Getting a mortgage illustration can feel confusing. You receive this detailed document from your lender, but what does it mean for your home-buying plans? This illustration document outlines key costs before you commit.

Many first-time buyers wonder if receiving a mortgage illustration means their loan is approved. Others worry it might be just another step in a long process that could still end in rejection. The truth is, mortgage illustrations serve a specific purpose that every buyer should understand. In other words, is a mortgage illustration a good sign or simply routine paperwork?

A mortgage illustration shows you exactly how much you’ll pay over your loan term. It breaks down monthly payments, interest costs, and total amounts. This document empowers you to make informed decisions about your most significant financial commitment. This comes directly from your mortgage lender and relates to your specific mortgage loan.

Please keep reading to learn what mortgage illustrations mean, when you’ll receive them, and how to use this information to secure the best deal for your home purchase. If anything is unclear, a mortgage broker can offer impartial mortgage advice.

What Is a Mortgage Illustration?

A mortgage illustration is a detailed document that shows you exactly what your home loan will cost over its entire term. Lenders must provide this standardized breakdown to help you understand the true cost of borrowing money for your property purchase.

The illustration includes your monthly payments, total interest charges, and the overall amount you’ll repay by the end of your mortgage term. Use the mortgage illustration to check affordability month by month.

Key Components of Mortgage Illustrations

- Key Facts Illustration (KFI) – A mandatory document for UK mortgages that shows costs, risks, and features in a clear format

- European Standardised Information Sheet (ESIS) – Required for buy-to-let and commercial mortgages, providing standardized information across EU countries

- Total cost breakdown – Shows exactly how much you’ll pay in interest and fees over the full loan period

Lenders provide mortgage illustrations at specific stages of your application process. You’ll typically receive one when you first inquire about a mortgage product, and another, more detailed version once you submit a formal application. Exact timings can vary by mortgage provider.

This timing ensures you can compare different mortgage offers before making your final decision. The illustration also serves as a legal requirement, protecting both you and the lender by ensuring full transparency about the loan terms and costs involved in your mortgage agreement.

Is a Mortgage Illustration a Good Sign?

Receiving a mortgage illustration is a positive sign in your application process. It indicates that your lender has reviewed your details and considers you a potential borrower.

But it’s not a guarantee of approval. The illustration helps you understand mortgage terms before any final decisions. So, is a mortgage illustration a good sign? Yes—it’s a marker of progress, not approval.

The timing indicates your application status. Early illustrations suggest that the lender is committed to working with you. This suggests you meet their basic lending requirements. This context helps you gauge where you stand in the mortgage application.

It also shows you’re prepared as a borrower. Lenders provide detailed illustrations to applicants, complete with all necessary information and documents.

Remember the key point: Multiple factors still need approval after receiving an illustration. Your credit score, job verification, property value, and final review all play a role in determining your mortgage approval. Applicants with bad credit may face extra checks or longer timelines.

Mortgage Illustration vs. Agreement in Principle (AIP)

An Agreement in Principle (AIP) is a conditional statement from a lender saying they would likely lend you money. It’s based on basic information about your income and credit score. The AIP gives you confidence when house-hunting and shows sellers that you’re a serious buyer.

| Aspect | Mortgage Illustration | Agreement in Principle (AIP) |

|---|---|---|

| Purpose | Shows detailed costs and terms | Confirms the potential lending amount |

| Information Required | Basic income and property details | Credit check and income verification |

| Timing | Early inquiry or after application | Before house hunting |

| Validity | No time limit (informational only) | Usually 60-90 days |

| Detail Level | Comprehensive payment breakdown | Simple lending amount |

| Commitment Level | No commitment from the lender | Conditional commitment |

| Use in Process | Compare mortgage options | Make property offers |

Timeline placement matters for both documents. You typically get an AIP first, before you start looking at properties. A mortgage broker will often suggest securing an AIP before viewing homes.

This gives you a budget to work with. The mortgage illustration comes later, either when you’re comparing lenders or after you’ve found a property and applied for your mortgage.

Both documents move you closer to your final mortgage approval, but serve different purposes in your home-buying process.

Mortgage Illustration vs. Mortgage Offer

A formal mortgage offer is the final approval document that legally commits the lender to provide your loan. This is completely different from a mortgage illustration, which only shows potential costs and terms. It relates specifically to your mortgage loan.

A mortgage offer comes after your full application review, credit checks, property valuation, and underwriting process. Once you receive and accept this offer, you can exchange contracts and complete the purchase of your property.

| Aspect | Mortgage Illustration | Formal Mortgage Offer |

|---|---|---|

| Legal Status | Informational document only | Legally binding commitment |

| Lender Commitment | No commitment to lend | Full commitment to provide a loan |

| Application Stage | Early inquiry or initial application | Final approval stage |

| Validity Period | No expiry (informational) | Usually 6 months |

| Requirements | Basic income and property info | Full documentation and checks |

| Next Steps | Compare options or apply | Exchange contracts and complete |

| Withdrawal Risk | Can change anytime | The lender cannot withdraw easily |

Complete your full mortgage application with all required documents, including payslips, bank statements, and proof of deposit. A mortgage advisor can help you gather and check these documents.

