Are you tired of paying ground rent and service charges forever?

Many leaseholders face this exact problem when considering buying their property’s freehold. A freehold purchase calculator takes the guesswork out of this major financial decision.

This tool helps you determine the true cost of buying your freehold. It factors in legal fees, valuation costs, and the actual purchase price. You’ll also learn about potential savings over time. It also presents an estimated cost breakdown for clarity.

This guide covers everything from basic freehold concepts to advanced calculator features. We’ll show you which calculators work best and how to prepare your financial data.

By the end, you’ll have the knowledge to make an informed freehold purchase decision.

What Is a Freehold Purchase?

A freehold purchase means buying the land your property sits on. When you own a leasehold property, someone else owns the ground beneath it. This creates ongoing costs and restrictions.

Key differences between leasehold and freehold

- Leasehold: You own the property for a set period (usually 99-999 years).

- Freehold: You own both the property and land permanently.

- Ground rent: Leaseholders pay annual fees to the freeholder.

- Service charges: Additional costs for building maintenance and repairs.

Owning the freehold gives you full control of your home, allowing changes without landlord approval and eliminating ground rent or service charges.

Benefits include complete property freedom, no lease worries, potential value increases, and full control over maintenance decisions without outside interference.

The process involves approaching your current freeholder with a purchase offer. If they refuse, you may have legal rights to force the sale under certain conditions.

Why Use a Freehold Purchase Calculator?

Freehold calculators simplify complicated property math and give you instant cost estimates, helping you make smarter purchasing decisions without expensive mistakes.

These tools handle the complex calculations that confuse most property owners and provide comprehensive financial insights.

- Simplifies complex calculations. Handles complicated freehold math automatically without manual errors.

- Provides quick cost estimates. Get instant results without waiting weeks for professional consultations.

- Complete cost overview. Includes hidden fees like solicitor costs, inspections, and government duties.

- Saves research time. No need to consult multiple professionals for basic pricing information.

- Prevents overpaying. Helps identify bad deals and overpriced properties before you commit.

- Avoids costly mistakes. Spot financial problems early in the purchase process.

- Smart investment tool. Used by experienced investors to make better informed decisions.

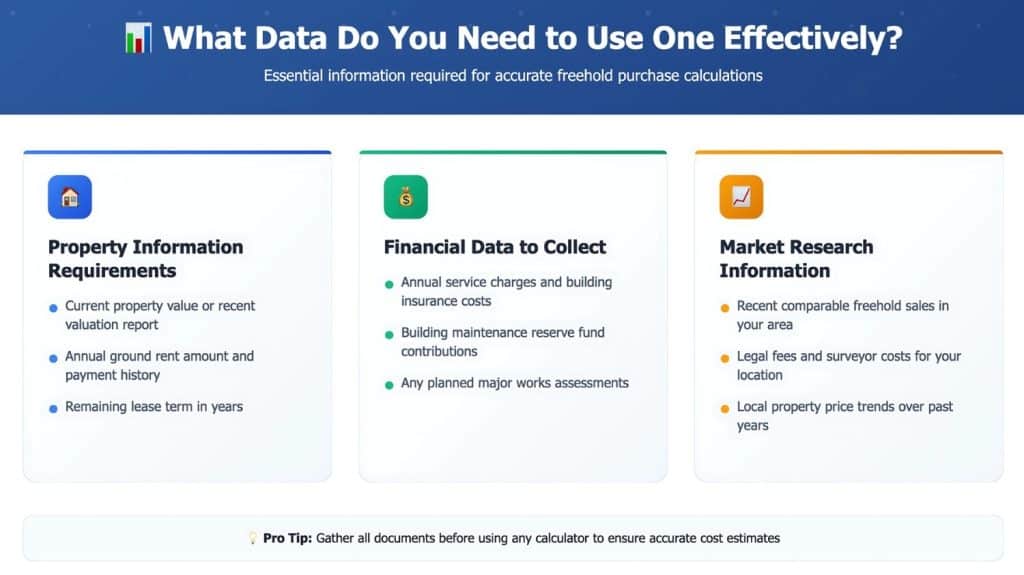

What Data Do You Need for a Freehold Purchase Calculator?

Successful freehold purchase calculations depend on thorough preparation and complete data collection. Missing key information often leads to unrealistic cost estimates.

Professional surveyors and solicitors recommend organizing financial records systematically. This preparation process typically takes several days but ensures accurate calculator results.

Contact your mortgage provider early if additional borrowing might be needed. Some lenders require advance notice for freehold purchase financing arrangements.

Review all lease clauses carefully with a qualified solicitor beforehand. Complex lease terms sometimes affect calculator assumptions and final purchase negotiations.

Top 5 Freehold Purchase Calculators to Try

Several online freehold calculators provide reliable freehold purchase estimates. Each offers different features and calculation methods for various property situations. Choose the calculator tool that fits your scenario.

