Most people dream of building wealth through real estate, but they often feel stuck before they even begin.

You’ve probably heard stories of investors making thousands in passive income each month. Meanwhile, you’re wondering if property investment is only for people with deep pockets or special connections.

The truth is that anyone can start investing in property with the proper knowledge and a well-planned approach. You don’t need a fortune or years of experience. What you need is a clear roadmap that shows you exactly what to do first, second, and third.

This guide breaks down property investment into straightforward steps that are easy for beginners to follow. You’ll learn how to start with limited funds, find profitable properties, and build your first investment portfolio.

Ready to turn your property investment dreams into reality? Let’s get started.

What Is a Property Investor?

A property investor is an individual who purchases real estate to generate a financial return rather than residing in it. They are buying houses, apartments, or commercial buildings to earn income through rent payments or sell the property at a later date for a higher price.

Property investors make money in these primary ways:

- Rental income – Monthly cash flow from tenants paying rent

- Capital appreciation – Profit when the property value increases over time

- Tax benefits – Deductions for repairs, depreciation, and other expenses

Unlike homeowners who buy property for personal use, investors treat real estate as a business opportunity.

They study market trends, calculate potential returns, and construct portfolios comprising multiple properties to generate long-term wealth. Some investors focus on residential properties, such as single-family homes or duplexes, while others invest in commercial spaces, including office buildings or retail stores.

7 Steps to Becoming a Successful Property Investor

Building wealth through property investment requires a structured approach, careful planning at each stage, and a solid understanding of market conditions and financial fundamentals.

1. Educate Yourself About Real Estate Investing

Knowledge is your foundation in real estate investing. Begin by learning basic terms such as cap rates, cash flow, and market analysis. Understanding these concepts enables you to make more informed investment decisions and avoid costly mistakes.

- Read real estate books – Start with beginner-friendly guides on investment strategies.

- Follow market reports – Track local property prices and rental rates in your area.

- Join investor forums – Connect with experienced investors who share practical tips.

Pro Tip: Spend at least 3 months studying before making any investment decisions. This preparation time saves you from expensive learning experiences later.

2. Research Investment Strategies and Locations

Different investment strategies are more effective in various markets. House flipping is more effective in growing suburbs, while rental properties tend to perform better in stable neighborhoods with good schools and employment opportunities. Choose your strategy based on your budget, time, and local market conditions.

- Study local rental demand – Check vacancy rates and average rent prices in target areas.

- Analyze property appreciation – Examine 5-year price trends to identify emerging markets.

- Consider your timeline – Flipping requires quick action, while rentals build long-term wealth.

Pro Tip: Drive through neighborhoods at different times of day to get a real feel for the area’s safety, traffic, and community vibe.

3. Create a Professional Plan

A solid business plan keeps you focused and helps secure financing. Write down your investment goals, budget limits, and expected returns. Include backup plans for market changes or unexpected costs.

- Set clear financial goals – Define how much income you want within specific timeframes.

- Calculate total costs – Include purchase price, repairs, taxes, and ongoing expenses.

- Plan your exit strategy – Know when and how you’ll sell or refinance each property.

Pro Tip: Review and update your plan every 6 months as market conditions and your experience level change.

4. Secure Financing

Most investors use loans to buy property because it lets them control more valuable assets with less cash. Research different loan types and get pre-approved before house hunting. This shows sellers you’re a serious buyer.

- Compare loan options – Conventional mortgages, hard money loans, and portfolio lenders offer different terms.

- Build strong credit – Pay down debts and avoid new credit applications before applying.

- Save for down payments – Investment properties typically require a down payment of 20-25%.

Pro Tip: Establish relationships with multiple lenders early. Having backup financing options gives you more negotiating power.

5. Make Your First Purchase

Your first investment property sets the tone for your entire portfolio. Take time to inspect the property thoroughly and negotiate based on repair needs and market conditions. Don’t rush this step just to get started.

- Get professional inspections – Hire experts to check electrical, plumbing, and structural issues.

- Research comparable sales – Know what similar properties sold for in the last 6 months.

- Factor in repair costs – Get contractor estimates for any needed work before closing.

Pro Tip: Always negotiate based on facts, not emotions. Treat this as a business transaction, not a personal home purchase.

6. Manage or Flip the Property

Effective property management is crucial to your long-term success as an investor. Good tenants pay their rent on time and take good care of your property. If flipping, focus on improvements that add the most value relative to their cost.

- Screen tenants carefully – Check credit scores, employment history, and previous rental references.

- Maintain the property – Regular maintenance prevents small problems from becoming expensive repairs.

- Track all expenses – Keep detailed records of income, repairs, and improvements for tax purposes.