Property valuation and survey must be completed to confirm that the home’s value meets lending requirements.

Final underwriting review, where the lender examines all your information and makes their final lending decision.

Only after completing these steps will you receive your formal mortgage offer and be able to proceed with finalizing your property purchase.

What’s Included in a Mortgage Illustration?

1. Loan Details and Repayments The illustration shows your exact loan amount, mortgage term length, and monthly payment estimates. It breaks down how much goes toward the principal and how much covers interest each month.

2. Interest Rates and APRC (Annual Percentage Rate of Charge): You’ll see the interest rate being offered and the APRC, which includes all costs associated with your mortgage. The APRC gives you the true cost of borrowing and helps you compare different mortgage products.

3. Charges Breakdown: This section lists all upfront and ongoing costs, including arrangement fees, valuation fees, broker fees, and legal costs. It shows exactly what you’ll pay beyond your monthly repayments.

4. Special Features and Flexibility Options: The illustration explains overpayment allowances, portability options (allowing you to take your mortgage to a new property), and any payment holidays available. These features can add value to your mortgage deal.

5. Early Repayment Charges and Cooling-Off Rights: This section details the penalties for paying off your mortgage early during fixed or discount periods. It also explains your 7-day cooling-off period after receiving a formal mortgage offer, which gives you time to change your mind without penalty.

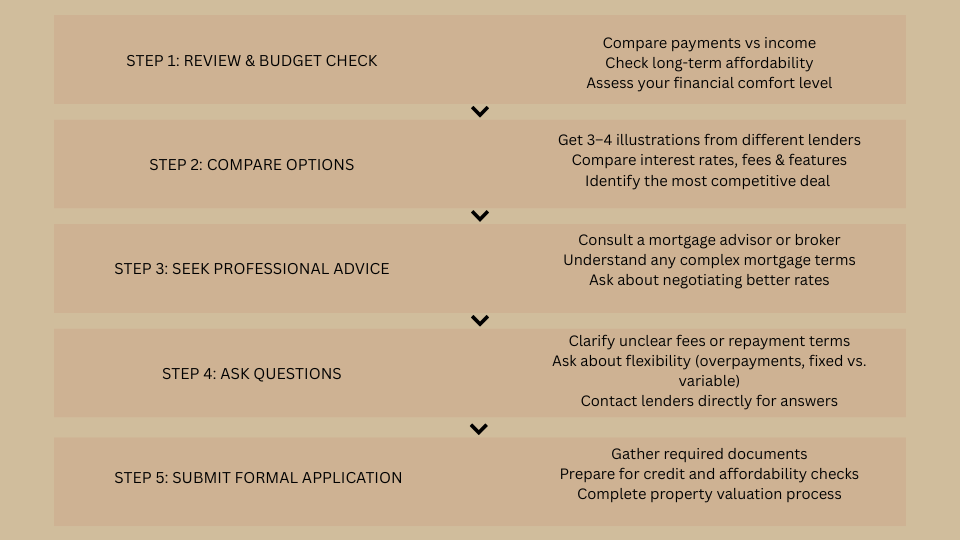

Next Steps After Receiving a Mortgage Illustration

Getting a mortgage illustration is just the beginning of your home-buying process. Here’s a step-by-step guide to help you make the most of your mortgage illustration and move confidently toward securing your home loan. Consider sharing the document with a mortgage broker for clarity on fees and features.

Conclusion

Getting a mortgage illustration is a positive step in your home-buying process. It shows lenders are willing to work with you and provides clear insight into potential loan costs. Use the mortgage illustration as a baseline when comparing like-for-like deals.

Remember that illustrations are information tools, not approval guarantees. Use them to compare different lenders and understand what your mortgage could cost over time. Treat illustrations as starting points for informed decision-making.

Review each illustration carefully. Compare rates, fees, and features across multiple lenders to find the best option for you. Ask questions or seek professional advice when terms seem unclear. If needed, a mortgage advisor can explain unfamiliar terms and trade-offs.

Your next step depends on what you find. If the terms fit your budget and goals, proceed with a formal application. If not, keep shopping around until you find the right mortgage deal.

Do you have questions about your mortgage illustration? Share your experience in the comments below.

Frequently Asked Questions

Is a Mortgage Illustration Binding?

No, mortgage illustrations are not binding. They’re estimates that can change based on your circumstances and market conditions. It’t doesn’t bind the lender to lend.

What Happens After a Mortgage Illustration?

You review terms, compare lenders, and then submit a formal mortgage application if you’re satisfied with the illustration.

How Long from Mortgage Illustration to Offer?

Typically, 2-4 weeks from illustration to formal mortgage offer, depending on your application complexity and lender processing times. It may take longer with bad credit or complex income.