1. Freehold Sale Calculator

This free tool effectively estimates freehold ground rent values. Input current market value, lease dates, annual ground rent, and original terms.

The calculator handles multiple flats easily. Add or remove properties quickly while getting instant estimated values for your specific situation.

2. The Freehold Collective Calculator

Get instant freehold purchase cost estimates through collective enfranchisement processes. Input property value and lease terms for immediate premium calculations.

This tool targets leaseholders specifically with professional features; it’s an enfranchisement calculator designed for collective claims. Follow-up appraisal options provide detailed analysis after initial calculator estimates are complete.

3. Harding Surveyors Freehold Purchase Calculator

RICS-qualified surveyors provide this estimation tool for London and Home Counties properties. Input property details, lease terms, and current values.

The calculator uses reasonable default values for inflation and interest rates automatically. Professional surveyor backing ensures reliable estimates for purchase decisions.

4. Freehold Calculator

This straightforward tool calculates freehold purchase or lease extension costs simply. User-friendly design helps leaseholders get quick estimates without complications.

Input basic property and lease details for instant results. The simple interface makes complex calculations easily accessible to all property owners. This freehold calculator keeps inputs minimal for speed.

5. Leasegevity Freehold Calculator

Enter property details for instant freehold purchase cost estimates. This tool provides quick valuations plus additional educational resources for users.

A free twelve-page guide comes with submissions automatically. Designed specifically for leaseholders seeking fast, reliable valuation estimates with supporting documentation included.

How the Calculator Works Behind the Scenes?

Have you ever wondered what happens when you click “calculate” on a freehold purchase calculator?

Think of the calculator as a smart assistant that follows the same rules property valuers use. It takes your information and runs it through established formulas that courts and tribunals recognize, using a standard valuation method.

Here’s How It Actually Works:

1. Starting With What You Know: The calculator begins with your property’s current market value. Let’s say your flat is worth £300,000 today as a leasehold property.

2. Working Out the Freehold Value: Next, it calculates what your property would be worth as freehold. This is a basic freehold valuation. This involves dividing your current value by something called a “relativity percentage.” So £300,000 ÷ 0.85 = £352,941 as freehold.

3. Finding the Freeholder’s Interest: Now, it looks at your annual ground rent. If you pay £200 yearly, the calculator divides this by the current yield rate (usually around 5%). That gives us £200 ÷ 0.05 = £4,000

4. Adding Marriage Value (The Tricky Part): If your lease has under 80 years left, you’ll pay something called marriage value. This represents half the difference between the freehold value and your current ownership. In our example (£352,941 – £300,000 – £4,000) ÷ 2 = £24,471

5. Including All the Extras: In the last step, the calculator incorporates professional service charges, valuation expenses, and any incidental costs to deliver your total projected payment. Total becomes £4,000 + £24,471 + £2,500 + £800 = £31,771

The calculator processes these formulas instantly using current market data. It adjusts calculations based on your specific lease terms and local property values automatically.

Now that you understand how calculators work and have your cost estimate, let’s find out what you should do next with those results.

What’s Next: After Using the Calculator?

Calculator results provide your starting point for freehold purchase decisions. Several important steps follow before making any final financial commitments.

- Schedule consultations with property law specialists for professional advice.

- Arrange formal property valuations from qualified surveyors in your area with a written report.

- Contact mortgage providers about additional borrowing requirements if needed.

- Start informal discussions with your current freeholder about a voluntary sale.

- Keep a contingency fund for unexpected costs during negotiations or legal steps.

- Create realistic timelines allowing six to eighteen months for completion.

Treat the calculator output as an initial guide, and verify the figures with professional assessments to ensure accuracy before committing to the purchase.

Final Thoughts

Freehold purchase calculators provide valuable first insights into property investment costs. These tools simplify complex calculations and reveal true expenses upfront, helping you make informed decisions.

Freehold ownership gives you complete control. These calculators give estimates only; final costs can change with negotiations, market trends, and legal factors.

Use calculator results as your starting point, then consult qualified surveyors and solicitors. Consider both immediate costs and long-term benefits carefully.

Freehold ownership delivers security and complete property control that leasehold arrangements cannot match. Many owners find the investment worthwhile despite higher upfront expenses.

Success depends on accurate data input and thorough market research. Take time to gather proper documentation before using any calculator.

Ready to start your freehold purchase calculations? Have questions about the process? Share your thoughts below.

Want to get the legal or money stuff right? Read more here.

Frequently Asked Questions

Is Buying the Freehold Expensive?

Average freehold purchase costs approximately £8,500 based on property value and marriage value calculations for typical properties. This is an estimated figure, not a quote.

Is It Worth Buying a Share of Freehold?

Share of freehold provides greater property control for flat owners but involves additional responsibilities and higher costs than leasehold.

What Is a Reasonable Allocation Between Land and Building?

Standard allocation follows the 20/80 rule: 20% of the purchase price for land, 80% for building in most calculations.