Are you a US property owner wondering how rental income tax works in the UK?

Owning rental property across the Atlantic brings unique tax challenges. HMRC expects you to report all rental profits, even when you live thousands of miles away.

Miss a filing deadline or claim the wrong expenses, and penalties start piling up fast. The good news is that managing your UK rental income tax doesn’t have to be overwhelming.

You can legally reduce your tax bill through proper expense claims, understand which rates apply to your situation, and stay compliant with UK tax authorities. From mortgage interest relief changes to capital gains tax when you sell, knowing the rules protects your investment.

This post covers everything US-based landlords need to know about UK rental income tax for the 2025/26 tax year.

What Counts as Rental Income?

Rental income is any money you earn from letting out property you own. This includes all payments from tenants and charges related to the property.

HMRC treats several types of payments as rental income, not just the monthly rent. Knowing what counts helps you report correctly and avoid issues later.

You need to declare all money you receive from your rental property. Even non-cash benefits must be reported at market value.

HMRC counts these as taxable income:

- Monthly or weekly rent payments

- Charges for services like cleaning or gardening

- Utility bills you pass on to tenants

- Fees for furniture or appliance use

- Advance payments or deposits you keep

If you receive money related to your rental property, it likely counts as income. Make sure you track every payment carefully throughout the tax year

Types of Letting Arrangements That Affect Your Tax

Your tax treatment depends on how you let your property. Different letting arrangements follow different HMRC rules.

1. Traditional Long-Term Lets

These are the most common rental types among UK landlords. Most offer standard residential tenancies that run for 6 to 12 months or longer, with many tenants staying for years.

You pay income tax on profits at your normal rate. These rentals provide steady income with fewer void periods and require less day-to-day management than short-term lets.

2. Furnished Holiday Lets (FHLs)

get special tax treatment if they meet specific HMRC criteria. Your property must be available for letting at least 210 days per year and actually let for at least 105 days.

FHLs qualify for better tax reliefs, including capital allowances on furniture and better capital gains tax treatment when you sell.

3. Joint Ownership

arrangements split the tax burden between multiple owners.

Each person reports their share of income and expenses on their own tax return, with HMRC assuming equal splits unless you prove otherwise with a Declaration of Trust.

You can use unequal splits to shift income to a lower-earning spouse or partner, which reduces overall tax.

4. Company Ownership

means your limited company holds the property, not you personally. Properties held this way are subject to corporation tax (currently 19-25%) rather than income tax, and companies can still deduct full mortgage interest from rental income.

This structure can save money for higher earners but adds complexity, making it harder to get mortgages or pass property to heirs.

Choose your letting arrangement based on your tax situation and long-term goals. Each type has different reporting requirements and tax implications.

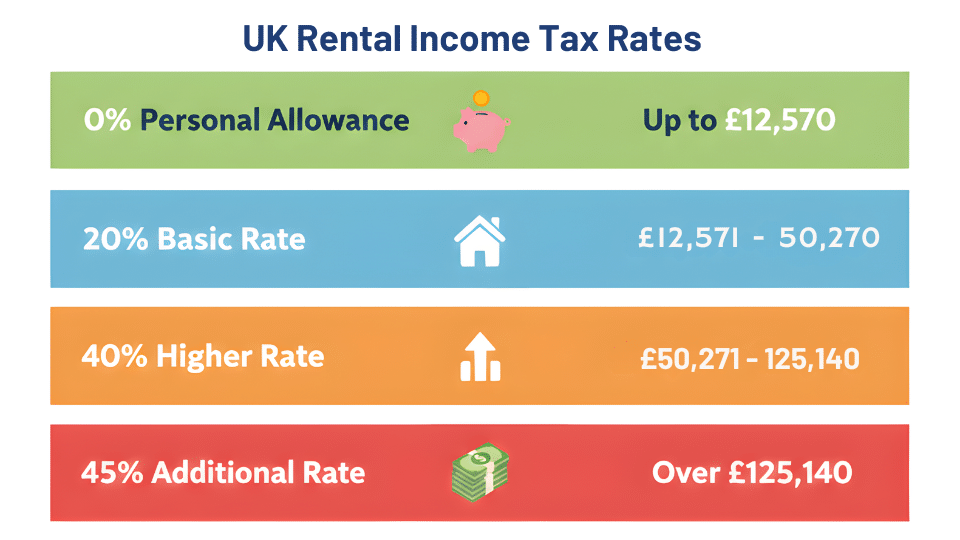

UK Rental Income Tax Rates

The UK taxes rental profits as regular income. Your rate depends on your total earnings for the year.

For the 2025/26 tax year, these rates apply to your rental income tax. Your rental profits add to any other income you earn. This combined total determines your tax band.

The infographic above shows how rental income tax works across different income levels. You pay no tax on the first £12,570 you earn, thanks to your personal allowance.

After that, the introductory rate of 20% applies to income between £12,571 and £50,270. If your total income pushes you higher, you’ll pay 40% on earnings from £50,271 to £125,140.

