Getting property through inheritance should feel like a blessing, not a financial burden.

However, many people are unaware that they may incur stamp duty charges on inherited property. This tax can catch families off guard, especially when they’re already dealing with the emotional stress of losing a loved one.

Understanding stamp duty rules for inherited property can save you thousands of dollars and prevent costly mistakes. You need to know when this tax applies, how much you might pay, and what exemptions could help your family.

This guide provides a clear breakdown of everything related to stamp duty on inherited property in simple terms. You’ll learn the key rules, common scenarios, and practical steps to handle this tax correctly.

Don’t let stamp duty confusion cost you money when you’re already going through tough times.

What is Stamp Duty?

Stamp duty is a government tax you pay when you transfer ownership of property or land. Think of it as a fee the state charges every time property is legally transferred.

This tax plays a vital role in property transactions because it formalizes the transfer and generates revenue for public services.

There are several types of stamp duty depending on your situation:

- Purchase stamp duty – paid when buying property as a regular transaction

- Transfer stamp duty – applied when selling property, with different rates for investors

- Inheritance stamp duty – charged when property passes from deceased family members

The amount varies depending on your state, property value, and specific circumstances.

Each type has its own rules and rates, so understanding which one applies to your situation can help you save money and avoid legal headaches later.

How Does Stamp Duty Apply to Inherited Property?

Many people believe that inherited property is entirely exempt from stamp duty, but this isn’t always the case. The reality depends on how the property transfer happens and your relationship with the deceased person.

1. Direct inheritance exemption – No stamp duty applies when property passes directly from a deceased person to their beneficiaries through a valid will or intestacy laws

2. Transfer between beneficiaries – Stamp duty becomes payable when one beneficiary transfers their inherited share to another family member or third party after receiving it

3. Property bought from estate – Full stamp duty applies if you purchase inherited property from the estate at market value, even if you’re a family member

4. Joint ownership transfers – Stamp duty may apply when surviving joint owners transfer the deceased person’s share to themselves or redistribute ownership portions

5. Commercial property inheritance – Different rules and potential stamp duty charges apply to inherited commercial properties compared to residential homes

Understanding these distinctions helps you plan properly and avoid unexpected tax bills during an already difficult time.

Cases When Stamp Duty Applies to Inherited Property

While inherited property often comes with tax benefits, certain situations can trigger stamp duty charges that catch families unprepared.

1. Transfer of Property to Heirs After Inheritance

Sometimes, the original heir needs to pass the property to other family members or sell their share of it. This secondary transfer can create stamp duty obligations even though the property was initially inherited tax-free.

The government treats this as a new property transaction between the current owner and the new recipient. The property must be formally transferred through legal documentation.

Stamp duty rates depend on the property value and state regulations. Family relationships may qualify for reduced rates or exemptions.

Remember: Even transfers between close family members can trigger stamp duty if not handled through proper inheritance channels.

2. If the Property Is Sold

When you sell an inherited property, you typically don’t pay stamp duty as the seller.

The buyer will pay stamp duty on their purchase, which might affect your negotiating position during the sale process.

Some states have specific rules regarding capital gains tax that work in conjunction with stamp duty considerations for the sale of inherited property.

It’s important to understand that the buyer, not the seller who inherits the property, is responsible for paying stamp duty.

The sale price you set will directly affect the amount of stamp duty the buyer needs to calculate and pay.

Additionally, capital gains tax may apply separately to your inheritance, so it’s worth consulting with a tax professional to understand your full tax obligations.

Remember: While you don’t pay stamp duty when selling, other taxes like capital gains may still apply to your profit.

3. If There’s a Mortgage or Loan Involved

When you inherit property that has an existing mortgage or need to secure new financing, you may face unexpected stamp duty charges.

This typically occurs when the lender requires a formal transfer of ownership or when you go through a refinancing process.

The situation becomes even more complicated when multiple heirs are involved, as they often need to restructure ownership arrangements to meet lending requirements.

Whether you’re taking over an existing mortgage or applying for a new loan against the inherited property, these financial transitions can trigger transfer duties that many people don’t anticipate during an already stressful time.

Remember: Always consult with your lender and tax advisor before making any mortgage changes to an inherited property.

Are There Any Exemptions or Reliefs?

The good news is that several exemptions and reliefs can help you avoid or reduce stamp duty on inherited property. Understanding these options can save your family a significant amount of money during an already challenging time.

| Type of Exemption | Who Qualifies | What’s Covered | Key Conditions |

|---|---|---|---|

| Spousal Transfer | Surviving spouse or civil partner | Complete exemption from stamp duty | Must be legally married or in a registered civil partnership |

| Direct Inheritance | All beneficiaries named in a will | There is no stamp duty on initial inheritance | Property must pass directly through probate or intestacy |

| Family Farm Relief | Family members inheriting farms | Reduced rates or full exemption | The farm must be the primary residence or working agricultural land |

| Principal Residence Relief | Heirs living on the property | Exemption when property becomes main home | Must occupy as primary residence within a specific timeframe |

| Small Estate Exemption | Heirs of modest estates | No stamp duty below certain thresholds | Total estate value must fall under state-specific limits |

| Charitable Transfer | Registered charities | Complete exemption from all duties | Property must transfer to qualifying charitable organizations |

Important Notes:

- Exemption rules vary significantly between different states and territories

- Some reliefs require formal applications within specific time limits

- Always seek professional advice to ensure you qualify for available exemptions

These exemptions can make a substantial difference to your financial obligations, so it’s worth checking which ones apply to your situation.

