Thinking about doing your transfer of equity without a solicitor?

You’re not alone; thousands of property owners choose the DIY route every year to save their legal fees.

DIY transfer savings can quickly turn into bigger costs due to form mistakes, surprise tax bills, and failed property sales.

The good news?

You can avoid these expensive mistakes completely. Once you know what to watch out for, you’ll make smart decisions that protect your money and legal position.

I’ll show you exactly what transfer of equity involves, whether you can realistically handle it yourself, the specific risks that catch people out, and when you absolutely need professional help. Let’s start with the basics. We’ll also cover whether your situation calls for a full transfer or a partial transfer.

What Is a Transfer of Equity?

Transfer of equity without solicitor processes involves legally changing the ownership structure of your property through official documentation filed with the Land Registry on the registered title.

You’re fundamentally altering who holds legal title to the property, whether that means adding new owners, such as spouses or children, removing existing owners during divorce or separation, or restructuring ownership percentages among multiple people already on the title deed. This can include arrangements between joint tenants or joint owners.

This process requires completing specific legal forms that document exactly how ownership will change, who will gain or lose rights to the property, and what percentage each person will own after the transfer completes. It should also clarify the beneficial interest each party will hold after completion.

A transfer of equity refers to the comprehensive legal process of transferring property ownership rights from one person to another or restructuring the ownership of a property among multiple individuals. This process involves completing specific Land Registry forms, paying fees, and adhering to strict legal procedures. You may also hear this called an equity transfer.

The ownership structure changes completely once you complete this process, affecting who has legal rights to the property, who is responsible for mortgage payments, and who can make decisions about selling or remortgaging. These changes only take effect once noted on the register.

Whether you’re going through divorce, gifting property to family, buying out a partner, or adding someone new to the deed, a transfer of equity legally documents these ownership changes. It makes them official with the Land Registry.

Why People Choose Transfer of Equity?

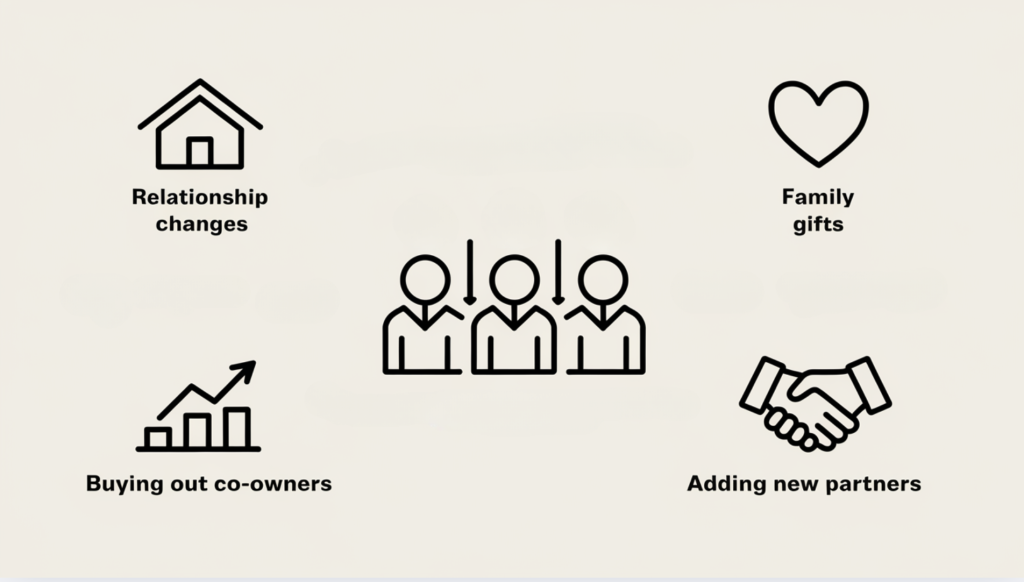

Property owners consider this option in several situations:

Relationship Changes

- Divorces or separations require splitting property ownership

- One partner may want their name removed from the deed

- Both parties need legal protection during the split

Family Gifts

- Parents often gift property shares to their children

- Family members transfer ownership between generations

- Tax benefits may apply in certain gift situations

Buying Out Co-Owners

- Business partners may want to exit property investments

- One owner buys the other’s share completely

- This creates single ownership from joint ownership

Adding New Partners

- Married couples add spouses to existing property deeds

- New business partners join property investments

- Cohabiting partners formalize their property rights

Can You Transfer Equity Without a Solicitor?

