Ever wondered what that important document proving you own your home actually looks like? In other words, what does a house deed look like when you finally receive it?

You’re not alone. Many homeowners have never seen their house deed or don’t know what to look for when they do.

A house deed is more than just a piece of paper. It’s your legal proof of ownership and contains specific details that protect your property rights.

Understanding the format of these documents can help you avoid costly mistakes and identify potential issues.

This guide will walk you through everything you need to know about house deeds. This includes their physical appearance, key components, different types, and how to properly handle them.

By the end, you’ll know exactly what to expect when you see your deed.

What Is a House Deed?

A house deed is a legal document that transfers ownership of real property from one person to another. This written contract serves as official proof that you own your home and the land it sits on.

The deed creates a permanent record of property ownership that gets filed with your local government office. Unlike a mortgage, which shows you owe money on the property, a deed shows you actually own it.

Basic Purpose of House Deeds

- Transfer ownership from the seller to the buyer during property sales — the deed transfer step.

- Provide legal proof of who owns the property

- Create public records that anyone can access and verify

The deed becomes your most important property document. Banks require it for mortgages. Insurance companies need it for coverage. Government offices use it for taxes and legal matters.

Deed vs. Title

Many confuse deeds and titles, but they differ. A deed is tangible proof and a historical record of a property’s ownership changes. Put simply, the deed is the paper instrument and the title is the ownership right.

Think of it this way, like the deed is like a car’s registration paper, while the title is your actual right to own and drive that car.

What Does a House Deed Look Like?

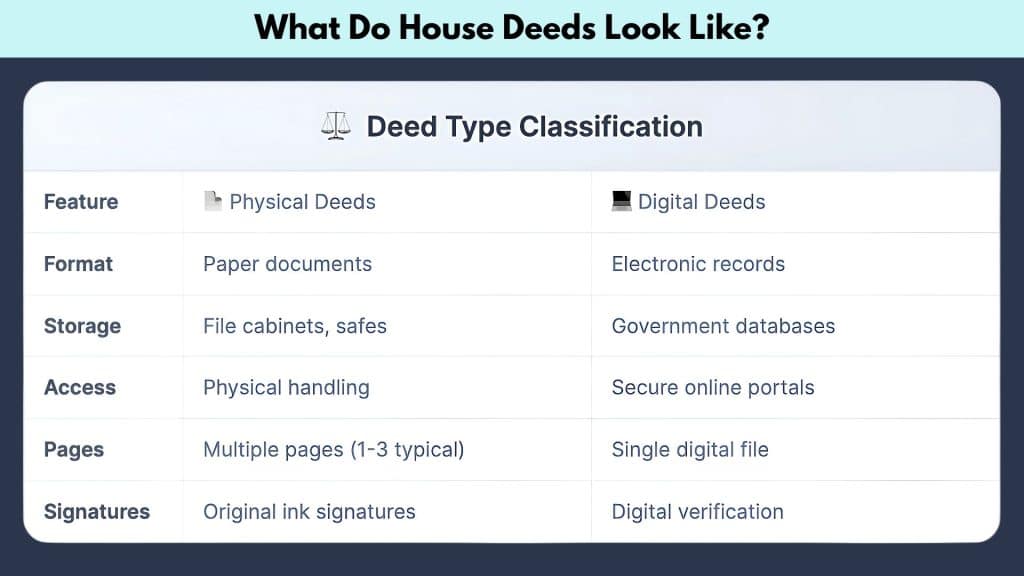

The appearance of house deeds depends on when the property was purchased and whether it has been registered with local government offices.

Both physical and digital deeds contain identical legal information, including owner names, property boundaries, and transfer details.

The main difference lies in storage method – older properties often have paper bundles, while newer properties use secure government databases.

The format, whether paper or digital, impacts how you access and store it, but the underlying role remains the same: safeguarding your ownership rights for legal and financial security.

Key Components of A House Deed

Every house deed contains essential elements that make it legally valid and enforceable. These components work together to create a complete record of property ownership transfer.

Grantor and Grantee Information: Full legal names and addresses of both seller (grantor) and buyer (grantee), exactly as they appear on official identification documents.

Property Description: Detailed legal boundaries, lot numbers, survey measurements, and street address that precisely identify the specific property being transferred between parties.

Consideration Amount: Purchase price or value exchanged for the property, sometimes listed as nominal amounts like $1 to maintain privacy about actual transaction details.

Signature Requirements: Original signatures from all parties in the presence of witnesses, with notarization required to make the document legally binding and recordable.

Recording Information: County recorder stamps, file numbers, and official recording dates that prove government registration and create permanent public property records for registered properties.