Pro Tip: Build a reliable team of contractors, property managers, and real estate agents before you need them. Good relationships save time and money.

7. Calculate Earnings and Adjust Strategy

Successful investors regularly review their financial data and adjust their strategies in response to market changes. Track your cash flow, return on investment, and property values. Use this data to decide whether to buy more properties, sell existing ones, or change strategies.

- Monitor monthly cash flow – Subtract all expenses from rental income to see true profitability.

- Review market conditions – Stay informed about local economic changes that affect property values.

- Plan for growth – Use profits from successful investments to fund additional purchases.

Pro Tip: Set aside 10-15% of rental income for unexpected repairs and vacancies. This emergency fund keeps your investments stable during tough times.

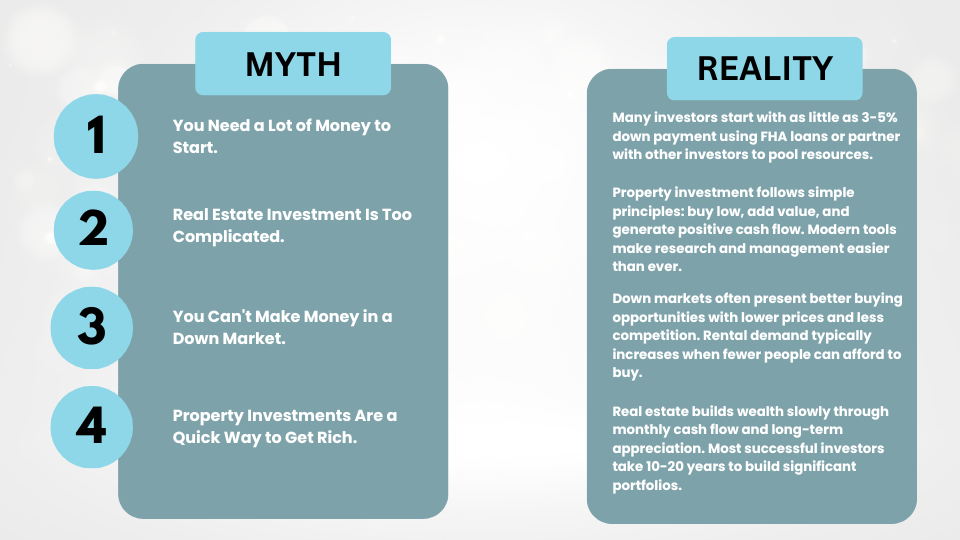

Real Estate Investing Myths

Understanding the truth behind common misconceptions helps new investors make better decisions and avoid unnecessary fears.

Property investment success comes from education, patience, and consistent action rather than large amounts of starting capital or complex strategies.

Why Should You Become a Real Estate Investor?

Real estate investing offers multiple financial benefits that can help you build wealth and create a more secure financial future.

1. Passive Income Generation – Rental properties provide monthly cash flow that continues even when you’re not actively working, creating financial freedom over time.

2. Long-Term Wealth Building – Real estate appreciates in value over decades, allowing you to build substantial net worth through property ownership and equity growth.

3. Tax Benefits and Deductions – Investment properties offer significant tax advantages, including depreciation, repair deductions, and mortgage interest write-offs that reduce your overall tax burden.

4. Inflation Protection – Property values and rental rates typically rise with inflation, thereby protecting your purchasing power, while fixed-rate mortgage payments remain the same.

5. Portfolio Diversification – Real estate provides a stable investment option that doesn’t fluctuate like stocks, helping balance your overall investment portfolio and reduce risk.

Conclusion

Property investment offers a proven path to building long-term wealth and financial freedom. You now know how to start your real estate investment journey, from understanding basic concepts to taking your first steps as an investor.

Remember, successful property investing requires patience, education, and careful planning. Start small with one property, learn from the experience, and gradually build your portfolio over time. Don’t let common myths stop you from getting started – many successful investors began with limited funds and basic knowledge.

The key is taking action. Begin by researching your local market, analyzing financing options, and connecting with experienced investors in your area. Property investment isn’t about getting rich quickly; it’s about creating steady income and building wealth that lasts for generations.

Ready to start your property investment journey? Take the first step today.

Frequently Asked Questions

Is It Hard to Become a Property Investor?

No, with proper education and planning, anyone can start. Begin with research, secure financing, and start small with one property.

Is $5000 Enough to Invest in Real Estate?

Yes, through house hacking, partnerships, or low-down payment programs. Many investors start with minimal capital and leverage financing.

What Is the 2% Rule for Investment Property?

Monthly rent should equal 2% of the purchase price. Example: A $100,000 property should generate $2,000 monthly rent for good cash flow.