Imagine this: your car insurance renewal arrives, demanding £800 immediately. Your stomach drops because you haven’t prepared.

You reluctantly reach for a credit card, knowing you’ll spend months paying it off with interest. This scenario repeats throughout the year with holidays, car repairs, and home maintenance, leaving you constantly stressed about money.

A sinking fund eliminates this cycle entirely by turning overwhelming expenses into manageable monthly savings.

By setting aside small amounts each month for predictable expenses, you change financial chaos into calm, confident preparation.

This comprehensive guide explains exactly what sinking funds are, why they’re essential for financial stability, and how to implement them successfully in your budget starting today.

What Is a Sinking Fund?

The idea of a sinking fund originated in finance and debt management. It referred to money set aside over time to gradually “sink” or eliminate a debt.

Today, the concept works the same way, just in a more everyday, practical sense.

A sinking fund is simply a planned pot of money you build slowly for an expense you know is coming. Instead of panicking at the last minute or turning to credit cards, you break a high-cost expense into smaller monthly payments and save for it intentionally.

For example, if you expect to spend around £600 on car maintenance this year, you’d put aside £50 each month. By the time the expense comes up, the money is sitting there ready to go, no stress, no surprise bill.

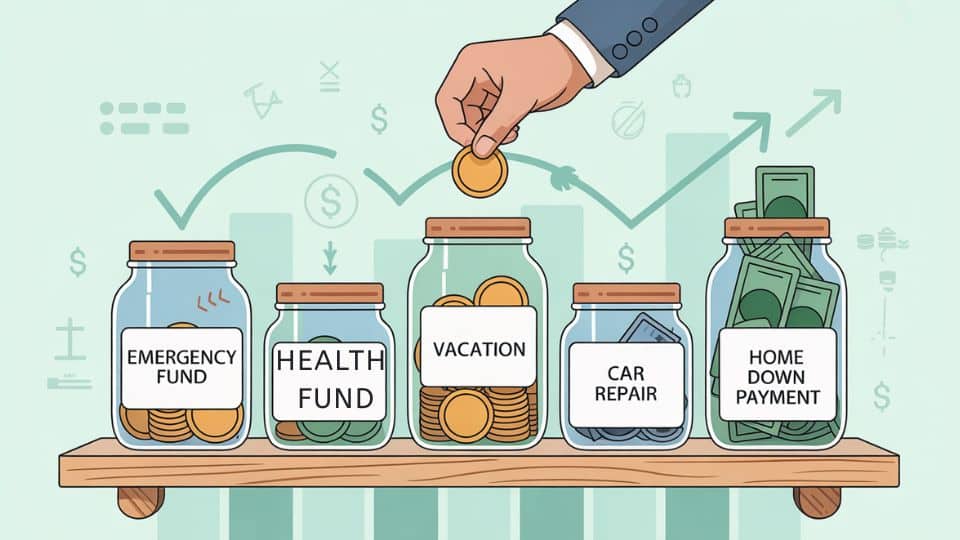

Common sinking fund categories include:

- Car expenses like MOT, servicing, and repairs

- Holiday and travel costs

- Home maintenance or emergency repairs

- Annual insurance premiums

- Medical or dental costs, such as routine checkups or prescriptions

Benefits of Sinking Funds

Financial stability requires more than earning income; it demands strategic planning for life’s predictable but irregular expenses.

-

Prevents Debt Accumulation – Having cash ready when bills arrive eliminates the need for credit cards or personal loans, saving you significant interest charges on predictable expenses.

-

Reduces Financial Stress & Anxiety – Knowing you’ve already allocated money for upcoming costs creates genuine peace of mind. You no longer dread annual renewals or seasonal expenses.

-

Improves Budget Predictability – Instead of chaotic months where massive expenses destroy your budget, sinking funds smooth irregular costs across the entire year, making every month manageable.

-

Builds Financial Discipline – Each contribution reinforces that financial success stems from preparation and planning rather than luck or last-minute scrambling.

