Have you ever wondered why some people choose to buy homes they don’t technically own for the long term? It sounds confusing, right?

Yet millions of property buyers worldwide opt for leasehold ownership and find it suits their needs perfectly. So, why would anyone buy a leasehold property?

Knowing different ownership types helps you make smarter housing decisions. This includes evaluating whether a freehold property aligns with your goals.

Leasehold properties may seem complex at first, but they serve a vital purpose in today’s housing landscape.

They can provide affordable access to premium locations, offer shared luxury amenities, and sometimes represent the only available option in desirable areas.

However, this ownership type also comes with unique considerations and potential pitfalls.

In this blog, I’ll show you exactly what leasehold properties involve, why people choose them, and whether this ownership type might work for your specific situation.

What Is a Leasehold Property?

A leasehold property means you own the building but not the land on which it is situated. You buy the right to live there for a specific time period.

When you purchase a leasehold property, you become the leaseholder. You can live there, sell it, or rent it out to other people.

The lease typically lasts between 99 and 999 years. Someone else, called the freeholder, owns the actual land on which your home is permanently situated. Your lease term is set out in the contract and can influence resale and financing.

Why do leasehold properties exist?

- Allows efficient land use in crowded cities.

- Helps developers build apartments for many families.

- Provides ongoing income for the original landowners.

- Controls property development in specific areas.

This system works particularly well for flats and apartments where multiple households need to share common spaces, such as hallways, gardens, and parking areas.

Leasehold vs Freehold: Key Differences

Having knowledge of various types of ownership helps you make informed decisions about property. Each option offers distinct benefits and responsibilities that affect your long-term financial planning and lifestyle choices.

| Aspect | Leasehold | Freehold |

|---|---|---|

| Land Ownership | You don’t own the land | You own both property and land |

| Lease Length | Fixed period (99-999 years typically) | Permanent ownership |

| Ground Rent | Usually required annually | No ground rent |

| Major Changes | Need freeholder permission | Complete freedom to modify |

| Selling Process | More complex with lease considerations | Simpler selling process |

| Service Charges | Common for the maintenance of shared areas | You handle all maintenance |

| Property Type | Often flats and apartments | Typically houses |

Freehold gives you absolute control over your property decisions. You can renovate, extend, or modify without seeking anyone’s approval for most changes.

Leasehold involves ongoing relationships with freeholders and other residents. This creates shared responsibilities but also means coordinating decisions with multiple parties for building matters.

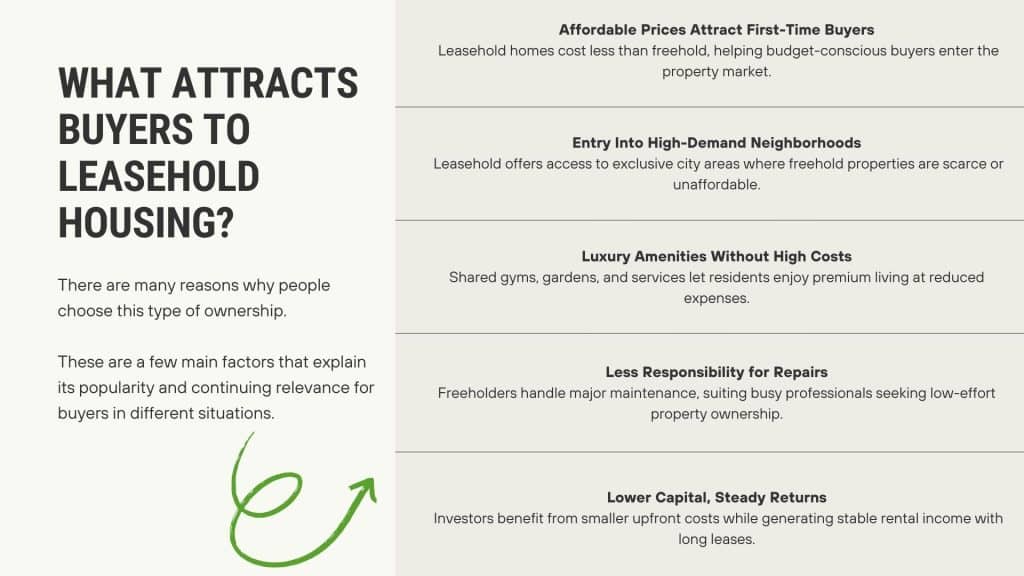

Reasons People Buy Leasehold Properties

Several factors make leasehold homes appealing to property buyers. Personal goals and budget constraints usually influence this important housing decision.