The top rate of 45% applies to income over £125,140. Your rental profits are added to any other income you earn, and the combined total determines your tax band.

Calculate your estimated tax bill before the end of the tax year. This helps you save enough to cover the payment due by January 31st.

Note: Rental income can push you into a higher tax bracket. This means you pay more tax on all your income above that threshold. Scotland uses different tax bands. If your tenant lives in Scotland, check the Scottish rates instead.

Who Pays Tax on Rental Income?

Not everyone files a tax return, but rental income usually requires one. Here’s when you must report.

UK Individual Landlords vs Companies

Individual landlords pay income tax through Self-Assessment by filing form SA100 with the SA105 property supplement. Limited companies that own property pay corporation tax instead and file a CT600 form with different rules.

The current corporation tax rate is 19% for profits up to £50,000 and 25% for profits above £250,000. If you’re a US citizen, remember the IRS also wants to know about your UK rental income. You may get credit for UK tax paid, but always check with a cross-border tax advisor.

Property Income Allowance & Thresholds

HMRC gives you a £1,000 property income allowance each tax year. If your total rental income is £1,000 or less, you don’t need to report it or pay tax. You have two options if you earn more than £1,000.

First, use the allowance and deduct £1,000 from your income, then pay tax on the rest without claiming any other expenses. Second, claim actual expenses by deducting all allowable costs and paying tax on the profit. Choose the option that gives you the lower tax bill.

Non-Resident Landlords

US-based owners are subject to the Non-Resident Landlord Scheme. Your letting agent or tenant must deduct 20% tax from your rent and send it to HMRC unless you apply for approval to receive rent without tax deducted.

To get approval, apply using form NRL1, and HMRC checks that you’re up to date with UK tax. Once approved, you receive full rent and pay tax through Self-Assessment instead.

Even if tax is deducted at source, you still must file a Self-Assessment return. You can claim back overpaid tax through your return.

How to Calculate Taxable Rental Profit?

Calculating your UK tax on rental profits requires careful record-keeping. Getting your calculations right helps you avoid penalties and claim all the deductions you’re entitled to.

Step 1: Add up all rental income received: Include every payment from tenants, such as monthly rent, service charges, and any deposits you keep. Don’t forget advance payments or fees for furniture use.

Step 2: Total all allowable expenses: List every cost related to running your rental property throughout the tax year. This includes repairs, insurance, agent fees, and travel costs to the property.

Step 3: Subtract expenses from income: Take your total expenses away from your total rental income. This calculation gives you your gross rental profit before any adjustments.

Step 4: Apply any losses from previous years: If you carried forward losses from earlier tax years, deduct them now. These losses reduce your current year’s taxable profit.

Step 5: The result is your taxable rental profit: The final number is what HMRC will tax at your applicable rate. This profit gets added to your other income to determine your tax band.

|

Formula: Gross Rental Income – Allowable Expenses = Taxable Profit |

Remember that HMRC adds your rental profit to all other income you earn during the year. This combined total determines whether you pay tax at 20%, 40%, or 45%.

What Expenses Can You Deduct From Rental Income?

HMRC lets you deduct costs that are “wholly and exclusively” for your rental business. Keep receipts for everything, as you’ll need proof to support your claims.

| Allowable Expenses | Non-Allowable Expenses |

|---|---|

| Repairs and maintenance | Capital improvements (new kitchen, extension) |

| Buildings and contents insurance | Your own time or labor |

| Letting agent fees | Initial purchase costs (stamp duty, conveyancing) |

| Legal fees (eviction costs) | Mortgage capital repayments |

| Accountant fees | Personal expenses unrelated to the rental |

| Utilities and council tax (if you pay) | Furniture and appliance purchases |

| Ground rent and service charges | Costs before the property was let |

| Travel costs to inspect the property | Depreciation (except through capital allowances) |

| Advertising for tenants | Entertaining tenants or contractors |

| Bank charges on rental accounts | Fines or penalties from authorities |

Common missed deductions that landlords often forget include travel costs, professional subscriptions to landlord associations, office costs if you work from home, phone calls about the property, and training courses on property management.

When to Report Rental Income to HMRC?

Filing late costs money. Here’s what you need to know about deadlines and reporting requirements.

1. Registration deadline: 5 October, after the tax year ends. You must register with HMRC by this date when you first start renting a property. The tax year runs from 6 April to 5 April the following year.

2. Filing deadlines: 31 October (paper) or 31 January (online): Paper returns must reach HMRC by 31 October following the tax year. Online returns have until 31 January, giving you more time to organize your records.

3. Payment deadline: 31 January following the tax year: All tax owed must be paid by this date. You may also need to make payments on account for the following year if your tax bill exceeds £1,000.

4. Simplified reporting for income between £1,000-£2,500: If your rental income falls between these amounts after expenses, you don’t need a full Self-Assessment return. Contact HMRC directly and they’ll explain the simplified reporting process, saving you time and paperwork.