-

Supports Long-Term Goals – Money that would otherwise go toward debt repayment remains available for wealth-building priorities, such as retirement contributions or investment accounts.

-

Prevents Emergency Fund Depletion – Keeping predictable expenses out of your emergency fund means it remains intact for genuine crises like job loss or urgent medical needs.

Sinking Fund vs Savings vs Emergency Fund

Many people confuse these three financial tools, but each serves a distinct purpose in a healthy financial system.

| Feature | Savings Account | Emergency Fund | Sinking Fund |

|---|---|---|---|

| Purpose | Long-term wealth building, general goals | Unexpected emergencies only | Specific known future expenses |

| When to Use | Major purchases, plans | Job loss, medical crisis, urgent repairs | Predictable irregular costs |

| Balance Behavior | Grows steadily over time | Remains stable, rarely touched | Cycles: grows then depletes |

| Flexibility | Can change goals | Fixed emergency purpose | Specific per fund |

| Success Looks Like | Increasing balance | Never needing it | Using exactly as planned |

| Typical Amount | Varies widely by goals | 3-6 months expenses | Cost of a particular expense |

Knowing these distinctions prevents the common mistake of using emergency funds for non-emergencies or raiding general savings for predictable expenses.

All three work together to create complete financial security.

How Much Should You Contribute to Sinking Funds?

Determining contribution amounts requires simple arithmetic and an honest assessment of your expenses.

Consider your total income and budget capacity when setting contribution amounts. Not every sinking fund carries equal priority.

Focus on essential expenses like insurance and car maintenance before adding funds for wants like holidays.

Add a 3-5% buffer to account for inflation, as costs typically rise yearly.

If starting mid-year, you’ll need larger monthly contributions to reach your goal by the deadline. Start with high-priority funds first, then add additional categories as your budget allows.

It’s better to fund three essential sinking funds than to fund eight partially.

How to Set Up a Sinking Fund: Simple Steps

Implementing sinking funds requires no special financial expertise, just precise planning and consistent execution.

Step 1: Identify All Predictable Irregular Expenses

Review last year’s bank statements to spot spending patterns. List every annual, quarterly, and seasonal cost, including insurance renewals, subscriptions, maintenance needs, and special occasions.

Step 2: Calculate Total Annual Cost for Each

Use actual past spending data wherever possible. For unknown costs, such as upcoming insurance renewals, research current quotes.

Add a small inflation buffer to ensure you don’t come up short.

Step 3: Determine Monthly Contribution Amounts

Apply the formula to each expense: annual cost ÷ 12 months.

Total all contributions to verify they fit your budget. If the total feels too high, prioritize essential expenses and add others gradually.

Step 4: Choose Where to Keep Sinking Funds

Select storage that separates these funds from everyday spending money. Options include separate savings accounts, digital bank sub-accounts like Monzo Pots or Starling Spaces, budgeting apps, and even physical cash envelopes.

Step 5: Automate the Process

Set up standing orders or direct debits to move money into sinking funds automatically on payday. Automation removes reliance on willpower and ensures consistency even during busy periods.

Step 6: Track, Review & Adjust Quarterly

Monitor whether contributions match actual expenses. If costs changed or new irregular expenses emerged, adjust your monthly amounts accordingly. Flexibility keeps your system relevant as life evolves.

Where Should You Keep Your Sinking Funds?

Simplicity often beats complexity in personal finance. Finding the right balance between organization and simplicity ensures your sinking fund system remains manageable, effective, and sustainable in the long term.

1. High-Interest Savings Account

Keeping sinking funds in a high-interest savings account earns passive income while maintaining accessibility.

This works best for larger sinking funds of £500 or more. The separation from your current account prevents accidental spending.

2. Digital Bank Sub-Accounts

Modern banks like Monzo and Starling offer Pots or Spaces to divide money within a single account. This provides excellent visual organization and instant access while maintaining mental separation from daily spending funds.

3. Budgeting Apps

Apps like YNAB or EveryDollar offer a virtual organization with detailed tracking capabilities.

Money remains in your main account in physical form, but the app creates virtual “envelopes” that require strong discipline to maintain boundaries.