1. More Affordable Entry Point

Leasehold properties typically cost significantly less than comparable freehold homes in identical neighborhoods.

This price difference makes homeownership more accessible to first-time buyers and individuals with limited financial resources.

2. Access to Desirable Locations

In prime city centers and sought-after neighborhoods, leasehold properties might be your only option.

Many apartment buildings in expensive areas operate under leasehold arrangements. Buying a leasehold allows you to live in locations that would otherwise be financially out of reach.

3. Shared Amenities and Services

Leasehold developments often feature premium amenities such as fitness centers, landscaped gardens, and professional concierge services.

These luxury features become financially viable when maintenance costs are split among all building residents.

4. Less Maintenance Responsibility

Freeholders manage major structural repairs, roof maintenance, and common area upkeep on your behalf. You’ll still contribute through service charges for shared areas and building upkeep.

This arrangement suits busy professionals who prefer avoiding hands-on property management and contractor coordination.

5. Investment Opportunities

Investors often choose leasehold properties because they require smaller initial capital while generating steady rental returns.

Success depends on selecting properties with substantial remaining lease years for future value retention.

The Pros and Cons of Leasehold Ownership

Before choosing leasehold ownership, carefully weigh its strengths and weaknesses, recognizing how each factor may impact your finances, lifestyle, and long-term property security.

| Pros | Cons |

|---|---|

| Lower initial commitment compared to freehold | Ongoing annual charges, such as ground rent |

| Opens doors to properties in competitive districts | Lease shortens over time, reducing resale value |

| Access to shared spaces and communal facilities | Alterations may require landlord approval |

| Building upkeep is often coordinated by the freeholder | Selling can involve extra checks and paperwork |

| Professional management for common areas | Service fees may rise unexpectedly |

| Strong sense of community in multi-unit settings | Limited autonomy over long-term decisions |

| Easier to anticipate collective repair costs | Some lenders are reluctant to offer shorter leases |

The decision ultimately depends on your personal priorities and financial situation. If affordable access to a great location is more important than complete ownership control, a leasehold might be a good option for you.

Consider your long-term plans carefully. If you expect to move within 10-15 years, the lease length might not significantly impact your investment.

However, if you want a forever home, freehold properties offer more security and control.

Common Mistakes to Avoid with Leasehold Purchases

Leasehold purchases present distinct challenges compared to freehold. Here are some common mistakes that buyers often make, which they must carefully avoid. Engaging experienced leasehold solicitors can help you interpret complex clauses and avoid costly errors.

- Check the remaining lease length carefully (the lease term), as properties with leases under 80 years become difficult to mortgage and sell.

- Review detailed service charge history for the past three years to understand typical annual costs.

- Read the entire lease document thoroughly to identify any unusual restrictions on pets or renovations and terms in the leasehold agreement.

- Research the freeholder’s reputation by speaking with current residents about their management experiences and responsiveness.

- Budget for potential lease extension costs in advance, as these can reach thousands of pounds.

- Verify exactly what services your monthly charges cover to ensure you receive good value for money and how service charges are calculated.

Final Thoughts

In summary, leasehold properties can be worthwhile investments when approached with awareness and preparation.

They offer affordable access to prime locations and often include shared amenities that would be costly to manage individually.

At the same time, they involve ongoing expenses and restrictions on ownership rights.

Success depends on thorough research, from checking lease terms and calculating costs to ensuring the arrangement aligns with your long-term plans.

Many people enjoy the benefits of leasehold living for decades, managing their responsibilities effectively.

Choosing between leasehold and freehold is not a universal decision. Consider your planned stay, comfort with shared control, and preferred lifestyle.

What specific concerns do you have about leasehold ownership, or would you like to share your property buying experiences with our community?

Frequently Asked Questions

Is It Difficult to Sell Leasehold Property?

Selling leasehold property follows similar steps to freehold sales but requires additional paperwork, legal checks, and extra forms for lease details.

How Much Does It Cost to Convert a Leasehold to Freehold?

Converting a leasehold to freehold typically costs around £8,500, calculated based on the property’s value, remaining lease years, annual ground rent, and marriage value.

Can You Get a Mortgage on A Leasehold?

Getting leasehold mortgages depends on the remaining lease length. Lenders prefer properties with at least 70 years remaining for mortgage approval consideration. Most lenders also consider the lease term when assessing applications.