5. Full Self-Assessment for income over £2,500: Once rental income exceeds £2,500 after expenses or £10,000 before expenses, you must file complete returns. Use Form SA100 as your main return and Form SA105 specifically for UK property income and expenses.

6. Voluntary disclosure for unreported past income: If you haven’t reported rental income from previous years, contact HMRC to make a voluntary disclosure. You’ll receive a disclosure reference number and have three months to calculate and pay what you owe with reduced penalties.

Miss deadlines and you face automatic penalties starting at £100 for being one day late. Penalties increase to £10 per day after three months (up to £900), then £300 or 5% of tax due after six months, with another £300 or 5% after twelve months. Keep all records for at least 5 years from the 31 January filing deadline.

Capital Gains Tax on Rental Property Sales

Selling your UK rental property might trigger capital gains tax. CGT applies when you sell a property for more than you paid for it, and you pay tax on the profit, not the sale price.

1. Calculating Your Gain

Take the sale price minus purchase price, buying costs, selling costs, and capital improvements. Buying costs include stamp duty land tax, legal fees, and survey fees.

Selling costs include estate agent and solicitor fees. Capital improvements are extensions or conversions, not repairs.

2. Allowance and Tax Rates

You get a £3,000 CGT allowance for 2025/26. Profits above this are taxed at 18% for basic rate taxpayers or 24% for higher and additional rate taxpayers.

Private Residence Relief can reduce or eliminate CGT if you lived in the property as your main home. You get full relief for the time you lived there, plus the final 9 months of ownership.

3. Reporting and Payment

Report and pay CGT within 60 days of completion using a UK Property Disposal return. Don’t wait for your annual Self-Assessment.

Non-resident landlords must strictly follow the 60-day rule. US citizens must also report the sale to the IRS and may face additional US capital gains tax.

Check whether the US-UK tax treaty provides relief to avoid double taxation. Consider consulting a cross-border tax specialist for both UK and US requirements.

Stamp Duty on Buy-to-Let Properties

Buying a rental property in England or Northern Ireland means paying Stamp Duty Land Tax. As a US-based investor, you face higher rates than regular homebuyers, as standard residential rates do not apply to rental properties.

Buy-to-Let Surcharge and Rates

Buy-to-let properties incur an extra 5% surcharge on top of standard rates across all price bands. The rates from April 2025 are 5% on the first £125,000, 7% from £125,001 to £250,000, 10% from £250,001 to £925,000, 12% from £925,001 to £1.5 million, and 17% above £1.5 million.

Non-Resident Additional Charge

Non-UK residents pay an extra 2% surcharge on top of buy-to-let rates. You’re classified as non-resident if you haven’t been present in the UK for at least 183 days during the 12 months before purchase.

US-based buyers typically pay this extra 2%. You must pay stamp duty within 14 days of completion, and your solicitor usually handles this. Scotland and Wales have different tax systems with their own rates.

Replacement of Domestic Items Relief for Rental Properties

Landlords can claim tax relief when replacing furnishings and household items in rental properties. This relief covers items tenants use, not items for your own use or property improvements.

What Qualifies:

- Furniture like sofas, beds, tables, and chairs is used by tenants

- Appliances such as fridges, washing machines, dishwashers, and ovens

- Soft furnishings, including curtains, carpets, rugs, and bedding

- Kitchenware and crockery, like plates, cutlery, pots, and pans

What Doesn’t Qualify:

- Initial purchases when you first furnish the rental property

- Improvements that make items better than the original version

- Items for your own personal use rather than tenant use

- Upgrades like replacing a single bed with a double bed

Claim the replacement cost, including delivery and installation, minus any money from selling the old item. Include these costs in your allowable expenses on your Self-Assessment return to reduce your taxable rental profit.

Making Tax Digital for Rental Income

HMRC is introducing Making Tax Digital for Income Tax, which will change how landlords report rental income. This digital system requires you to keep digital records and submit updates through compatible software.

From April 2026, landlords with total income over £50,000 must follow MTD rules. From April 2027, the threshold drops to £30,000.

You’ll submit quarterly updates showing income and expenses, replacing the annual Self-Assessment. The updates are summaries of financial activity, not tax calculations. You’ll still file an end-of-year statement to finalize your tax position.

Start using accounting software or spreadsheets that connect to HMRC systems. Many property management platforms offer MTD-compliant features.

Keep digital records of transactions, receipts, and expenses throughout the year rather than gathering everything at tax time. This spreads the administrative work across the year and helps you track your rental business in real time.

Conclusion

Managing UK rental income tax as a US property owner requires attention to detail and proper planning. HMRC expects accurate reporting regardless of where you live, and the tax rules for rental properties have specific requirements you must follow.

The key is staying organized throughout the year rather than scrambling at tax time. Keep detailed records, know which expenses you can claim, and remember that mortgage interest is now treated as a tax credit rather than a full deduction.

When you eventually sell, plan to file your capital gains tax return within 60 days. If cross-border tax obligations feel complex, working with a specialist accountant can save you money and prevent costly mistakes. Your rental property investment deserves proper tax management.