4. Cash Envelopes

Physical envelopes provide tangible visibility and spending control, making them well-suited for small amounts and visual learners.

However, this method offers no interest and carries a risk of theft, making it less practical for large sums.

The key principle across all methods: maintain accessibility while ensuring separation from daily spending money.

How Many Sinking Funds Should You Have?

Simplicity often beats complexity in personal finance. Finding the right balance ensures your system remains manageable.

Start Small and Strategic

- Begin with 3-6 high-value needs rather than attempting to fund every possible expense

- Focus on the biggest impacts: car expenses, holidays, home maintenance, insurance premiums

- Clarity beats complexity: Too many categories become overwhelming

Digital Tools That Help

Recommended Options:

- Monzo or Starling Bank:- Offer Pots/Spaces to divide money within one account

- YNAB (You Need A Budget):- Excels at tracking multiple funds digitally

- Other budgeting apps:- Provide clear visibility without multiple bank accounts

Choose the approach that matches your personality and spending habits.

Common Sinking Fund Mistakes to Avoid

Avoiding these common mistakes will help you create a sinking fund system that works effectively for your long-term financial success.

| Mistake | Why It’s a Problem | Solution |

|---|---|---|

| 1. Using Funds for Other Expenses | Defeats the entire purpose | Maintain strict boundaries |

| 2. Inconsistent Contributions | Creates shortfalls when needed | Automate your contributions |

| 3. Too Many Categories | Causes tracking burnout | Start with 3-5 categories only |

| 4. Underestimating Costs | Creates stress and debt | Add 10-15% buffer to estimates |

| 5. Forgetting Subscriptions | Surprise renewals drain funds | Audit bank statements annually |

| 6. Ignoring Inflation | Contributions fall short yearly | Increase contributions 3-5% yearly |

| 7. Keeping in the Main Account | Money gets accidentally spent | Use separate accounts or sub-accounts |

Once you’ve set up your sinking funds properly, you might wonder whether investing them could boost your returns.

How Much Should You Contribute to Sinking Funds?

Consider your total income and budget capacity when setting contribution amounts. Not every sinking fund carries equal priority. Focus on essential expenses like insurance and car maintenance before adding funds for wants like holidays.

Add a 3-5% buffer to account for inflation, as costs typically rise yearly. If starting mid-year, you’ll need larger monthly contributions to reach your goal by the deadline.

Start with high-priority funds first, then add additional categories as your budget allows. It’s better to fully fund three essential sinking funds than partially fund eight.

How to Start a Sinking Fund (Simple Steps + Easy Math)

Creating your first sinking fund requires no special financial knowledge, just clear thinking and basic arithmetic.

How to Start a Sinking Fund?

Creating your first sinking fund requires no special financial knowledge, just clear thinking and basic arithmetic.

Step 1: List Predictable Future Expenses

Review last year’s bank statements carefully to identify all annual, quarterly, or irregular expenses, including insurance renewals, subscriptions, seasonal costs, maintenance needs, and special occasions.

Step 2: Assign a Total Yearly Amount to Each

Estimate each expense category using your actual past spending data from previous years. For example, Christmas gifts £360, car maintenance £600, and summer holiday £1,200.

Step 3: Use Simple Math to Determine Your Monthly Savings

Use this straightforward formula: Total amount ÷ number of months = monthly contribution needed. Example calculation: £360 Christmas spending ÷ 12 months = £30/month contribution.

Step 4: Choose Where to Keep Sinking Funds

Select storage options, such as separate savings accounts, digital bank sub-accounts (e.g., Monzo Pots or Starling Spaces), budgeting apps, or physical cash envelopes, to improve organization.

Step 5: Automate Your Contributions

Set up standing orders or direct debits on your payday to transfer money automatically into sinking funds, completely removing reliance on willpower and ensuring consistent contributions.

Step 6: Track & Adjust

Review your sinking funds quarterly to verify you’re making good progress, adjust contribution amounts for cost changes, and add new expense categories as your financial needs evolve.