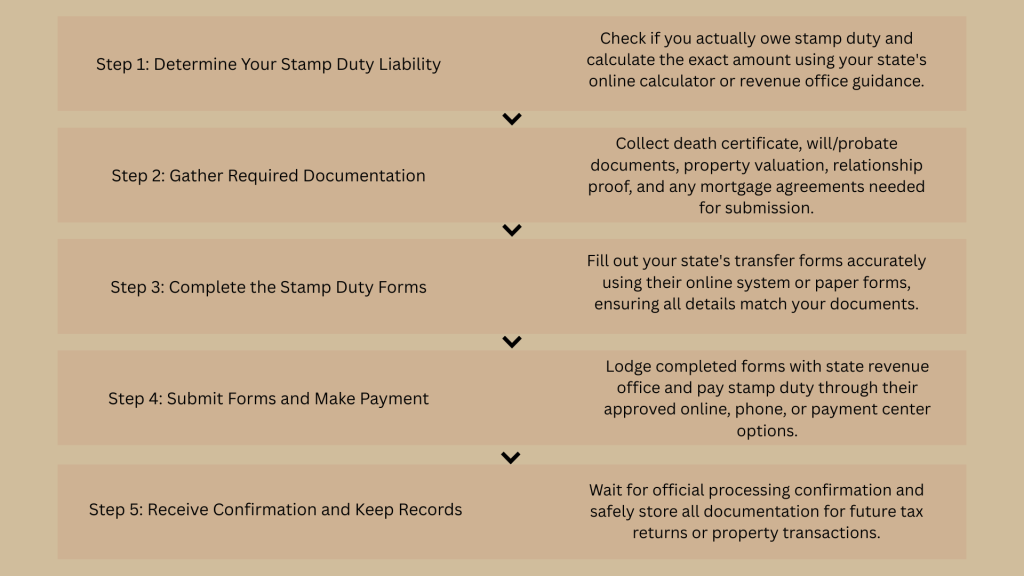

How to Pay Stamp Duty on Inherited Property?

Paying stamp duty on inherited property doesn’t have to be complicated if you follow the right process. Here’s a clear step-by-step approach to handling your obligations correctly and avoiding costly mistakes.

Penalties to avoid:

- Late payment can result in interest charges of up to 20% annually.

- Incorrect information may trigger audits and additional fees.

- Missing deadlines often means paying the full amount plus penalties.

Impact of Stamp Duty on Inherited Property

Stamp duty on inherited property can significantly affect your financial situation and long-term plans. Understanding these impacts helps you make informed decisions about whether to keep, sell, or transfer inherited property.

1. Cash flow disruption – Unexpected stamp duty bills can strain your immediate finances, especially when you’re already dealing with funeral costs and other estate expenses during the inheritance process.

2. Property value correlation – Higher property values result in larger stamp duty bills, with rates often increasing in tiers; therefore, a $500,000 property might incur significantly more stamp duty than a $300,000 one.

3. Investment decision influence – Stamp duty costs may prompt you to sell the inherited property quickly rather than retaining it as a rental investment, potentially impacting your long-term wealth-building strategy.

4. Multiple tax burden – You may face stamp duty alongside capital gains tax, inheritance tax, and ongoing property taxes, creating a complex web of financial obligations that require careful planning.

5. Family planning complications – When multiple heirs are involved, stamp duty obligations can complicate decisions about who keeps the property, sells their share, or buys out other family members.

Managing your tax obligations: Consider getting professional tax advice early, set aside funds for potential stamp duty payments, explore available exemptions thoroughly, and plan property transfers carefully to minimize the overall tax impact on your inheritance.

Conclusion

Inheriting property doesn’t have to drain your bank account. Understanding stamp duty on inherited property helps you avoid costly surprises during difficult times.

While many inheritances come with exemptions, certain situations can trigger stamp duty obligations.

The key is knowing when this tax applies and what exemptions might help your family. Property values directly affect your stamp duty bill, so getting accurate valuations and professional advice early can save thousands.

Contact your state revenue office or a qualified tax professional to review your specific inheritance situation. They can help you identify available exemptions and create a plan that protects your financial interests.

Don’t let stamp duty confusion turn your inheritance into a financial burden. With proper planning and the right information, you can handle these obligations smoothly.

Frequently Asked Questions

What Are the Disadvantages of Inheriting a House?

High maintenance costs, property taxes, potential stamp duty, emotional stress, and disputes over shared ownership with other heirs can create significant financial burdens.

Is It Better to Sell or Keep Inherited Property?

Depends on your finances, market conditions, maintenance costs, and emotional attachment. Consider ongoing expenses versus potential rental income or appreciation.

What Happens When You Inherit an Estate?

You receive legal ownership through probate, may be subject to various taxes, must handle property maintenance, and can sell, rent, or live in the property.