Your fixed-term tenancy just ended, and your tenant is still there. No drama, no new paperwork, just rent arriving on schedule.

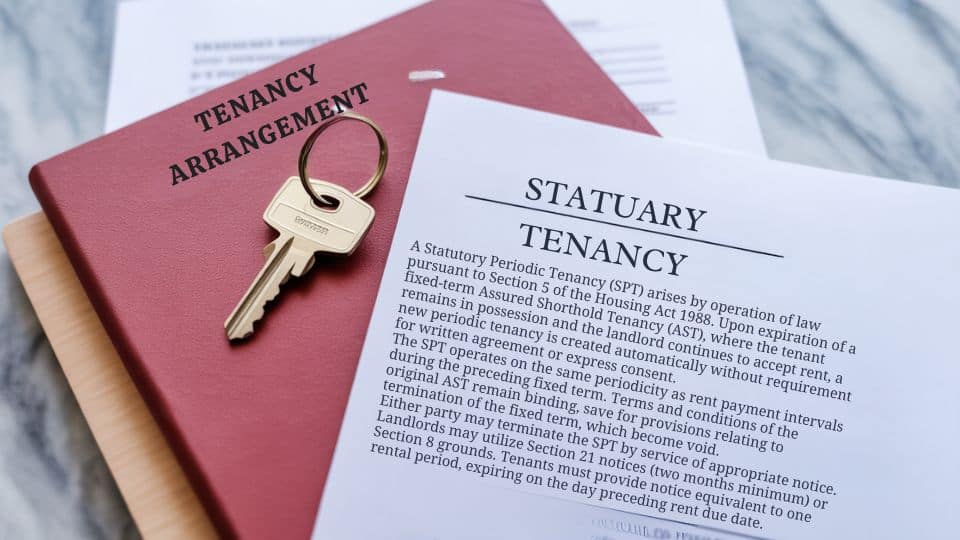

A Statutory Periodic Tenancy is created by law, functioning as an automatic lease extension that rolls over month-to-month or week-to-week.

You keep your rights as a landlord, tenants avoid the stress of moving, and everyone carries on. But here’s the thing: this entire setup has an expiration date.

A new law called the Renters’ Rights Act 2025 got approved on 27 October 2025, and it’s changing everything from 1 May 2026.

This affects deposit protection, council tax, eviction procedures, and rent increases. Understanding which tenancy type you have now matters.

Let’s break down how Statutory Periodic Tenancies work today, and what’s changing next year.

The Current System: What Is a Statutory Periodic Tenancy?

A Statutory Periodic Tenancy (SPT) is like an automatic extension of your rental agreement.

Imagine signing a one-year lease, which then converts into a rolling one-month or week-to-week lease after the year, based on your previous payment schedule.

No new paperwork or signing is needed for this to happen.

Here’s what happens: When your original lease ends and the tenant stays, the tenancy automatically changes to a rolling contract under the law from the Housing Act 1988.

It’s just a simple “rollover” of the previous deal. Key things to know about Statutory Periodic Tenancies:

- No paperwork needed: The tenancy starts automatically when the fixed term ends and the tenant stays put.

- Everything stays the same: Rent amount, payment dates, and who’s responsible for what in the property, it all continues from your original agreement.

- Certain clauses stop working: Things like break clauses (early exit options) from the fixed term don’t carry over.

- Payment schedule matters: If you were paying rent monthly during the fixed term, your rolling tenancy will be monthly. If it were weekly, it would become weekly.

But here’s an important detail:

knowing whether you have a statutory or contractual periodic tenancy matters for deposit penalties and council tax rules.

How to Figure Out Which Type of Tenancy You Have

Not sure what type of tenancy you’re dealing with? Here’s a simple way to work it out:

No mention of continuation in your original agreement? : You have a Statutory Periodic Tenancy (SPT)

Your agreement mentions it will continue or roll over: You have a Contractual Periodic Tenancy (CPT)

Check your original rental agreement under sections like “Term of Tenancy” or “Duration.” Look for phrases like “will continue as a periodic tenancy,” “rolling monthly thereafter,” or “automatically extended.”

Those indicate a contractual tenancy.

Can’t find your agreement? : If you’ve been accepting rent since the fixed term ended without signing anything new, you have a periodic tenancy. The distinction matters because it affects potential financial penalties and responsibilities.

If you’ve accepted rent after the fixed term without new paperwork, you have a periodic tenancy. This affects deposit penalties and council tax liability.

SPT vs Contractual Periodic Tenancy: Why It Matters?

The difference between these two arrangements has real financial consequences. Let’s break down the key differences:

| Feature | Statutory Periodic Tenancy (SPT) | Contractual Periodic Tenancy (CPT) |

|---|---|---|

| How It’s Created | Automatically, after a fixed-term lease ends | By a clause in the original agreement |

| Rent and Terms | Stay the same from the original agreement | May have specific terms about rent increases or notice periods |

| New Agreement | No new agreement needed | Terms specified in the original contract |

| Deposit Protection Penalties | 2-6 times the deposit amount if not protected properly | 1-3 times the deposit if not protected |

| Council Tax Liability | Tenants are only liable while actually living there | Tenants are liable until the notice period ends, even after moving out |

For example, let’s say you’re renting a flat for a year, and that lease ends.