How Many Sinking Funds Should You Have?

Simplicity often beats complexity in personal finance. Finding the right balance ensures your system remains manageable.

Start Small and Strategic

- Begin with 3-6 high-value needs rather than attempting to fund every possible expense

- Focus on the biggest impacts: car expenses, holidays, home maintenance, and insurance premiums

- Clarity beats complexity: Too many categories become overwhelming

Digital Tools That Help

Recommended Options:

- Monzo or Starling Bank – Offer Pots/Spaces to divide money within one account

- YNAB (You Need A Budget) – Excels at tracking multiple funds digitally

- Other budgeting apps – Provide clear visibility without multiple bank accounts

Choose the approach that matches your personality and spending habits.

Benefits of Using Sinking Funds in Your Long-Term Financial Plan

Beyond helping with immediate expenses, sinking funds offer significant advantages that strengthen your overall financial health and future planning goals.

Core Financial Benefits

- Prevent last-minute borrowing when unexpected bills arrive

- Reduce reliance on credit cards and break the debt cycle

- Smooth out irregular expenses across the entire year

- Create a budget consistent with predictable monthly spending

- Remove conflicts between current needs and future plans

- Support long-term planning for home improvements or vehicle upgrades

- Eliminate interest payments by paying cash instead of borrowing

Who Benefits Most

- Families managing multiple financial priorities

- Landlords handling property expenses

- Individuals building financial independence

- Anyone seeking stress-free money management

Where Should You Keep Your Sinking Funds?

The right storage location keeps your sinking funds accessible for planned expenses while preventing accidental spending on daily purchases.

1. High-Interest Savings Account

Keeping sinking funds in a high-interest savings account earns passive income while maintaining accessibility. This works best for larger sinking funds exceeding £500. The separation from your current account prevents accidental spending.

2. Digital Bank Sub-Accounts

Modern banks like Monzo and Starling offer Pots or Spaces to divide money within a single account. This provides excellent visual organization and instant access while maintaining mental separation from daily spending funds.

3. Budgeting Apps

Apps like YNAB or EveryDollar offer a virtual organization with detailed tracking capabilities. Money remains in your main account physically, but the app creates virtual “envelopes” requiring strong discipline to maintain boundaries.

4. Cash Envelopes

Physical envelopes provide tangible visibility and spending control, making them well-suited to small amounts and visual learners. However, this method offers no interest and carries a risk of theft, making it less practical for large sums.

The key principle across all methods: maintain accessibility while ensuring separation from daily spending money.

Should You Invest Your Sinking Fund?

The temptation to grow sinking fund money through investing requires careful consideration.

Why do most sinking funds stay liquid?

Most sinking funds cover expenses needed within 12 months, making market volatility too risky for such short timeframes, requiring guaranteed access.

When could investing your sinking fund work?

Consider cautious investment only for expenses 2+ years away, particularly large amounts exceeding £5,000, while maintaining a fully funded emergency backup.

What’s the better alternative for short-term funds?

High-interest savings accounts offering 4-5% in the UK provide reasonable returns without investment risk, balancing earning potential with required accessibility.

What’s the quick investment rule by timeframe?

- Under 1 year: Keep in high-interest savings accounts for guaranteed, immediate access when needed

- 1-3 years: Consider low-risk investments like government bonds or conservative, stable investment funds

- Over 3 years: Explore growth-focused investments with higher potential returns and acceptable risk levels

Conclusion

A sinking fund represents one of the most powerful yet simple tools in personal finance.

By breaking predictable expenses into manageable monthly contributions, you eliminate financial surprises and maintain control throughout the year.

This straightforward approach prevents debt, reduces stress, and creates the stability necessary for long-term financial success.

Whether managing car maintenance, planning holidays, or preparing for insurance renewals, sinking funds changes overwhelming costs into routine budget items.

Start today by choosing one expense that stresses you most, calculating your monthly contribution, and setting up automation this week.

Small, consistent action creates significant results. Sinking funds prove that financial peace comes from preparation rather than luck.