ownership If: Choose Business Ownership If: Your current tax bracket and income level play the biggest role in determining which approach saves you more money. The number of properties you plan to own also matters significantly, as company structures work better for larger portfolios. Consider your tolerance for administrative complexity, since business ownership requires ongoing paperwork and compliance tasks. Finally, consider your long-term investment goals and exit strategy, as companies often offer more flexibility for growth and succession planning than personal ownership. The Bottom Line Learning how to buy a house through your business UK opens doors to significant tax savings and better investment protection. Company ownership provides complete mortgage interest relief, lower corporation tax rates, and limited liability benefits that personal ownership cannot match. The process requires careful planning, from incorporating your limited company to securing buy-to-let mortgages. While upfront costs and ongoing administration create extra work, the financial benefits make company ownership worthwhile for serious property investors. Higher-rate taxpayers and those building larger portfolios see the greatest advantages when they buy a house through your business in the UK. With proper guidance and specialist advice, company property ownership becomes a powerful wealth-building strategy that transforms how you approach rental property investment.

Cost Breakdown and Ongoing Expenses

Cost Type

Amount

When Due

Initial Setup Costs

Company incorporation

£12-£40

One-time at setup

Legal fees (company property)

£1,500-£3,000

At completion

SDLT (including 3% surcharge)

Varies by property value

Within 14 days of completion

Mortgage Costs

Arrangement fees

£1,000-£3,000

At the mortgage setup

Valuation fees

£300-£800

At application

Higher deposit requirement

20-25% of property value

At completion

Ongoing Annual Costs

Accountancy fees

£1,000-£3,000

Annually

Companies House fees

£13-£34

Annually

Registered office service

£50-£200

Annually

Corporation tax

19% on profits

Annually

Should You Buy Property Personally or Through Your Business?

Frequently Asked Questions