If you don’t sign a new contract but keep paying rent, your agreement becomes a Statutory Periodic Tenancy, a rolling month-to-month deal.

You must give at least a month’s notice if you want to leave, or longer depending on your rent cycle.

These distinctions become irrelevant from May 2026 when everything changes.

The Big Change: How the Renters’ Rights Act 2025 Ends SPTs?

The Renters’ Rights Act 2025 is about to fundamentally change English rental law. Phase 1 reforms start on 1 May 2026, and here’s what that means:

1. No More Fixed-Term Leases

From 1 May 2026, landlords can’t create new fixed-term agreements anymore.

Everyone will be on rolling, indefinite contracts from day one. Any attempt to create a fixed-term lease after 30 April 2026 won’t be valid.

2. Everything Converts Automatically

All existing rental agreements, whether you’re mid-lease or already on a periodic tenancy, automatically convert to the new system on 1 May 2026. No exceptions.

3. “Section 21” Evictions Are Gone

Section 21 is just a way for landlords to ask tenants to leave without giving a reason.

From May 2026, that’s disappearing. Landlords will need to give a legitimate reason if they want to end a tenancy.

The final deadline to use a Section 21 notice is 4:30 pm on Thursday, 30 April 2026. After that, it’s gone for good.

4. Transition Rules

If you serve a valid Section 21 notice before the deadline, you can still enforce it.

But you must start court proceedings by 31 July 2026 or within six months of serving the notice, whichever comes first.

5. New Reasons for Eviction

After May 2026, landlords can only ask tenants to leave for specific reasons:

- Moving in yourself or a close family member (but only after the tenant has been there for 12 months, and with 2 months’ notice)

- Selling the property (but only after 12 months, and with 2 months’ notice)

- Serious rent arrears (now requires three months of missed rent instead of two, with 4 weeks’ notice)

- Other grounds – Anti-social behaviour or breaking tenancy rules (with specific conditions that must be proven)

The key shift here is clear: landlords lose the ability to evict without justification, while tenants gain guaranteed stability for at least the first 12 months of any tenancy.

Life After 1 May 2026: What Changes?

Come May 2026, things are changing significantly. Fixed-term leases won’t exist anymore. Everyone will be on rolling, indefinite contracts.

This means no more sudden evictions without good reason, making tenants more secure. Landlords must now prove grounds for eviction, which could complicate matters.

Take a breath and think about your situation right now: Are you mid-lease? Month-to-month? Fixed-term ending soon? Your answer determines what you need to do before May.

Here’s what else is changing:

For tenants:

- You can stay indefinitely unless your landlord can prove a valid reason to evict you

- You’ll need to give two months’ notice to leave (up from one rental period currently)

- Rent can only increase once per year, and you get two months’ advance notice

- You can challenge rent increases if you think they’re unfair

- You have the right to request pets (landlords can’t automatically say no)

- Landlords can’t ask you to bid higher than the advertised rent

For landlords:

- You can only regain your property by proving valid grounds

- You must give proper notice and follow the new rules

- You need better record-keeping, especially for rent arrears and behaviour issues

- If your deposit isn’t protected as it should be, there can be serious fines up to six times the deposit amount for statutory periodic tenancies

Preparing for the Transition

Whether you’re a landlord or tenant, here’s what you should do now:

For Landlords

Stop reading for a moment and grab your property portfolio list. Let’s work through this together:

- Review your properties now: Identify which tenancies might need action before Section 21 becomes unavailable

- Improve your records: Keep better documentation of rent payments and any tenant issues

- Consider timing: New tenancies starting from January 2026 won’t benefit from Section 21 (due to the four-month minimum notice period)

- Plan ahead: Factor these changes into your letting strategy

For Tenants

Here are the critical steps you need to take before May 2026:

- Know your new rights: You’ll have more security from May 2026 onward

- Remember the notice change: You’ll need to give two months’ notice instead of one rental period

- Know your protections: Landlords can only evict you for valid reasons, not just because they want to

The approaching deadline makes understanding these changes crucial for everyone in the private rented sector.

The Countdown Is On

Your Statutory Periodic Tenancy has 108 days left. On 1 May 2026, it vanishes along with Section 21, fixed-term ASTs, and every familiar rule you’ve operated under.

This is not a drill.

Landlords: Every day you delay is one less option you have. List your tenancies today, identify which need Section 21 notices before 30 April, and verify deposit protection immediately. The deadline is absolute.

Tenants: Your rights are about to expand dramatically. Verify your deposit protection now through DPS, MyDeposits, or TDS. Understand what’s coming; it’s substantial.

The entire rental system resets in 108 days. Will you lead the change or chase it?

Your move.