Yes, you can complete the transfer of equity without the assistance of a solicitor. Many property owners handle this process themselves to save money. This is essentially DIY conveyancing.

The legal system allows you to file the paperwork directly. You don’t need a lawyer to make the transfer valid. However, you must follow specific steps correctly.

1. Required Forms and Documents

Essential Paperwork Includes

- TR1 Form – The main transfer deed document

- AP1 Form – Application to change the register

- ID1 Form – Identity verification requirements

Each form serves a different purpose in the process. The TR1 form transfers the legal ownership. The AP1 form tells the Land Registry about the change. The ID1 form verifies your identity. Details for the transferor and transferee must be consistent across documents. Official guidance for these documents is available on gov.uk.

2. Signature Requirements

All signatures need proper witnessing. This step is legally required and cannot be skipped. Sign where indicated on the transfer deed to avoid rejection.

Witness Rules

- Must be present when you sign

- Cannot be family members or beneficiaries

- Must provide their full name and address

- Should be over 18 years old

The witness makes the document legally binding. Without proper witnessing, the Land Registry will reject your application.

3. Time and Effort Considerations

DIY transfers take more time than hiring professionals. You’ll spend hours researching forms and requirements. Expect occasional queries from the Land Registry that you must answer promptly.

Common Challenges

- Understanding legal terminology

- Completing forms without errors

- Meeting strict deadlines

- Handling rejection notices

Many people underestimate the complexity involved. Simple mistakes can delay the process by weeks or months.

Risks of Going Without Legal Assistance

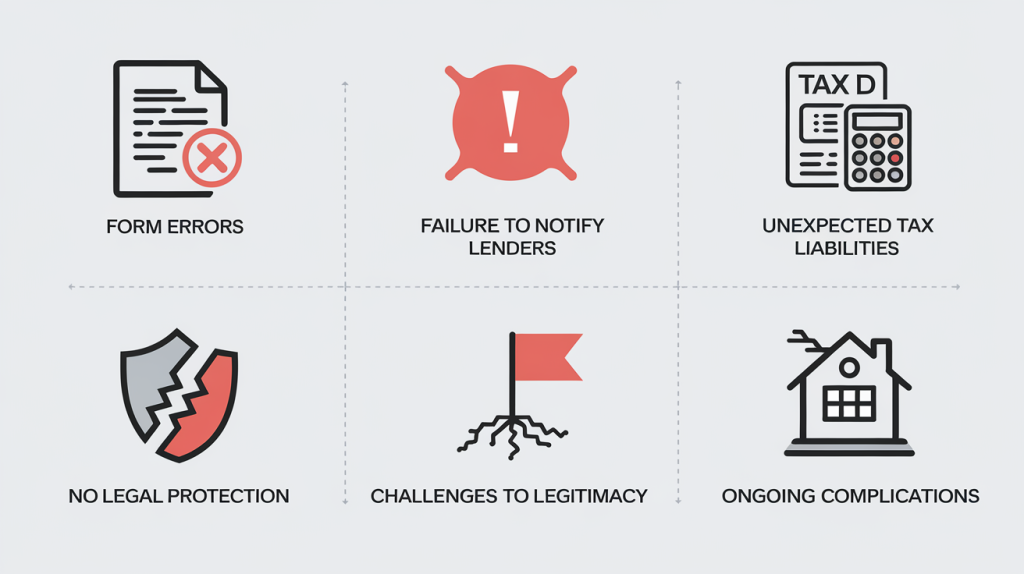

Transfer of equity without a solicitor creates serious risks. These mistakes often cost more than hiring professional help.