Legal Warranties: Promises made by the seller about property title status, offering varying levels of protection against hidden liens, disputes, or title defects.

Types of House Deeds

Different types of deeds offer varying levels of protection and warranties to property buyers during ownership transfers.

1. Warranty Deed

A warranty deed provides the highest level of protection for property buyers. The grantor guarantees a clear title and promises to defend against any future claims.

This deed type includes comprehensive warranties covering the entire property history. Buyers receive maximum legal protection against title defects, liens, or ownership disputes.

2. Quitclaim Deed

A quitclaim deed transfers only the grantor’s current interest in the property. It provides no warranties or guarantees about a clear title or property condition.

This deed type is commonly used between family members or in divorce settlements. Buyers accept all risks regarding potential title problems or existing liens on the property.

3. Special Warranty Deed

A special warranty deed protects buyers only against title defects during the grantor’s ownership. It does not cover problems that existed before the grantor acquired the property.

This deed offers moderate protection compared to full warranty deeds available. Buyers are protected from the grantor’s actions but not from the previous owners’ issues.

4. Grant Deed

A grant deed implies certain warranties without explicitly stating them in writing. The grantor promises they own the property and haven’t transferred it elsewhere.

This deed type is common in some states for standard property transfers. It provides basic protection while being simpler than comprehensive warranty deed documents.

5. Executor’s Deed

An executor’s deed transfers property from a deceased person’s estate to beneficiaries. The executor acts on behalf of the estate during this transfer process.

What do title deeds look like when issued by executors? They include special language indicating estate authority and probate court approval for the transfer.

How to Obtain Your Property Deed?

Getting your deed when buying a home is simple. You’ll receive an official copy of your house deed when the property title transfers to your name. This happens at closing when you complete your home purchase.

The deed you receive becomes your permanent record. Keep it in a safe place with other important documents. This copy proves you own the property legally.

Need extra copies later? Contact your county recorder’s office directly. They can provide notarized and certified copies of your deed. There’s usually a small fee for this service.

Most county offices offer online services, too. You can often request deed copies through their website. Processing time varies by location but typically takes 3-5 business days.

How to Update Your House Deed?

Several situations require deed changes. When a co-owner passes away, you might need to update ownership details. Refinancing your mortgage also triggers deed modifications since lenders record new liens.

Common reasons for deed updates include

- Death of a co-owner: Surviving owners need a clear title.

- Mortgage refinancing: New lenders require lien documentation.

- Clerical mistakes: Spelling errors or wrong legal descriptions.

- Ownership transfers: Adding or removing names from the deed.

The process involves specific steps. Since deeds are public records, changes often require court approval. Your local court reviews the requested modifications to ensure they’re legal and proper.

Once approved, you must file the updated deed with your county’s Recorder of Deeds office. This makes the changes official and part of the public record.

I’d suggest getting professional help. Real estate attorneys know the deed requirements in your state. They can walk you through the process and help you avoid costly mistakes.

How to Store and Safeguard Them Properly?

Your deed proves you own your home legally. Losing this important document creates serious problems when you want to sell or refinance your property later.

Proper storage protects your valuable investment completely. Smart deed management saves you significant time and money when you need access to this document most urgently.

- Store the original in a fireproof safe at home or a bank safety deposit box.

- Make several copies and keep them in different locations.

- Scan your deed and save digital copies to cloud storage.

- Email yourself a copy for quick access when needed.

- Check your stored deed once a year to ensure it’s still readable.

- Replace any damaged copies immediately to avoid future issues.

Final Thoughts

Knowing what house deeds look like helps you protect your most valuable asset.

These legal documents contain specific information that proves your ownership rights. From the property description to signature requirements, every detail matters for your financial security.

Some regions also offer subscription-based monitoring services, which alert you whenever your deed is accessed or altered in public records, providing an extra safeguard against fraud.

Proper storage prevents costly problems down the road. Beyond storage, consider accessibility, ensuring that trusted family members or executors know where and how to retrieve your deed if needed urgently.

Ready to secure your property deed?

Contact your county recorder’s office today to request certified copies and learn about their online services.

Learn more about maintaining and improving your property.

Frequently Asked Questions

Who Holds the Deed to My House?

The homeowner retains the deed once the house is paid off in full. If you still owe mortgage payments, your lender may hold it.

Which Is More Important, Title or Deed?

Both matter for different reasons. The deed transfers ownership legally. The title shows who owns the property and controls it completely.

What Is the Best Deed for A Married Couple?

Tenancy by the Entirety works best for married couples. This option provides the strongest legal protection for both spouses in most states.