-

Form Errors: Minor mistakes, such as incorrect property descriptions or missing signatures, can invalidate your transfer, resulting in rejected applications, wasted fees, and prolonged delays.

-

Failure to Notify Lenders: Not informing your mortgage lender can void your agreement, resulting in full repayment demands, legal action, and long-lasting damage to your credit rating.

-

Unexpected Tax Liabilities: Complex tax rules can lead to capital gains tax, stamp duty, or income tax issues, resulting in penalties or interest charges for missteps.

-

No Legal Protection: Without a solicitor, there’s no indemnity insurance for mistakes, meaning you cover all correction costs and are personally liable for disputes.

-

Challenges to Legitimacy: Transfers conducted without legal assistance may raise red flags for buyers, resulting in delays, additional document requests, and lower offers.

-

Ongoing Complications: Incorrect ownership records can cause title issues, boundary disputes, mortgage refinancing problems, and inheritance difficulties for years.

When Is Professional Help Essential?

In situations such as mortgage involvement, disputes, leasehold transfers, legal compliance, tax implications, and protection against legal disputes, professional assistance is crucial. A solicitor ensures that all legal requirements are met and potential risks are minimized, ultimately safeguarding your investment and peace of mind. A conveyancing solicitor can coordinate with lenders and freeholders efficiently.

| Situation | Explanation |

|---|---|

| Involvement of a Mortgage Lender | Mortgage lenders must approve ownership changes, which typically require legal procedures. Lenders can refuse the transfer without proper documentation. |

| Disagreements Between Parties | Family or business disputes often require professional mediation to draft agreements that prevent future disagreements. |

| Leasehold Properties with Additional Restrictions | Leasehold transfers need landlord consent, and responsibilities for rent or charges may change. Solicitors help interpret complex lease terms. |

| Ensuring Legal Compliance | Professional solicitors stay updated with the latest legal changes and ensure all procedures are compliant with current laws and requirements. |

| Guidance on Tax Implications | Tax rules are complex. Professional advice helps with capital gains, stamp duty, and gift tax, allowing for savings through careful planning. |

| Protection Against Legal Disputes | Solicitors’ insurance covers mistakes in legal advice and documentation, protecting clients from financial loss and providing representation in case of disputes. |

While transferring equity without a solicitor is possible in some cases, involving a professional is highly recommended for complex situations to avoid costly mistakes and ensure a smooth, legally sound process.

Wrapping It Up

Transferring equity without a solicitor might save you money upfront, but the hidden costs can be substantial. Form mistakes, tax surprises, and legal complications often create expenses far beyond what you’d pay a professional. The risks I’ve shown you are real.

Your property is likely your most significant asset, so protecting it is crucial. Getting this wrong doesn’t just cost money, it can make selling harder, damage your credit, and create family disputes that last for years.

So what should you do next?

Honestly assess your situation using the knowledge you’ve gained here. If you have a mortgage, disputes, or leasehold property, get professional help. For simple cases, you might be able to manage alone, but now you know exactly what to watch for. If you’re unsure, speak to a qualified conveyancer before you proceed.

Share your experience in the comments below. Your story could help other readers avoid costly mistakes or gain confidence in their decisions.

Frequently Asked Questions

What Is the Best Way to Transfer Ownership?

For complex cases, hire a solicitor. For simple transfers, DIY is a viable option if you understand the legal requirements and accept the associated risks.

How Much Does a Lawyer Charge to Transfer a Deed?

Real estate attorneys typically charge between $500 and $1,500 for deed transfers, depending on the complexity, state, and whether mortgages are involved.

What Is the Strongest Form of Ownership?

A fee simple absolute is the strongest form of ownership, granting you complete control over the property with no restrictions or time limits.